DeepState

Multi-Strategy, Quant and Fundamental

- Joined

- 30 March 2014

- Posts

- 1,615

- Reactions

- 81

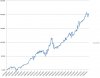

My ignorance and luck has served me well.

As I have clearly in correctly designed and traded systems profitably

Very profitably.

Your solution then is not systems developement and trading them.

What is?

So having a platform and getting some backtest that showed, you know: low drawdown, high ratios etc. and trading it is sufficient? Apparently....that's all there is to it. My bad!