You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

MXR - Maximus Resources

- Thread starter Riesling

- Start date

- Joined

- 28 February 2008

- Posts

- 24

- Reactions

- 0

benwax, no one needs to do that here. This forum is about discussion and analysis, not dick comparisons, which are impossible to substantiate over the net without a webcam.

Good on you Kennas!!! I think this forum should be for what its meant for.

Recently bought in (MXR) and i must say YT has given me a much clear picture with the detailed analysis he's done.

I think he is right on the money...

- Joined

- 18 June 2007

- Posts

- 6

- Reactions

- 0

So YT can you tell me why the CAPEX is so small? Are the figures correct??

Lol - Joking mate.

Got in today also, agree with your sentiments about re-rating.

Lol - Joking mate.

Got in today also, agree with your sentiments about re-rating.

- Joined

- 18 February 2006

- Posts

- 4,200

- Reactions

- 2

So YT can you tell me why the CAPEX is so small? Are the figures correct??

Lol - Joking mate.

Got in today also, agree with your sentiments about re-rating.

lol Lampard was about to roll my eyes and think fark not another idiot, but then read on, yeah some people huh?

Glad your not one of them,

Hey fqzq88, nick/user id thats what I meant, its an interesting choiuce of letters and numbers nevertheless

Getting back to MXR, its performance was very veyr strong today considering how down the mkts were,

I wonder if all the buying was ASF? I doubt it, but one thing that had me scratching my head was the amount of cross trades that went through today, like 4 out of very 5 orders were cross trades and most were 50k buys, anyone else see that?

- Joined

- 18 February 2006

- Posts

- 4,200

- Reactions

- 2

Yeah YT. I saw that cross trade thingy. Sorry to ask u, wat is the significance of a cross trade? Is it just the trade between different brokers or does it mean sth else??

Hey Ong,

Cross trade means its a trade occuring within the same broker, its very very rare to see so many, I have never seen it before,

I don't what it means, or what to make of it, but its strange nevertheless,

I know Patersons underwrote and took a large placement at 20c to certain clients, perhaps they are selling these shares to toher clients withing Pato's, who knows?

- Joined

- 8 March 2007

- Posts

- 2,943

- Reactions

- 4,085

I trade with Commsec and have noticed that my own trades carry the XT Label

I just always assumed it was crossed by another Commsec client?

BTW 50k XT are not large what I would call Large trades when x 0.16 cents

Salute and Gods' speed

I just always assumed it was crossed by another Commsec client?

BTW 50k XT are not large what I would call Large trades when x 0.16 cents

Salute and Gods' speed

- Joined

- 18 February 2006

- Posts

- 4,200

- Reactions

- 2

Hey Captain Chaza,

Yeah agree completely regarding the fact that they're smallish orders ie $8k (50k@16c) but I was talking to someone else about and he made a very interesting point saying sometimes brokers will buy for clients who have a real diversified portfolio of stocks that that broker is pushing say $10k or less of a share if something is coming up, maybe but this is just all speculation

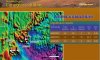

I was taking a close look at MXR's Canegrass/Shepards projects as to me these are the long term money huge re-rating projects, as a resource of 100Mt-200Mt will be worth $100m - $200m to MXR as it would be in high demand from WVL,

Eith that in mind I've gotten some extracts from MXR's ann's just focusing on Cangegrass/Shepards,

Whats amazing is how much land MXR controls around WVL, it really is astonishing

Yeah agree completely regarding the fact that they're smallish orders ie $8k (50k@16c) but I was talking to someone else about and he made a very interesting point saying sometimes brokers will buy for clients who have a real diversified portfolio of stocks that that broker is pushing say $10k or less of a share if something is coming up, maybe but this is just all speculation

I was taking a close look at MXR's Canegrass/Shepards projects as to me these are the long term money huge re-rating projects, as a resource of 100Mt-200Mt will be worth $100m - $200m to MXR as it would be in high demand from WVL,

Eith that in mind I've gotten some extracts from MXR's ann's just focusing on Cangegrass/Shepards,

Whats amazing is how much land MXR controls around WVL, it really is astonishing

Attachments

Narndee does look very prospective and may hold some serious long term value but with gold at record levels its Sellhiem that interests me most.

If as the company says the project can be brought into production so easily and gold produced so cheap at a cost of $200/oz this will be a big earner for the company.

I think that the Sellhiem JORC which you've said is overdue could be a real milestone for the company.

I got this from another forum where a member has done some figures to estimate the potential JORC at Sellhiem

Big Kev's "interesting picture" comment about Sellheim made me get out the ruler and calculator this morning....

