bigdog

Retired many years ago

- Joined

- 19 July 2006

- Posts

- 8,267

- Reactions

- 5,735

Source: http://finance.yahoo.com

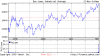

Was OK until the last 45 minutes; check the chart below!!!

An aggressive selling effort in the final hour of trade took the stock market from a solid gain to a considerable loss. The downturn was broad based and left many of the major sectors to settle at session lows.

Stocks had been showing moderate weakness ahead of the opening bell, but jumped out to a strong gain in the early going. The S&P 500 even made its way to a near 1% gain so that it fractionally set a new high for 2009.

Spooked traders unraveled a rally in stocks late Wednesday as a downbeat assessment of a bank touched off fears that the market is getting overheated.

The Dow Jones industrial average ended down 92 points after having risen 78 points earlier in the day to a new high for the year.

Analysts pointed to a note on Wells Fargo & Co. from banking analyst Richard Bove as the source of the drop, but also said a mix of complacency and lingering concerns about the pace of the market's climb in the past seven months left stocks ripe for a hit.

The NYSE DOW closed LOWER -92.12 points -0.92% on Wednesday October 21

Sym Last........ ........Change..........

Dow 9,949.36 -92.12 -0.92%

Nasdaq 2,150.73 -12.74 -0.59%

S&P 500 1,081.40 -9.66 -0.89%

30-yr Bond 4.23% +0.07

NYSE Volume 6,514,343,500 (prior day 6,108,117,000)

Nasdaq Volume 2,600,789,500 (prior day 2,156,024,250)

Oil 71.50 -0.05 -0.07%

Gold US$/oz 1058.95 +4.35 +0.41%

Europe

Symbol... Last...... .....Change.......

FTSE 100 5,257.85 +14.45 +0.28%

DAX 5,833.49 +21.72 +0.37%

CAC 40 3,873.22 +1.77 +0.05%

Asia

Symbol..... Last...... .....Change.......

Nikkei 225 10,333.39 -3.45 -0.03%

Hang Seng 22,318.11 -66.85 -0.30%

Straits Times 2,692.55 -18.54 -0.68%

http://finance.yahoo.com/news/Stocks-turn-lower-as-note-on-apf-2891092628.html?x=0

Stocks turn lower as note on banks spooks traders

Stock market turns lower as analyst note about Wells Fargo hurts financials; Dow falls 92

By Tim Paradis, AP Business Writer

On 5:44 pm EDT, Wednesday October 21, 2009

NEW YORK (AP) -- Spooked traders unraveled a rally in stocks late Wednesday as a downbeat assessment of a bank touched off fears that the market is getting overheated.

The Dow Jones industrial average ended down 92 points after having risen 78 points earlier in the day to a new high for the year.

Analysts pointed to a note on Wells Fargo & Co. from banking analyst Richard Bove as the source of the drop, but also said a mix of complacency and lingering concerns about the pace of the market's climb in the past seven months left stocks ripe for a hit.

Joe Saluzzi, co-head of equity trading at Themis Trading LLC, said the note was a reminder of troubles still in the economy and was enough to scare many traders.

"They all ran for the exits at the same time," he said.

The slide in the final hour of trading was reminiscent of the types of big swings seen a year ago at the height of the financial crisis. But analysts said the reasons for the latest slide had been building throughout the day: Major stock indexes touched their highest levels in a year, the dollar extended its drop, oil rose above $82 a barrel and Wal-Mart Stores Inc. said it was cutting prices, a sign that consumers are still struggling.

The pullback comes as analysts say some investors have become too relaxed.

The Chicago Board Options Exchange's Volatility Index, known as the market's fear index, jumped late in the day and ended with a gain of 6.3 percent. During trading it had touched its lowest level since August 2008. The VIX stands at 22.2 and is down 44.5 percent this year. Its historical average is 18-20. It hit a record 89.5 a year ago.

Todd Colvin, vice president at MF Global, said investors had grown too complacent in betting that stocks would continue to climb.

"It was a very one-sided trade. Stocks have been going up," he said. "We're starting to see 'Wait a minute, we're not out of the woods yet.'"

The Dow Jones industrial average fell 92.12, or 0.9 percent, to 9,949.36, just above its low of the day. It was the biggest point and percent drop since Oct. 1. The Dow, which also lost ground Tuesday, has fallen in three of the last four days. The Dow closed above 10,000 last week for the first time in a year.

The broader Standard & Poor's 500 index fell 9.66, or 0.9 percent, to 1,081.40, after reaching 1,101.36, its highest level in the past year. The Nasdaq composite index fell 12.74, or 0.6 percent, to 2,150.73.

Two stocks fell for every one that rose on the New York Stock Exchange, where consolidated volume came to 5.7 billion shares compared with 5.4 billion Tuesday.

Stocks spent much of the day higher after a handful of banks, including Wells Fargo, as well as Morgan Stanley and US Bancorp, posted better results for the July-September quarter. All of them also had higher loan losses, however. That is a sign that the broader economy is struggling even as the financial industry recovers.

