bigdog

Retired many years ago

- Joined

- 19 July 2006

- Posts

- 8,202

- Reactions

- 5,635

Stocks close mixed as regulators seek pause in J&J vaccine

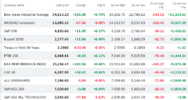

A choppy day of trading on Wall Street ended with indexes mixed Tuesday as a drop in bond yields hurt bank stocks but helped big technology companies.

The S&P 500 rose 0.3% after briefly slipping into the red in the early going. The modest gain nudged the benchmark index to an all-time high. Technology stocks and companies that rely on consumer spending helped lift the broad market index. The gains were tempered by a pullback in banks, industrial companies and other stocks.

Johnson & Johnson fell 1.3% after U.S. regulators recommended a pause in using its single-dose COVID-19 vaccine to investigate reports of possibly dangerous blood clots. Moderna, which also makes a COVID-19 vaccine, climbed 7.4%.

Worries about the potential loss of a vaccine option also pulled down companies that are counting on pandemic restrictions easing, though the losses eased by the end of the day. American Airlines slipped 1.5% and Delta Air Lines fell 1.1%.

The broader market has been mostly notching gains this month, reflecting cautious optimism among investors that the economy will strengthen and corporate profits will improve as the distribution of COVID-19 vaccines paves the way for more restrictions on businesses to be lifted. A pause in the rollout of the Johnson & Johnson vaccine isn’t going to derail that, analysts said.

“The response today has been very muted and isolated,” said, Scott Knapp, chief market strategist at CUNA Mutual Group. “Markets don’t expect lockdowns. The recovery may be delayed, but not a return to pandemic conditions.”

The market’s initial sell-off on the J&J news was “a bit of an overreaction,” said Jay Hatfield, CEO of Infrastructure Capital Management.

“We had a dress rehearsal for this last week because there was a huge disruption to the J&J supply and nobody seemed to care,” Hatfield said. “Clearly, the recovery is not dependent on J&J significantly.”

The S&P 500 rose 13.60 points to 4,141.59. The Dow Jones Industrial Average fell 68.13 points, or 0.2%, to 33,677.27. The Nasdaq gained 146.10 points, or 1.1%, to 13,996.10. The divergence between the Dow and Nasdaq was largely due to the fact the Dow has more bank stocks and also includes Johnson & Johnson, while the Nasdaq is heavily weighted with technology companies.

Small company stocks also lost ground. The Russell 2000 index of smaller companies gave up 4.86 points, or 0.2%, to 2,228.92.

The yield on the 10-year U.S. Treasury fell to to 1.62% from 1.67% the day before. JPMorgan Chase fell 1.2% and Wells Fargo lost 2.4%.

Investors will get a chance to look over the books of the big banks starting Wednesday, when JPMorgan Chase and Wells Fargo report their quarterly results. Bank of America and Citigroup report their results on Thursday.

The Australian share market looks set to push higher today. According to the latest SPI futures, the ASX 200 is expected to open the day 18 points or 0.25% higher. This follows a largely positive night of trade on Wall Street. Although the Dow Jones dropped 0.2%, the S&P 500 rose 0.33% and the Nasdaq stormed 1.05% higher.

https://apnews.com/article/technolo...rus-pandemic-956d1bf9c5eb1ecfcd2abc963933d1f4

Stocks close mixed as regulators seek pause in J&J vaccine

By DAMIAN J. TROISE and ALEX VEIGA

A choppy day of trading on Wall Street ended with indexes mixed Tuesday as a drop in bond yields hurt bank stocks but helped big technology companies.

The S&P 500 rose 0.3% after briefly slipping into the red in the early going. The modest gain nudged the benchmark index to an all-time high. Technology stocks and companies that rely on consumer spending helped lift the broad market index. The gains were tempered by a pullback in banks, industrial companies and other stocks.

Johnson & Johnson fell 1.3% after U.S. regulators recommended a pause in using its single-dose COVID-19 vaccine to investigate reports of possibly dangerous blood clots. Moderna, which also makes a COVID-19 vaccine, climbed 7.4%.

Worries about the potential loss of a vaccine option also pulled down companies that are counting on pandemic restrictions easing, though the losses eased by the end of the day. American Airlines slipped 1.5% and Delta Air Lines fell 1.1%.

The broader market has been mostly notching gains this month, reflecting cautious optimism among investors that the economy will strengthen and corporate profits will improve as the distribution of COVID-19 vaccines paves the way for more restrictions on businesses to be lifted. A pause in the rollout of the Johnson & Johnson vaccine isn’t going to derail that, analysts said.

