- Joined

- 22 August 2008

- Posts

- 914

- Reactions

- 20

I had some time free up which is good for you as I can post a bit more...

So the clock is a general tool and it is the events on the outside of the clock that determine where you are in terms of the clock. I'm going to focus on the events at the start (bottom) and end (peak) of the share market cycle, rather than go through a full cycle, because I think that will be the limit of the time I can give and then open it up to questions.

Start of the Share Market Cycle

What is the trigger for the start of the new share cycle? As we approach the six o'clock position we've already gone through the optimal buying window for both Residential Property and Fixed interest. Interest rates, which started high, have been lowered by the Reserve Bank under their charter to stimulate the economy. This time around the guvmint also handed out great wads of cash in the form of stimulus packages to...you guessed it, stimulate the economy from the depths of recession.

The technical definition of a recession is two consecutive quarters of negative GDP. So this is one of the signals that you will use to determine your position on the clock...are we in a technical recesssion. (Note that the release of these figures is three months after the event so the lag can catch you if you are not aware of it.)

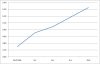

The other main indicator of the start of the new cycle is what is happening in the unemployment cycle. (See the image attached below).

When we look at the chart above you can see how in a general sense it follows a sine wave pattern...IE it's cyclical. You'll also hopefully note the correlation that exists between the peak of that cycle and the bottom of the share market that occured in March 2009. Yes there is a lag effect..it's not a perfect correlation as the unemployment cycle lags the start of the share market cycle, but the peak of the unemployment cycle is significant evidence that we are at the beginning of the new share cycle.

Let me explain what is happening and what drives our economy out of the correction. The guvmint draws back a vast amount of our overseas reserves whith which to employ capital expediture projects (and give free money away making Kevin Rudd everyone's best friend). Reserve Bank has lowered interest rates, making it cheaper and easier for business to do business. HOUSEHOLDERS however at this point in the cycle, are counting every penny. Businesses have been laying off staff. They have to if they want to survive in the corrective environment. The peak of unemployment however is when the company starts re-hiring. All the existing employees breath a sigh of relief because they now feel more secure in their jobs. All those expenses that they have been putting off to put some money away just in case now get paid. The car gets a much needed service, the kids get new school shoes, hubby takes the wife out to dinner etc etc etc and it's this activity and increase in consumer confidence that has a significant effect in driving us out of the recession.

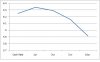

Because these expenses build up and all occur within a very short period of time, this leads share prices to have a bounce at the immediate bottom, (the tipping point if you will) around people being fired and people being hired. See the picture of the All Ords below and note the rapid rise in share prices that occured after the tipping point. Now look at the Unemployment cycle picture. During that initial very profitable rise in share prices, the unemployment cycle only started to improve at the end of that run. Thats the correlated yet lagging effect I was talking about. So your trigger for the start of the new bull market run, is when the unemployment cycle reaches peak, NOT, when it starts to improve.

This is golden time for long-term and savvy investors. Yields are HUGE on some really great shares that have had the **** kicked out of them. Banks with near 10% yield? I'll have me some of that thanks. So Yields (particularly Aggregate yield or EPS) can be used as an indicator to tell whether you are near the bottom of the market. This is an expression of the cyclical market. Brokers are yammering on about great yield and technicals as if they are the be all and end of of analysis. Stochastic this, MACD that.

When the Reserve Bank starts to increase interest rates again (guess where we are in terms of the interest rate cycle), you can be assured that the beginning of the new market has occurred. If you look at one of the clock diagrams in the previous post...you'll see rising share prices as one of the indicators I was talking about. Hey look another cycle

A bit later and we start to see commodity prices begin to improve, because the stockpiles that were created when the market corrected, have now been eaten into by the increase in demand. Queue another indicator of improvement and the movement of the clock away from the 6 - 7 o'clock position. Good Grief yet another cycle within the broader cycle.

It's at this time that the Reserve Bank starts to rebuild our overseas reserves, and will continue to raise rates in order to get good purchasing against oversea's currencies. Heaven's yet another cycle within the broader cycle.

It's around this time (say about 8-9 o'clock) that Banks and lending institutions start to free up the credit market. They turn the faucet off in a BIG way as we approach the recession because they can't justify lending money to any tom, dick and harry because heads have rolled because of the stupidity they had when lending to unemployed people to buy houses. (Ok this wasn't us...it was the U.S. ) and look another cycle.

) and look another cycle.

Mid Cycle

Mid cycle we've reached the old high of the market. Straight away you should be looking at the All Ords and saying OK we are not yet at 9 o'clock. we are between six and nine, but probably after seven because we've had that initial rise in share prices, and an improvement in commodity prices, so we're somewhere between seven and eight. It's this point where the clock tends to slow down. We can sit at this point for a long while whilst we wait for the Synchronisation in Global Economies to occur to lead us to those ecstatic peaks.

End of the cycle (Peak of the market)

Banks are giving credit away like's it's water with a use-by date. Commodities have razor thin stockpiles and prices are jumping like a cockroach on a hot barbeque. Share price yields are looking THIN and brokers are saying...Look its all about the fundamentals.

OK I have to stop again. I need to talk some more about what to look for at the end of the cycle, but I'll open this up to comments now. Be aware I have OBVIOUSLY pitched this at a newbie level. I'm happy to go into greater detail, but don't want to derail the thread.

