bigdog

Retired many years ago

- Joined

- 19 July 2006

- Posts

- 8,232

- Reactions

- 5,682

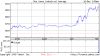

NYSE Dow Jones finished today at:

Source: http://finance.yahoo.com

A stock market gaining confidence in the nation's financial system bolted higher Wednesday, propelling the Dow Jones industrials and Standard & Poor's 500 index to their first four-day advance since last spring.

The market reversed losses from earlier in the session after President-elect Barack Obama pledged he would have a plan to deal with the nation's economic crisis on his first day in office. After filling more spots to his economic team, Obama stated that "help is on the way."

The NYSE DOW closed HIGHER Dow +247.14 points +2.91% on wedneday November 26

Sym Last........ ........Change..........

Dow 8,726.61 +247.14 +2.91%

Nasdaq 1,532.10 +67.37 +4.60%

S&P 500 887.68 +30.29 +3.53%

30-yr Bond 3.5630% -0.0690

NYSE Volume 6,442,327,000

Nasdaq Volume 2,001,666,875

Europe

Symbol... Last...... .....Change.......

FTSE 100 4,152.69 -18.56 -0.44%

DAX 4,560.50 +0.08 +0.00%

CAC 40 3,169.85 -39.71 -1.24%

Asia

Symbol..... Last...... .....Change.......

Nikkei 225 8,213.22 -110.71 -1.33%

Hang Seng 13,369.45 +490.85 +3.81%

Straits Times 1,711.13 +57.88 +3.50%

http://biz.yahoo.com/ap/081126/wall_street.html

Dow, S&P 500 clinch 4th straight winning session

Wednesday November 26, 5:49 pm ET

By Tim Paradis, AP Business Writer

Stocks rally after Obama comments about economy; Dow and S&P rise for 4th straight day

NEW YORK (AP) -- A stock market gaining confidence in the nation's financial system bolted higher Wednesday, propelling the Dow Jones industrials and Standard & Poor's 500 index to their first four-day advance since last spring.

The market reversed losses from earlier in the session after President-elect Barack Obama pledged he would have a plan to deal with the nation's economic crisis on his first day in office. After filling more spots to his economic team, Obama stated that "help is on the way."

The major indexes built on their gains through the afternoon, but analysts warned that this latest advance came on light pre-holiday volume. The Dow is up 1,174 points, or 15.5 percent, during the past four days, and the S&P 500 is up 135, or 18 percent -- giving both indicators their biggest four-day rise since the Great Depression. The rally marks a string of gains that seemed impossible to achieve in the depths of selling that began in mid-September after the collapse of Lehman Brothers Holdings Inc.

Analysts saw encouraging signs in the rally, but they were still cautious given months of extreme market volatility.

"Sentiment has turned slightly more positive over the past few days with some of the government packages in the U.S. and the stimulus programs that have been announced," said Michael Sheldon, chief market strategist at RDM Financial Group. "That might help turn the tide."

The government's latest steps aimed at restoring the nation's financial system to health came Tuesday, when the Bush administration and the Federal Reserve pledged $800 billion to boost lending on credit cards, auto loans, mortgages and other borrowing.

Obama's remarks, meanwhile, calmed the market after the day's economic reports pointed to more weakness. The government reported that unemployment at recessionary levels, new home sales at their lowest level in nearly 18 years, another plunge in consumer spending, and factory orders for big-ticket items down by the largest amount in two years.

Analysts said some of the turnaround in stocks was due to the fact that the economic news was expected to be bad. Further, volume was about half of its normal levels on the floor of the New York Stock Exchange -- with 1.4 billion shares traded -- which can exacerbate price movements. Consolidated volume, which includes trades on other exchanges, came to 5.71 billion shares, compared to 6.72 billion on Tuesday.

"What we're seeing in the market is basically a light-volume shrugging off of bad news, which is very encouraging in the short term," said Sal Arnuk, co-head of equity trading at Themis Trading LLC.

The Dow industrials rose 247.14, or 2.91 percent, 8,726.61. The Dow has not had four straight gains since April 15-18; its advance is its biggest since 1932, during the Depression.

Broader indicators also rose. The S&P 500 advanced 30.29, or 3.53 percent, to 887.68; it last had a four-day winning streak May 27-30. Its rally was its largest since 1933.

The Nasdaq composite index rose 67.37, or 4.60 percent, to 1,532.10. The Russell 2000 index of smaller companies rose 25.45, or 5.74 percent, to 468.63.

The indexes remain far below the peaks they reached in October 2007. The Dow is down 38.39 percent, the S&P 500 is down 43.28 percent, and the Nasdaq is off 46.41 percent.

Advancing issues outnumbered decliners by 3 to 1 on the NYSE.

On Tuesday, stocks finished mostly higher as investors were encouraged by the government's new initiatives to help unfreeze the credit markets.

The market's performance in recent sessions has been a show of stability as stocks have generally traded with less volatility than they had in the past three months as the market's yearlong pullback intensified. But analysts remain cautious about how long the calm will last.

