bigdog

Retired many years ago

- Joined

- 19 July 2006

- Posts

- 8,219

- Reactions

- 5,663

Source: http://finance.yahoo.com

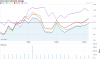

The NYSE DOW closed LOWER ▼ -117.16 points or ▼ -0.65% on Thursday, 19 March 2015

Symbol …........Last …......Change.......

Dow_Jones 17,959.03 ▼ -117.16 ▼ -0.65%

Nasdaq____ 4,992.38 ▲ 9.55 ▲ 0.19%

S&P_500___ 2,089.27 ▼ -10.23 ▼ -0.49%

30_Yr_Bond____ 2.54 ▲ 0.00 ▲ 0.08%

NYSE Volume 3,290,154,250

Nasdaq Volume 1,626,514,250

Europe

Symbol... .....Last ….....Change.......

FTSE_100 6,962.32 ▲ 17.12 ▲ 0.25%

DAX_____ 11,899.40 ▼ -23.37 ▼ -0.20%

CAC_40__ 5,037.18 ▲ 3.76 ▲ 0.07%

Asia Pacific

Symbol...... ….......Last .....Change…......

ASX_All_Ord___ 5,912.50 ▲ 104.50 ▲ 1.80%

Shanghai_Comp 3,582.27 ▲ 4.97 ▲ 0.14%

Taiwan_Weight 9,736.73 ▲ 83.30 ▲ 0.86%

Nikkei_225___ 19,476.56 ▼ -67.92 ▼ -0.35%

Hang_Seng.__ 24,468.89 ▲ 348.81 ▲ 1.45%

Strait_Times.__ 3,386.16 ▲ 24.41 ▲ 0.73%

NZX_50_Index_ 5,859.40 ▲ 12.74 ▲ 0.22%

http://finance.yahoo.com/news/us-stock-market-sinks-price-155627320.html

US stock market sinks as price of crude oil resumes a slide

US stocks slip as oil price fades, bringing down energy sector; Apple joins Dow industrials

Associated Press

By Matthew Craft, AP Business Writer

NEW YORK (AP) -- Another drop in oil prices helped drive the stock market to a loss on Thursday, as major indexes gave up their gains from the day before. Chevron, Exxon Mobil and other energy companies led stocks down.

Benchmark U.S. oil sank 70 cents to close at $43.96 a barrel in New York, extending a slump that has slashed prices by more than half over the past year.

"Given the big drop that we've had the big question is, when does oil hit bottom?" said Jeff Carbone, a senior partner at Cornerstone Financial Partners in Charlotte, North Carolina. "I don't think oil will bottom out until a company or a country flinches and cuts production. Right now producers are still pumping as much as they can."

It was Apple's first day as a member of the Dow Jones industrial average, as the maker of iPhones, iPads and other gadgets replaced AT&T. Goldman Sachs also took Visa's title as the most expensive stock among the blue chips. Because the Dow weighs its 30 companies by their share price instead of their market value, a stock split for Visa pushed the payment processor off its perch.

The Standard & Poor's 500 fell 10.23 points, or 0.5 percent, to 2,089.27.

The Dow Jones industrial average lost 117.16 points, or 0.6 percent, to 17,959.03. The Nasdaq composite rose 9.55 points, or 0.2 percent, to 4,992.38.

The economic news out Thursday gave investors little encouragement to drive stocks up. An index aimed at gauging the economy's momentum rose by a slight amount for a second straight month, and the number of people seeking U.S. unemployment benefits held steady. The Labor Department reported that weekly applications for unemployment aid edged up by 1,000 to 291,000 last week.

Phil Orlando, chief equity strategist at Federated Investors, thinks the market could hit a rough patch soon, with the S&P 500 sliding 5 percent or more in the coming months. "Why do we think that? Because what hit the fourth quarter hit in the first quarter: the stronger dollar, the decline in energy prices and the weather."

Any turbulence shouldn't last long, Orlando said, arguing that low gas prices could lead to a surge in consumer spending later in the year. "At some point, people have to say maybe energy prices will stay low and so we'll ratchet up our spending," he said.

The stock market surged Wednesday after the Federal Reserve signaled that it wasn't in a hurry to raise interest rates. Years of ultra-low rates has helped lift stock and bond prices by keeping the cost of borrowing cheap. The Fed has held its benchmark interest rate close to zero since 2008.

Major markets in Europe were mixed. Germany's DAX fell 0.2 percent, while France's CAC 40 edged up 0.1 percent. Britain's FTSE 100 rose 0.2 percent.

Back in the U.S., Nucor, a steel company, cut its forecast for quarterly earnings, blaming rising imports for driving steel prices down. Nucor plunged $3.17, or 6 percent, to $46.10.

Transocean announced late Wednesday that it would scrap four drilling rigs that it had tried to sell, requiring the company to take a charge against its earnings. Transocean sank $1.09, or 7 percent, to $14.16.

Prices for U.S. government bond prices slipped, nudging yields up. The yield on the 10-year Treasury note rose to 1.97 percent from 1.92 percent on Wednesday.

In the commodity markets, precious and industrial metals settled with strong gains. Gold rose $17.70 to $1,169 an ounce, while silver jumped 57 cents to $16.11 an ounce. Copper added nine cents to $2.66 a pound.

Brent crude, a benchmark for international oils used by many U.S. refineries, fell $1.48 to close at $54.43 in London.

In other futures trading on the New York Mercantile Exchange:

”” Wholesale gasoline fell 2.5 cents to close at $1.774 a gallon.

”” Heating oil fell 5.1 cents to close at $1.722 a gallon.