Cheers

Sir O

So the clock is a general tool and it is the events on the outside of the clock that determine where you are in terms of the clock. I'm going to focus on the events at the start (bottom) and end (peak) of the share market cycle, rather than go through a full cycle, because I think that will be the limit of the time I can give and then open it up to questions.

Start of the Share Market Cycle

What is the trigger for the start of the new share cycle? As we approach the six o'clock position we've already gone through the optimal buying window for both Residential Property and Fixed interest. Interest rates, which started high, have been lowered by the Reserve Bank under their charter to stimulate the economy. This time around the guvmint also handed out great wads of cash in the form of stimulus packages to...you guessed it, stimulate the economy from the depths of recession.

The technical definition of a recession is two consecutive quarters of negative GDP. So this is one of the signals that you will use to determine your position on the clock...are we in a technical recesssion. (Note that the release of these figures is three months after the event so the lag can catch you if you are not aware of it.)

The other main indicator of the start of the new cycle is what is happening in the unemployment cycle. (See the image attached below).

When we look at the chart above you can see how in a general sense it follows a sine wave pattern...IE it's cyclical. You'll also hopefully note the correlation that exists between the peak of that cycle and the bottom of the share market that occured in March 2009. Yes there is a lag effect..it's not a perfect correlation as the unemployment cycle lags the start of the share market cycle, but the peak of the unemployment cycle is significant evidence that we are at the beginning of the new share cycle.

Let me explain what is happening and what drives our economy out of the correction. The guvmint draws back a vast amount of our overseas reserves whith which to employ capital expediture projects (and give free money away making Kevin Rudd everyone's best friend). Reserve Bank has lowered interest rates, making it cheaper and easier for business to do business. HOUSEHOLDERS however at this point in the cycle, are counting every penny. Businesses have been laying off staff. They have to if they want to survive in the corrective environment. The peak of unemployment however is when the company starts re-hiring. All the existing employees breath a sigh of relief because they now feel more secure in their jobs. All those expenses that they have been putting off to put some money away just in case now get paid. The car gets a much needed service, the kids get new school shoes, hubby takes the wife out to dinner etc etc etc and it's this activity and increase in consumer confidence that has a significant effect in driving us out of the recession.

Because these expenses build up and all occur within a very short period of time, this leads share prices to have a bounce at the immediate bottom, (the tipping point if you will) around people being fired and people being hired. See the picture of the All Ords below and note the rapid rise in share prices that occured after the tipping point. Now look at the Unemployment cycle picture. During that initial very profitable rise in share prices, the unemployment cycle only started to improve at the end of that run. Thats the correlated yet lagging effect I was talking about. So your trigger for the start of the new bull market run, is when the unemployment cycle reaches peak, NOT, when it starts to improve.

This is golden time for long-term and savvy investors. Yields are HUGE on some really great shares that have had the **** kicked out of them. Banks with near 10% yield? I'll have me some of that thanks. So Yields (particularly Aggregate yield or EPS) can be used as an indicator to tell whether you are near the bottom of the market. This is an expression of the cyclical market. Brokers are yammering on about great yield and technicals as if they are the be all and end of of analysis. Stochastic this, MACD that.

When the Reserve Bank starts to increase interest rates again (guess where we are in terms of the interest rate cycle), you can be assured that the beginning of the new market has occurred. If you look at one of the clock diagrams in the previous post...you'll see rising share prices as one of the indicators I was talking about. Hey look another cycle

A bit later and we start to see commodity prices begin to improve, because the stockpiles that were created when the market corrected, have now been eaten into by the increase in demand. Queue another indicator of improvement and the movement of the clock away from the 6 - 7 o'clock position. Good Grief yet another cycle within the broader cycle.

It's at this time that the Reserve Bank starts to rebuild our overseas reserves, and will continue to raise rates in order to get good purchasing against oversea's currencies. Heaven's yet another cycle within the broader cycle.

It's around this time (say about 8-9 o'clock) that Banks and lending institutions start to free up the credit market. They turn the faucet off in a BIG way as we approach the recession because they can't justify lending money to any tom, dick and harry because heads have rolled because of the stupidity they had when lending to unemployed people to buy houses. (Ok this wasn't us...it was the U.S.

Mid Cycle

Mid cycle we've reached the old high of the market. Straight away you should be looking at the All Ords and saying OK we are not yet at 9 o'clock. we are between six and nine, but probably after seven because we've had that initial rise in share prices, and an improvement in commodity prices, so we're somewhere between seven and eight. It's this point where the clock tends to slow down. We can sit at this point for a long while whilst we wait for the Synchronisation in Global Economies to occur to lead us to those ecstatic peaks.

End of the cycle (Peak of the market)

Banks are giving credit away like's it's water with a use-by date. Commodities have razor thin stockpiles and prices are jumping like a cockroach on a hot barbeque. Share price yields are looking THIN and brokers are saying...Look its all about the fundamentals.

OK I have to stop again. I need to talk some more about what to look for at the end of the cycle, but I'll open this up to comments now. Be aware I have OBVIOUSLY pitched this at a newbie level. I'm happy to go into greater detail, but don't want to derail the thread.

Cheers

Sir O