- Joined

- 12 January 2008

- Posts

- 7,363

- Reactions

- 18,405

I've got an open MT4 account that I'm not using, so rather than close it I thought I'd try trading it and see if I can rekindle some interest in FX trading in ASF. The account is small enough that it wouldn't concern me if I lost most of it. However I don't trade to lose money. I'd like to see if I can double or triple the balance without trading recklessly.

I've written a few more introductory posts but as I've been writing them I had my first trade so I'm going to show this as a teaser trade.

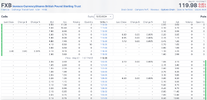

T1: XAUUSD - long, if 2300 provides some support.

This is a 4H chart with the only indicator that I'm using, Bollinger Bands (20,2). After a rapid selloff yesterday, price has paused outside the lower band (oversold or extended) setting up a potential reversal trading opp. This is most definitely a high risk reversal as both the 4H and daily trends are impulsively down. The only reason for me to be trading this reversal is that I'm very clearly bullish gold atm.

XAUUSD: 4H and 1H charts

The setup formed when the 1st 4H green bar closed above the prior long legged doji bar. It's one of my fav candlestick reversal patterns.

On the 1H chart (right) the trigger level coincides with the prior Aus session high. This setup could be called a prior session BO trade.

Trade Management: This was always going to be a quick trade as most of Europe is on holiday (May Day) and the US market is waiting for the next morning's FOMC statement. Price is unlikely to go very far with this uncertainty present.

Details: Buy 2290.5, (iSL 2283) Risk = 7.5 Exit Sell: 2301 for +10.5 or +1.4R result

The pending FOMC news will rock the market tomorrow morning and I'll wait to see if there's a trading opp after the news (if I'm awake).

I've written a few more introductory posts but as I've been writing them I had my first trade so I'm going to show this as a teaser trade.

T1: XAUUSD - long, if 2300 provides some support.

This is a 4H chart with the only indicator that I'm using, Bollinger Bands (20,2). After a rapid selloff yesterday, price has paused outside the lower band (oversold or extended) setting up a potential reversal trading opp. This is most definitely a high risk reversal as both the 4H and daily trends are impulsively down. The only reason for me to be trading this reversal is that I'm very clearly bullish gold atm.

XAUUSD: 4H and 1H charts

The setup formed when the 1st 4H green bar closed above the prior long legged doji bar. It's one of my fav candlestick reversal patterns.

On the 1H chart (right) the trigger level coincides with the prior Aus session high. This setup could be called a prior session BO trade.

Trade Management: This was always going to be a quick trade as most of Europe is on holiday (May Day) and the US market is waiting for the next morning's FOMC statement. Price is unlikely to go very far with this uncertainty present.

Details: Buy 2290.5, (iSL 2283) Risk = 7.5 Exit Sell: 2301 for +10.5 or +1.4R result

The pending FOMC news will rock the market tomorrow morning and I'll wait to see if there's a trading opp after the news (if I'm awake).