- Joined

- 12 February 2006

- Posts

- 202

- Reactions

- 0

Many probably know the power of pivot tables in Excel - here is a nice way to use them.

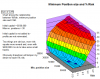

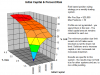

The 3D charts in Amibroker are really good for a visual look at how robust a system is. If you copy the optimise data to Excel you can set up a surface chart using a pivot table. Put the optimize variables as the rows and columns. Drop whatever metric you want to look at as the data and plot the chart. Set the chart type to surface.

Once set up as a chart I can drag different metrics off & on the chart to look at different aspects of the system. So I can quickly look at % drawdown or CAR just by dragging and dropping on the chart. In the example you can drag the "Sum of net %profit" off the chart, grab RAR from the PivotTable field list and drag it onto the chart to see a different view. The 3D view can be easily adjusted as well.

In the example attached the columns are a dummy variable to look at variation of the results. The 0 to 100 axis is the "Monte Carlo" or dummy axis. I also added a custom metric for expectancy. Custom metrics could be used to set up your own measure of system performance based on what you look for in a system, something that I haven't explored yet but apparently mentioned in Howard Bandy's book.

The advantage over the AB 3D charts (although they are really good) the the speed that you can look at all the different metrics vary quickly. It is also a nice way to store a optimisation for later reference.

regards

The 3D charts in Amibroker are really good for a visual look at how robust a system is. If you copy the optimise data to Excel you can set up a surface chart using a pivot table. Put the optimize variables as the rows and columns. Drop whatever metric you want to look at as the data and plot the chart. Set the chart type to surface.

Once set up as a chart I can drag different metrics off & on the chart to look at different aspects of the system. So I can quickly look at % drawdown or CAR just by dragging and dropping on the chart. In the example you can drag the "Sum of net %profit" off the chart, grab RAR from the PivotTable field list and drag it onto the chart to see a different view. The 3D view can be easily adjusted as well.

In the example attached the columns are a dummy variable to look at variation of the results. The 0 to 100 axis is the "Monte Carlo" or dummy axis. I also added a custom metric for expectancy. Custom metrics could be used to set up your own measure of system performance based on what you look for in a system, something that I haven't explored yet but apparently mentioned in Howard Bandy's book.

The advantage over the AB 3D charts (although they are really good) the the speed that you can look at all the different metrics vary quickly. It is also a nice way to store a optimisation for later reference.

regards