“The response today has been very muted and isolated,” said, Scott Knapp, chief market strategist at CUNA Mutual Group. “Markets don’t expect lockdowns. The recovery may be delayed, but not a return to pandemic conditions.”

The market’s initial sell-off on the J&J news was “a bit of an overreaction,” said Jay Hatfield, CEO of Infrastructure Capital Management.

“We had a dress rehearsal for this last week because there was a huge disruption to the J&J supply and nobody seemed to care,” Hatfield said. “Clearly, the recovery is not dependent on J&J significantly.”

The S&P 500 rose 13.60 points to 4,141.59. The Dow Jones Industrial Average fell 68.13 points, or 0.2%, to 33,677.27. The Nasdaq gained 146.10 points, or 1.1%, to 13,996.10. The divergence between the Dow and Nasdaq was largely due to the fact the Dow has more bank stocks and also includes Johnson & Johnson, while the Nasdaq is heavily weighted with technology companies.

Small company stocks also lost ground. The Russell 2000 index of smaller companies gave up 4.86 points, or 0.2%, to 2,228.92.

The yield on the 10-year U.S. Treasury fell to to 1.62% from 1.67% the day before. JPMorgan Chase fell 1.2% and Wells Fargo lost 2.4%.

Investors will get a chance to look over the books of the big banks starting Wednesday, when JPMorgan Chase and Wells Fargo report their quarterly results. Bank of America and Citigroup report their results on Thursday.

Big technology stocks, which have fallen when bond yields have risen, closed solidly higher. Apple rose 2.4% and Microsoft gained 1%. Technology stocks rose sharply in 2020 as investors bet that stay-at-home Americans would shift even more to online buying and electronic entertainment to keep themselves busy in the pandemic.

Investors had little reaction to a report that showed U.S. consumer prices increased a sharp 0.6% in March, the most since 2012, while inflation over the past year rose a sizable 2.6%. The big gains are expected to be a temporary blip and not a sign that long dormant inflation pressures were emerging. The index rose 0.4% in February.

The Fed has been trying to reassure markets that any increase in inflation would be temporary as the economy recovers.

“It looks like the market is starting to internalize that point of view,” Knapp said.

Traders in cryptocurrencies pushed up the price of Bitcoin above $63,000 for the first time Tuesday. It rose 5.3% to $63,179.98, according to the tracking site CoinDesk. The rally comes as cryptocurrency exchange and digital wallet operator Coinbase is set to make its stock market debut Wednesday.

A choppy day of trading on Wall Street ended with indexes mixed Tuesday as a drop in bond yields hurt bank stocks but helped big technology companies.

The S&P 500 rose 0.3% after briefly slipping into the red in the early going. The modest gain nudged the benchmark index to an all-time high. Technology stocks and companies that rely on consumer spending helped lift the broad market index. The gains were tempered by a pullback in banks, industrial companies and other stocks.

Johnson & Johnson fell 1.3% after U.S. regulators recommended a pause in using its single-dose COVID-19 vaccine to investigate reports of possibly dangerous blood clots. Moderna, which also makes a COVID-19 vaccine, climbed 7.4%.

Worries about the potential loss of a vaccine option also pulled down companies that are counting on pandemic restrictions easing, though the losses eased by the end of the day. American Airlines slipped 1.5% and Delta Air Lines fell 1.1%.

The broader market has been mostly notching gains this month, reflecting cautious optimism among investors that the economy will strengthen and corporate profits will improve as the distribution of COVID-19 vaccines paves the way for more restrictions on businesses to be lifted. A pause in the rollout of the Johnson & Johnson vaccine isn’t going to derail that, analysts said.

“The response today has been very muted and isolated,” said, Scott Knapp, chief market strategist at CUNA Mutual Group. “Markets don’t expect lockdowns. The recovery may be delayed, but not a return to pandemic conditions.”

The market’s initial sell-off on the J&J news was “a bit of an overreaction,” said Jay Hatfield, CEO of Infrastructure Capital Management.

“We had a dress rehearsal for this last week because there was a huge disruption to the J&J supply and nobody seemed to care,” Hatfield said. “Clearly, the recovery is not dependent on J&J significantly.”

The S&P 500 rose 13.60 points to 4,141.59. The Dow Jones Industrial Average fell 68.13 points, or 0.2%, to 33,677.27. The Nasdaq gained 146.10 points, or 1.1%, to 13,996.10. The divergence between the Dow and Nasdaq was largely due to the fact the Dow has more bank stocks and also includes Johnson & Johnson, while the Nasdaq is heavily weighted with technology companies.

Small company stocks also lost ground. The Russell 2000 index of smaller companies gave up 4.86 points, or 0.2%, to 2,228.92.

