- Joined

- 30 June 2007

- Posts

- 7,200

- Reactions

- 1,227

Diggers and Drillers says "buy up to $1" and look at them all sitting there.

Diggers and Drillers says "buy up to $1" and look at them all sitting there.

Sorry Boggo, but there is no comparison to be made! But I don't want to start slinging mud (it's still in the process anyway!) I'll let the prices do the talking. I have been in NST for quite a while and can't believe they are adding a dividend with so much drilling still to be done, but I'll take the money!

Boggo, how can you possibly compare the two. Red and NST. Red I believe getting absolutely flooded, and dont report to shareholders. NST on the other hand, underground and dry and still making a motza. Lol. Cheers

And (the bolding) is exactly my point, you can't. Now have a look at the number of posts telling us how good RED is compared to the number of posts on NST.

I could list a dozen or more NST's at the moment but some miss the point and just get hung up on one stock.

Boggo - your opinion if you have time ? And can you name the other NST's that you refer to apart from DLS ?

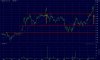

Can't really ever say what it is going to do. The daily EW chart below has a number of target areas, its an individual thing as to how you handle it when it starts to retrace.

I entered NST off the weekly Metastock scan chart in my earlier post above, an entry off the daily chart using EW pattern entry (below) would have been a little ripper in hindsight.

There are many daily breakout charts at the moment but I am finding more stability in the weekly breakouts, AIX (which has taken off today) is another example. It does get you in later but it seems to filter out some of the chaff.

Have a close look at the last breakout on AIX, all you need is a basic chart as the potential breakout at $2.00 stands out like the proverbial on the second chart below, its that simple really.

(NST daily and AIX weekly - click to expand)

Hmmm $2.00 stands out like what?

Looks like NST has the jitters. Yesterday RED and Today Northern Stars gone south must be catchy hey Boogo?

Here's a question from someone at home (sick and bored todayAn average mug punter dependant on and influenced by RED silt emails would probably see it as the jitters, others who treat this as a business predict these 'jitters' in advance (see chart above) and are neither surprised or dissapointed when the expected occurs.

Just for you jancha, a bit of textbook predictable behaviour

Here's a question from someone at home (sick and bored today):

Is the 38.2% W4 retracement target fairly close to the min typ 3 line on your chart? 50% fib seems to be around a $1.00, I take it that you would be using those as support zones and look out below if the second one is breached...

edit: and from what I understand it would also typically do both of those on less volume than the w3 moves.

Thanks - I guess the "grey" area that needs to be analysed in these cases is where wave 3 ends (I take this is only really known if it hits the first 38.2% retracement area?). Wave 3 obviously has lots of utility in deciding targets for wave 5 and so on. Phew! All sounds a bit beyond me, but interesting to think about it in terms of an intellectual pursuit.I can expand on it later V as I have to run now, initially just apply a 38.2% and 50% retracement.

I am tending to think that there may be more upside before a significant correction.

More later if needed.

An average mug punter dependant on and influenced by RED silt emails would probably see it as the jitters, others who treat this as a business predict these 'jitters' in advance (see chart above) and are neither surprised or dissapointed when the expected occurs.

Just for you jancha, a bit of textbook predictable behaviour

So what is the thinking now that InvestMet have reduced their holding by 18.1 Million shares and the MD and Chairman have given their families a nice early Christmas present by selling (8.2M and 3.3M) of their holdings at $1.35.

A nice little fall from $1.54 to a low of $1.33 today following the announcement.

This management team are very good at keeping their cards well hidden to be able to transact 19.6 million shares without the market being aware.

Yeah it's likely to bounce back pretty quick with all the excitement around this one.

It's always seemed too good to be true to me.

Why would these guys get out like that if the story is so great, why not wait till it's 2.50. Alarm bells are screaming!!!

Should be worth 2.50 easy given the announcements are so SPECTACULAR in the way they are worded.

Dunno, just makes me a bit wary despite the fact that excitement will bounce this soon you'd think.

Hello and welcome to Aussie Stock Forums!

To gain full access you must register. Registration is free and takes only a few seconds to complete.

Already a member? Log in here.