Last week, Bank of America Corp., JPMorgan Chase & Co. and Citigroup Inc. also reported higher credit losses as consumers and businesses struggle to pay off their bills.

Dan Deming, a trader with Strutland Equities in Chicago, said the S&P 500's move above 1,100 made some investors uneasy about the market's rise. The index is up 59.9 percent from a 12-year low in early March.

Bond prices fell, pushing yields higher. The yield on the benchmark 10-year Treasury note rose to 3.39 percent from 3.34 percent late Tuesday.

The day's drop came as crude oil rose $2.25 to settle at $81.37 per barrel on the New York Mercantile Exchange as the dollar weakened. Commodities are priced in dollars, making them cheaper for overseas buyers when the greenback slides.

If energy prices rise too far it could make it harder for the economy to recover by raising transportation and other costs.

Banks, which had been leading the market higher, were mainly lower after the note about Wells Fargo. Wells Fargo fell $1.56, or 5.1 percent, to $28.90. Morgan Stanley rose $1.56, or 4.8 percent, to $34.08 and US Bancorp rose 63 cents, or 2.7 percent, to $24.43.

Wal-Mart said during the afternoon that it would cut prices this holiday season for a week at a time on thousands of items. That made some investors nervous that the nation's largest retailer doesn't expect consumers will be able to spend much for the important shopping period.

Airlines slumped after American Airlines parent AMR Corp., Continental Airlines Inc. and UAL Corp.'s United Airlines posted losses. AMR shares fell 91 cents, or 11.9 percent, to $6.75 and Continental slid $2.19, or 13.8 percent, to $13.73, while UAL fell 98 cents, or 12.4 percent, to $6.92.

The market's slide didn't pull all stocks lower. Some technology names rose after Yahoo Inc. and SanDisk Corp., a maker of flash memory cards, reported profits that topped analyst expectations after the close of trading Tuesday. Yahoo rose 49 cents, or 2.9 percent, to $17.66, while SanDisk jumped $2.05, or 9.5 percent, to $23.53.

Shares of Apple Inc. set a record, topping its previous trading high of $202.96 from Dec. 27, 2007. The company, which on Monday posted a 47 percent jump in its third-quarter earnings, rose $6.16, or 3.1 percent, to $204.92. It traded as high as $208.71.

In other trading, the Russell 2000 index of smaller companies fell 8.30, or 1.4 percent, to 605.11.

Overseas, Britain's FTSE 100 rose 0.3 percent, Germany's DAX index rose 0.4 percent, and France's CAC-40 advanced 0.1 percent. Japan's Nikkei stock average fell 0.03 percent.

Was OK until the last 45 minutes; check the chart below!!!

An aggressive selling effort in the final hour of trade took the stock market from a solid gain to a considerable loss. The downturn was broad based and left many of the major sectors to settle at session lows.

Stocks had been showing moderate weakness ahead of the opening bell, but jumped out to a strong gain in the early going. The S&P 500 even made its way to a near 1% gain so that it fractionally set a new high for 2009.

Spooked traders unraveled a rally in stocks late Wednesday as a downbeat assessment of a bank touched off fears that the market is getting overheated.

The Dow Jones industrial average ended down 92 points after having risen 78 points earlier in the day to a new high for the year.

Analysts pointed to a note on Wells Fargo & Co. from banking analyst Richard Bove as the source of the drop, but also said a mix of complacency and lingering concerns about the pace of the market's climb in the past seven months left stocks ripe for a hit.

The NYSE DOW closed LOWER -92.12 points -0.92% on Wednesday October 21

Sym Last........ ........Change..........

Dow 9,949.36 -92.12 -0.92%

Nasdaq 2,150.73 -12.74 -0.59%

S&P 500 1,081.40 -9.66 -0.89%

30-yr Bond 4.23% +0.07

NYSE Volume 6,514,343,500 (prior day 6,108,117,000)

Nasdaq Volume 2,600,789,500 (prior day 2,156,024,250)

Oil 71.50 -0.05 -0.07%

Gold US$/oz 1058.95 +4.35 +0.41%

Europe

Symbol... Last...... .....Change.......

FTSE 100 5,257.85 +14.45 +0.28%

DAX 5,833.49 +21.72 +0.37%

CAC 40 3,873.22 +1.77 +0.05%

Asia

Symbol..... Last...... .....Change.......

Nikkei 225 10,333.39 -3.45 -0.03%

Hang Seng 22,318.11 -66.85 -0.30%

Straits Times 2,692.55 -18.54 -0.68%

http://finance.yahoo.com/news/Stocks-turn-lower-as-note-on-apf-2891092628.html?x=0

Stocks turn lower as note on banks spooks traders

Stock market turns lower as analyst note about Wells Fargo hurts financials; Dow falls 92

By Tim Paradis, AP Business Writer

On 5:44 pm EDT, Wednesday October 21, 2009

NEW YORK (AP) -- Spooked traders unraveled a rally in stocks late Wednesday as a downbeat assessment of a bank touched off fears that the market is getting overheated.