"I don't think its a sign of longer-term stability, but feel this is a sign of shorter-term stability," said Todd Salamone, director of trading and vice president of research at Schaeffer's Investment Research in Cincinnati. "There's just too much uncertainty out there."

Bond prices rose Wednesday. The yield on the benchmark 10-year Treasury note, which moves opposite its price, fell to 2.99 percent from 3.10 percent late Tuesday. The yield on the three-month T-bill, considered one of the safest investments, fell to 0.03 percent from 0.09 percent late Tuesday.

The dollar mostly rose against other major currencies, while gold prices fell. Light, sweet crude rose $3.67 to settle at $54.44 a barrel on the New York Mercantile Exchange.

In economic news, the Labor Department said initial requests for unemployment benefits fell to a seasonally adjusted 529,000 from the previous week's upwardly revised figure of 543,000. That is lower than analysts' expectations of 537,000. Still, the initial claims remain at recessionary levels.

The Commerce Department said orders to U.S. factories for big-ticket manufactured goods plunged in October by the largest amount in two years as the economy weakened. The 6.2 percent drop was more than double the 3 percent decline economists expected.

It also reported that sales of new homes fell 5.3 percent in October to the lowest level in nearly 18 years. The seasonally adjusted annual sales pace of 433,000 homes was the lowest level since January 1991, when the country was facing another steep housing downturn.

Americans also cut back on their spending in October by the largest amount since the 2001 terror attacks. The Commerce Department said consumer spending plunged by 1 percent last month, worse than the 0.9 percent decline that had been expected. The report also said personal incomes rose 0.3 percent last month, more than the 0.1 percent gain analysts had predicted.

There was also some uneasiness ahead of the holiday shopping season. The season, which accounts for as much as 40 percent of annual profits for many stores, is expected to be the weakest in decades, as consumers grapple with rising unemployment and a drop in household wealth.

Some consumer technology names managed to post gains as investors hoped they might be able to see post holiday results.

Apple Inc. rose $4.20, or 4.6 percent, to $95.00, while Dell Inc. rose 63 cents, or 6 percent, to $11.05.

Blue chip stocks were higher. Citigroup Inc., which received a bailout by the government this week to stabilize the bank, surged 97 cents, or 16 percent, to $7.05. Consumer products maker Procter & Gamble Co. fell 2 cents to $63.16, while Chevron Corp. rose $3.40, or 4.4 percent, to $79.39.

Overseas, Japan's Nikkei stock average fell 1.33 percent. In afternoon trading, Britain's FTSE 100 fell 0.44 percent, Germany's DAX index was unchanged, and France's CAC-40 fell 0.52 percent.

Source: http://finance.yahoo.com

A stock market gaining confidence in the nation's financial system bolted higher Wednesday, propelling the Dow Jones industrials and Standard & Poor's 500 index to their first four-day advance since last spring.

The market reversed losses from earlier in the session after President-elect Barack Obama pledged he would have a plan to deal with the nation's economic crisis on his first day in office. After filling more spots to his economic team, Obama stated that "help is on the way."

The NYSE DOW closed HIGHER Dow +247.14 points +2.91% on wedneday November 26

Sym Last........ ........Change..........

Dow 8,726.61 +247.14 +2.91%

Nasdaq 1,532.10 +67.37 +4.60%

S&P 500 887.68 +30.29 +3.53%

30-yr Bond 3.5630% -0.0690

NYSE Volume 6,442,327,000

Nasdaq Volume 2,001,666,875

Europe

Symbol... Last...... .....Change.......

FTSE 100 4,152.69 -18.56 -0.44%

DAX 4,560.50 +0.08 +0.00%

CAC 40 3,169.85 -39.71 -1.24%

Asia

Symbol..... Last...... .....Change.......

Nikkei 225 8,213.22 -110.71 -1.33%

Hang Seng 13,369.45 +490.85 +3.81%

Straits Times 1,711.13 +57.88 +3.50%

http://biz.yahoo.com/ap/081126/wall_street.html

Dow, S&P 500 clinch 4th straight winning session

Wednesday November 26, 5:49 pm ET

By Tim Paradis, AP Business Writer

Stocks rally after Obama comments about economy; Dow and S&P rise for 4th straight day

NEW YORK (AP) -- A stock market gaining confidence in the nation's financial system bolted higher Wednesday, propelling the Dow Jones industrials and Standard & Poor's 500 index to their first four-day advance since last spring.

The market reversed losses from earlier in the session after President-elect Barack Obama pledged he would have a plan to deal with the nation's economic crisis on his first day in office. After filling more spots to his economic team, Obama stated that "help is on the way."

The major indexes built on their gains through the afternoon, but analysts warned that this latest advance came on light pre-holiday volume. The Dow is up 1,174 points, or 15.5 percent, during the past four days, and the S&P 500 is up 135, or 18 percent -- giving both indicators their biggest four-day rise since the Great Depression. The rally marks a string of gains that seemed impossible to achieve in the depths of selling that began in mid-September after the collapse of Lehman Brothers Holdings Inc.