The yield on the 10-year U.S. Treasury fell to to 1.62% from 1.67% the day before. JPMorgan Chase fell 1.2% and Wells Fargo lost 2.4%.

Investors will get a chance to look over the books of the big banks starting Wednesday, when JPMorgan Chase and Wells Fargo report their quarterly results. Bank of America and Citigroup report their results on Thursday.

ASX 200 expected to rise

The Australian share market looks set to push higher today. According to the latest SPI futures, the ASX 200 is expected to open the day 18 points or 0.25% higher. This follows a largely positive night of trade on Wall Street. Although the Dow Jones dropped 0.2%, the S&P 500 rose 0.33% and the Nasdaq stormed 1.05% higher.

https://apnews.com/article/technolo...rus-pandemic-956d1bf9c5eb1ecfcd2abc963933d1f4

Stocks close mixed as regulators seek pause in J&J vaccine

By DAMIAN J. TROISE and ALEX VEIGA

A choppy day of trading on Wall Street ended with indexes mixed Tuesday as a drop in bond yields hurt bank stocks but helped big technology companies.

The S&P 500 rose 0.3% after briefly slipping into the red in the early going. The modest gain nudged the benchmark index to an all-time high. Technology stocks and companies that rely on consumer spending helped lift the broad market index. The gains were tempered by a pullback in banks, industrial companies and other stocks.

Johnson & Johnson fell 1.3% after U.S. regulators recommended a pause in using its single-dose COVID-19 vaccine to investigate reports of possibly dangerous blood clots. Moderna, which also makes a COVID-19 vaccine, climbed 7.4%.

Worries about the potential loss of a vaccine option also pulled down companies that are counting on pandemic restrictions easing, though the losses eased by the end of the day. American Airlines slipped 1.5% and Delta Air Lines fell 1.1%.

The broader market has been mostly notching gains this month, reflecting cautious optimism among investors that the economy will strengthen and corporate profits will improve as the distribution of COVID-19 vaccines paves the way for more restrictions on businesses to be lifted. A pause in the rollout of the Johnson & Johnson vaccine isn’t going to derail that, analysts said.

“The response today has been very muted and isolated,” said, Scott Knapp, chief market strategist at CUNA Mutual Group. “Markets don’t expect lockdowns. The recovery may be delayed, but not a return to pandemic conditions.”

The market’s initial sell-off on the J&J news was “a bit of an overreaction,” said Jay Hatfield, CEO of Infrastructure Capital Management.

“We had a dress rehearsal for this last week because there was a huge disruption to the J&J supply and nobody seemed to care,” Hatfield said. “Clearly, the recovery is not dependent on J&J significantly.”

The S&P 500 rose 13.60 points to 4,141.59. The Dow Jones Industrial Average fell 68.13 points, or 0.2%, to 33,677.27. The Nasdaq gained 146.10 points, or 1.1%, to 13,996.10. The divergence between the Dow and Nasdaq was largely due to the fact the Dow has more bank stocks and also includes Johnson & Johnson, while the Nasdaq is heavily weighted with technology companies.

Small company stocks also lost ground. The Russell 2000 index of smaller companies gave up 4.86 points, or 0.2%, to 2,228.92.

The yield on the 10-year U.S. Treasury fell to to 1.62% from 1.67% the day before. JPMorgan Chase fell 1.2% and Wells Fargo lost 2.4%.

Investors will get a chance to look over the books of the big banks starting Wednesday, when JPMorgan Chase and Wells Fargo report their quarterly results. Bank of America and Citigroup report their results on Thursday.

Big technology stocks, which have fallen when bond yields have risen, closed solidly higher. Apple rose 2.4% and Microsoft gained 1%. Technology stocks rose sharply in 2020 as investors bet that stay-at-home Americans would shift even more to online buying and electronic entertainment to keep themselves busy in the pandemic.

Investors had little reaction to a report that showed U.S. consumer prices increased a sharp 0.6% in March, the most since 2012, while inflation over the past year rose a sizable 2.6%. The big gains are expected to be a temporary blip and not a sign that long dormant inflation pressures were emerging. The index rose 0.4% in February.

The Fed has been trying to reassure markets that any increase in inflation would be temporary as the economy recovers.

“It looks like the market is starting to internalize that point of view,” Knapp said.

Traders in cryptocurrencies pushed up the price of Bitcoin above $63,000 for the first time Tuesday. It rose 5.3% to $63,179.98, according to the tracking site CoinDesk. The rally comes as cryptocurrency exchange and digital wallet operator Coinbase is set to make its stock market debut Wednesday.