The Dow Jones industrial average ended down 92 points after having risen 78 points earlier in the day to a new high for the year.

Analysts pointed to a note on Wells Fargo & Co. from banking analyst Richard Bove as the source of the drop, but also said a mix of complacency and lingering concerns about the pace of the market's climb in the past seven months left stocks ripe for a hit.

Joe Saluzzi, co-head of equity trading at Themis Trading LLC, said the note was a reminder of troubles still in the economy and was enough to scare many traders.

"They all ran for the exits at the same time," he said.

The slide in the final hour of trading was reminiscent of the types of big swings seen a year ago at the height of the financial crisis. But analysts said the reasons for the latest slide had been building throughout the day: Major stock indexes touched their highest levels in a year, the dollar extended its drop, oil rose above $82 a barrel and Wal-Mart Stores Inc. said it was cutting prices, a sign that consumers are still struggling.

The pullback comes as analysts say some investors have become too relaxed.

The Chicago Board Options Exchange's Volatility Index, known as the market's fear index, jumped late in the day and ended with a gain of 6.3 percent. During trading it had touched its lowest level since August 2008. The VIX stands at 22.2 and is down 44.5 percent this year. Its historical average is 18-20. It hit a record 89.5 a year ago.

Todd Colvin, vice president at MF Global, said investors had grown too complacent in betting that stocks would continue to climb.

"It was a very one-sided trade. Stocks have been going up," he said. "We're starting to see 'Wait a minute, we're not out of the woods yet.'"

The Dow Jones industrial average fell 92.12, or 0.9 percent, to 9,949.36, just above its low of the day. It was the biggest point and percent drop since Oct. 1. The Dow, which also lost ground Tuesday, has fallen in three of the last four days. The Dow closed above 10,000 last week for the first time in a year.

The broader Standard & Poor's 500 index fell 9.66, or 0.9 percent, to 1,081.40, after reaching 1,101.36, its highest level in the past year. The Nasdaq composite index fell 12.74, or 0.6 percent, to 2,150.73.

Two stocks fell for every one that rose on the New York Stock Exchange, where consolidated volume came to 5.7 billion shares compared with 5.4 billion Tuesday.

Stocks spent much of the day higher after a handful of banks, including Wells Fargo, as well as Morgan Stanley and US Bancorp, posted better results for the July-September quarter. All of them also had higher loan losses, however. That is a sign that the broader economy is struggling even as the financial industry recovers.

Last week, Bank of America Corp., JPMorgan Chase & Co. and Citigroup Inc. also reported higher credit losses as consumers and businesses struggle to pay off their bills.

Dan Deming, a trader with Strutland Equities in Chicago, said the S&P 500's move above 1,100 made some investors uneasy about the market's rise. The index is up 59.9 percent from a 12-year low in early March.

Bond prices fell, pushing yields higher. The yield on the benchmark 10-year Treasury note rose to 3.39 percent from 3.34 percent late Tuesday.

The day's drop came as crude oil rose $2.25 to settle at $81.37 per barrel on the New York Mercantile Exchange as the dollar weakened. Commodities are priced in dollars, making them cheaper for overseas buyers when the greenback slides.

If energy prices rise too far it could make it harder for the economy to recover by raising transportation and other costs.

Banks, which had been leading the market higher, were mainly lower after the note about Wells Fargo. Wells Fargo fell $1.56, or 5.1 percent, to $28.90. Morgan Stanley rose $1.56, or 4.8 percent, to $34.08 and US Bancorp rose 63 cents, or 2.7 percent, to $24.43.

Wal-Mart said during the afternoon that it would cut prices this holiday season for a week at a time on thousands of items. That made some investors nervous that the nation's largest retailer doesn't expect consumers will be able to spend much for the important shopping period.

Airlines slumped after American Airlines parent AMR Corp., Continental Airlines Inc. and UAL Corp.'s United Airlines posted losses. AMR shares fell 91 cents, or 11.9 percent, to $6.75 and Continental slid $2.19, or 13.8 percent, to $13.73, while UAL fell 98 cents, or 12.4 percent, to $6.92.

The market's slide didn't pull all stocks lower. Some technology names rose after Yahoo Inc. and SanDisk Corp., a maker of flash memory cards, reported profits that topped analyst expectations after the close of trading Tuesday. Yahoo rose 49 cents, or 2.9 percent, to $17.66, while SanDisk jumped $2.05, or 9.5 percent, to $23.53.

Shares of Apple Inc. set a record, topping its previous trading high of $202.96 from Dec. 27, 2007. The company, which on Monday posted a 47 percent jump in its third-quarter earnings, rose $6.16, or 3.1 percent, to $204.92. It traded as high as $208.71.

In other trading, the Russell 2000 index of smaller companies fell 8.30, or 1.4 percent, to 605.11.

Overseas, Britain's FTSE 100 rose 0.3 percent, Germany's DAX index rose 0.4 percent, and France's CAC-40 advanced 0.1 percent. Japan's Nikkei stock average fell 0.03 percent.