”” Natural gas fell 10.7 cents to close at $2.813 per 1,000 cubic feet.

The NYSE DOW closed LOWER ▼ -117.16 points or ▼ -0.65% on Thursday, 19 March 2015

Symbol …........Last …......Change.......

Dow_Jones 17,959.03 ▼ -117.16 ▼ -0.65%

Nasdaq____ 4,992.38 ▲ 9.55 ▲ 0.19%

S&P_500___ 2,089.27 ▼ -10.23 ▼ -0.49%

30_Yr_Bond____ 2.54 ▲ 0.00 ▲ 0.08%

NYSE Volume 3,290,154,250

Nasdaq Volume 1,626,514,250

Europe

Symbol... .....Last ….....Change.......

FTSE_100 6,962.32 ▲ 17.12 ▲ 0.25%

DAX_____ 11,899.40 ▼ -23.37 ▼ -0.20%

CAC_40__ 5,037.18 ▲ 3.76 ▲ 0.07%

Asia Pacific

Symbol...... ….......Last .....Change…......

ASX_All_Ord___ 5,912.50 ▲ 104.50 ▲ 1.80%

Shanghai_Comp 3,582.27 ▲ 4.97 ▲ 0.14%

Taiwan_Weight 9,736.73 ▲ 83.30 ▲ 0.86%

Nikkei_225___ 19,476.56 ▼ -67.92 ▼ -0.35%

Hang_Seng.__ 24,468.89 ▲ 348.81 ▲ 1.45%

Strait_Times.__ 3,386.16 ▲ 24.41 ▲ 0.73%

NZX_50_Index_ 5,859.40 ▲ 12.74 ▲ 0.22%

http://finance.yahoo.com/news/us-stock-market-sinks-price-155627320.html

US stock market sinks as price of crude oil resumes a slide

US stocks slip as oil price fades, bringing down energy sector; Apple joins Dow industrials

Associated Press

By Matthew Craft, AP Business Writer

NEW YORK (AP) -- Another drop in oil prices helped drive the stock market to a loss on Thursday, as major indexes gave up their gains from the day before. Chevron, Exxon Mobil and other energy companies led stocks down.

Benchmark U.S. oil sank 70 cents to close at $43.96 a barrel in New York, extending a slump that has slashed prices by more than half over the past year.

"Given the big drop that we've had the big question is, when does oil hit bottom?" said Jeff Carbone, a senior partner at Cornerstone Financial Partners in Charlotte, North Carolina. "I don't think oil will bottom out until a company or a country flinches and cuts production. Right now producers are still pumping as much as they can."

It was Apple's first day as a member of the Dow Jones industrial average, as the maker of iPhones, iPads and other gadgets replaced AT&T. Goldman Sachs also took Visa's title as the most expensive stock among the blue chips. Because the Dow weighs its 30 companies by their share price instead of their market value, a stock split for Visa pushed the payment processor off its perch.

The Standard & Poor's 500 fell 10.23 points, or 0.5 percent, to 2,089.27.

The Dow Jones industrial average lost 117.16 points, or 0.6 percent, to 17,959.03. The Nasdaq composite rose 9.55 points, or 0.2 percent, to 4,992.38.

The economic news out Thursday gave investors little encouragement to drive stocks up. An index aimed at gauging the economy's momentum rose by a slight amount for a second straight month, and the number of people seeking U.S. unemployment benefits held steady. The Labor Department reported that weekly applications for unemployment aid edged up by 1,000 to 291,000 last week.

Phil Orlando, chief equity strategist at Federated Investors, thinks the market could hit a rough patch soon, with the S&P 500 sliding 5 percent or more in the coming months. "Why do we think that? Because what hit the fourth quarter hit in the first quarter: the stronger dollar, the decline in energy prices and the weather."

Any turbulence shouldn't last long, Orlando said, arguing that low gas prices could lead to a surge in consumer spending later in the year. "At some point, people have to say maybe energy prices will stay low and so we'll ratchet up our spending," he said.

The stock market surged Wednesday after the Federal Reserve signaled that it wasn't in a hurry to raise interest rates. Years of ultra-low rates has helped lift stock and bond prices by keeping the cost of borrowing cheap. The Fed has held its benchmark interest rate close to zero since 2008.

Major markets in Europe were mixed. Germany's DAX fell 0.2 percent, while France's CAC 40 edged up 0.1 percent. Britain's FTSE 100 rose 0.2 percent.

Back in the U.S., Nucor, a steel company, cut its forecast for quarterly earnings, blaming rising imports for driving steel prices down. Nucor plunged $3.17, or 6 percent, to $46.10.

Transocean announced late Wednesday that it would scrap four drilling rigs that it had tried to sell, requiring the company to take a charge against its earnings. Transocean sank $1.09, or 7 percent, to $14.16.

Prices for U.S. government bond prices slipped, nudging yields up. The yield on the 10-year Treasury note rose to 1.97 percent from 1.92 percent on Wednesday.

In the commodity markets, precious and industrial metals settled with strong gains. Gold rose $17.70 to $1,169 an ounce, while silver jumped 57 cents to $16.11 an ounce. Copper added nine cents to $2.66 a pound.

Brent crude, a benchmark for international oils used by many U.S. refineries, fell $1.48 to close at $54.43 in London.

In other futures trading on the New York Mercantile Exchange:

”” Wholesale gasoline fell 2.5 cents to close at $1.774 a gallon.

”” Heating oil fell 5.1 cents to close at $1.722 a gallon.

”” Natural gas fell 10.7 cents to close at $2.813 per 1,000 cubic feet.