Garpal Gumnut

Ross Island Hotel

- Joined

- 2 January 2006

- Posts

- 14,068

- Reactions

- 11,249

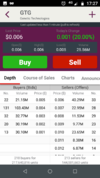

If you place a sell order "at market" and the stock is trading at volumes above the number of shares you are offering they should sell.Can anyone shed some light on the question below please?

I place a sell order with my platform and it seems to never get filled, when i question it with the platform they refer to the market depth, what does that mean...? When i want to sell at the right time (to make some money) but cant i lose money... can you help?

If you place a sell order at a specific sell price it may never sell as the market buying and selling may move down from your price.

Not all sales will come to fruition as reflected in the order nor buy sell lists, as people will just pop in and buy or sell at the sell or buy price or at market.

Orders to sell may be purged if they are too far away from the market price as it clogs up the system otherwise.

It is not quite as simple as that but ask away. I do hope I did not get it a*se about.

In summary if I really want to buy or sell a share I place an at market order.

gg