Analysts saw encouraging signs in the rally, but they were still cautious given months of extreme market volatility.

"Sentiment has turned slightly more positive over the past few days with some of the government packages in the U.S. and the stimulus programs that have been announced," said Michael Sheldon, chief market strategist at RDM Financial Group. "That might help turn the tide."

The government's latest steps aimed at restoring the nation's financial system to health came Tuesday, when the Bush administration and the Federal Reserve pledged $800 billion to boost lending on credit cards, auto loans, mortgages and other borrowing.

Obama's remarks, meanwhile, calmed the market after the day's economic reports pointed to more weakness. The government reported that unemployment at recessionary levels, new home sales at their lowest level in nearly 18 years, another plunge in consumer spending, and factory orders for big-ticket items down by the largest amount in two years.

Analysts said some of the turnaround in stocks was due to the fact that the economic news was expected to be bad. Further, volume was about half of its normal levels on the floor of the New York Stock Exchange -- with 1.4 billion shares traded -- which can exacerbate price movements. Consolidated volume, which includes trades on other exchanges, came to 5.71 billion shares, compared to 6.72 billion on Tuesday.

"What we're seeing in the market is basically a light-volume shrugging off of bad news, which is very encouraging in the short term," said Sal Arnuk, co-head of equity trading at Themis Trading LLC.

The Dow industrials rose 247.14, or 2.91 percent, 8,726.61. The Dow has not had four straight gains since April 15-18; its advance is its biggest since 1932, during the Depression.

Broader indicators also rose. The S&P 500 advanced 30.29, or 3.53 percent, to 887.68; it last had a four-day winning streak May 27-30. Its rally was its largest since 1933.

The Nasdaq composite index rose 67.37, or 4.60 percent, to 1,532.10. The Russell 2000 index of smaller companies rose 25.45, or 5.74 percent, to 468.63.

The indexes remain far below the peaks they reached in October 2007. The Dow is down 38.39 percent, the S&P 500 is down 43.28 percent, and the Nasdaq is off 46.41 percent.

Advancing issues outnumbered decliners by 3 to 1 on the NYSE.

On Tuesday, stocks finished mostly higher as investors were encouraged by the government's new initiatives to help unfreeze the credit markets.

The market's performance in recent sessions has been a show of stability as stocks have generally traded with less volatility than they had in the past three months as the market's yearlong pullback intensified. But analysts remain cautious about how long the calm will last.

"I don't think its a sign of longer-term stability, but feel this is a sign of shorter-term stability," said Todd Salamone, director of trading and vice president of research at Schaeffer's Investment Research in Cincinnati. "There's just too much uncertainty out there."

Bond prices rose Wednesday. The yield on the benchmark 10-year Treasury note, which moves opposite its price, fell to 2.99 percent from 3.10 percent late Tuesday. The yield on the three-month T-bill, considered one of the safest investments, fell to 0.03 percent from 0.09 percent late Tuesday.

The dollar mostly rose against other major currencies, while gold prices fell. Light, sweet crude rose $3.67 to settle at $54.44 a barrel on the New York Mercantile Exchange.

In economic news, the Labor Department said initial requests for unemployment benefits fell to a seasonally adjusted 529,000 from the previous week's upwardly revised figure of 543,000. That is lower than analysts' expectations of 537,000. Still, the initial claims remain at recessionary levels.

The Commerce Department said orders to U.S. factories for big-ticket manufactured goods plunged in October by the largest amount in two years as the economy weakened. The 6.2 percent drop was more than double the 3 percent decline economists expected.

It also reported that sales of new homes fell 5.3 percent in October to the lowest level in nearly 18 years. The seasonally adjusted annual sales pace of 433,000 homes was the lowest level since January 1991, when the country was facing another steep housing downturn.

Americans also cut back on their spending in October by the largest amount since the 2001 terror attacks. The Commerce Department said consumer spending plunged by 1 percent last month, worse than the 0.9 percent decline that had been expected. The report also said personal incomes rose 0.3 percent last month, more than the 0.1 percent gain analysts had predicted.

There was also some uneasiness ahead of the holiday shopping season. The season, which accounts for as much as 40 percent of annual profits for many stores, is expected to be the weakest in decades, as consumers grapple with rising unemployment and a drop in household wealth.

Some consumer technology names managed to post gains as investors hoped they might be able to see post holiday results.

Apple Inc. rose $4.20, or 4.6 percent, to $95.00, while Dell Inc. rose 63 cents, or 6 percent, to $11.05.

Blue chip stocks were higher. Citigroup Inc., which received a bailout by the government this week to stabilize the bank, surged 97 cents, or 16 percent, to $7.05. Consumer products maker Procter & Gamble Co. fell 2 cents to $63.16, while Chevron Corp. rose $3.40, or 4.4 percent, to $79.39.

Overseas, Japan's Nikkei stock average fell 1.33 percent. In afternoon trading, Britain's FTSE 100 fell 0.44 percent, Germany's DAX index was unchanged, and France's CAC-40 fell 0.52 percent.