Very possible that we could see a 300,000oz gold resource at Sellheim.... that would be huge.

Alluvial gold worth $300M at cash cost of $200oz, could easily bring in $200M+ profit.... plus the resource being open in all directions...

This would see a big re-rating IMHO.

To work out the 300,000oz here are some rough calcs.

3 seperate ore bodies with approx sizes of

800m x 800m = 640,000m2

500m x 500m = 250,000m2

500m x 400m = 200,000m2

Total Surface metres = 1,090,000m2

Given a 2g/t grade (highest grades at 14 g/t), depth of 3m, and a Tonne per m of 2.5, gives 15 grams gold per surface m2. Even knocking this back to 11grams (1/3 oz), gives us....

1,090,000 x 1/3oz = 360,000oz

Can't wait to see if I am near the ball park. Wouldn't be suprised to see a JORC of over 500,000oz IMHO..."

If as the company says the project can be brought into production so easily and gold produced so cheap at a cost of $200/oz this will be a big earner for the company.

I think that the Sellhiem JORC which you've said is overdue could be a real milestone for the company.

I got this from another forum where a member has done some figures to estimate the potential JORC at Sellhiem

Big Kev's "interesting picture" comment about Sellheim made me get out the ruler and calculator this morning....

Very possible that we could see a 300,000oz gold resource at Sellheim.... that would be huge.

Alluvial gold worth $300M at cash cost of $200oz, could easily bring in $200M+ profit.... plus the resource being open in all directions...

This would see a big re-rating IMHO.

To work out the 300,000oz here are some rough calcs.

3 seperate ore bodies with approx sizes of

800m x 800m = 640,000m2

500m x 500m = 250,000m2

500m x 400m = 200,000m2

Total Surface metres = 1,090,000m2

Given a 2g/t grade (highest grades at 14 g/t), depth of 3m, and a Tonne per m of 2.5, gives 15 grams gold per surface m2. Even knocking this back to 11grams (1/3 oz), gives us....

1,090,000 x 1/3oz = 360,000oz

Can't wait to see if I am near the ball park. Wouldn't be suprised to see a JORC of over 500,000oz IMHO..."

- Joined

- 18 February 2006

- Posts

- 4,200

- Reactions

- 2

Gekko,

I too am very bullish on Sellhiem, if you check my first couple of posts they were Sellhiem related,

I think the Sellhiem JORC will cause some interest and possible re-rating of the stock to more appropriate levels,

Below you can see my production/profit calcs

Selllheim Gold, 100%, Qld

No JORC yet, have been waiting for an appropriately qualified Geo to sign off on it given its an "ALLEUVIAL" deposit

Company estimates producing 15k-20k oz's Au p.a. @ $200 AUD oz cash cost, using a $1000 AUD spot = margins of $800oz = $12m - $16m PROFIT p.a.

Now even if they achieve say 1/3rd of this ie $5m Profit p.a. it shos just how much of a cash cow Sellhiem can be and the CAP EX will only be $2m

They expect to be producing by July![/QUOTE]

As for the potential size of Sellhiem, the below figures confuse me a litte

If we go with the assumptions of

Total Surface area = 1million metres squared

Depth = 3m

S.G. = 2.5

I get 7.5Mt's of dirt

Now using the 2g/t head grade I get

7.5Mt's@2g/tAu = 535K oz's Gold

If we use a head grade of 1g/t Au I still get

7.5Mt's@1g/tAu = 270K oz's Gold

Even this figure would be enough for 10years of production, but as the company expressed Sellhiem to be a short term Cash Cow I actually think such a large deposit is unlikely, I would be happy with a JORC of 150koz's as this would be enough for 5yrs+ of production

I too am very bullish on Sellhiem, if you check my first couple of posts they were Sellhiem related,

I think the Sellhiem JORC will cause some interest and possible re-rating of the stock to more appropriate levels,

Below you can see my production/profit calcs

Selllheim Gold, 100%, Qld

No JORC yet, have been waiting for an appropriately qualified Geo to sign off on it given its an "ALLEUVIAL" deposit

Company estimates producing 15k-20k oz's Au p.a. @ $200 AUD oz cash cost, using a $1000 AUD spot = margins of $800oz = $12m - $16m PROFIT p.a.

Now even if they achieve say 1/3rd of this ie $5m Profit p.a. it shos just how much of a cash cow Sellhiem can be and the CAP EX will only be $2m

They expect to be producing by July![/QUOTE]

As for the potential size of Sellhiem, the below figures confuse me a litte

If we go with the assumptions of

Total Surface area = 1million metres squared

Depth = 3m

S.G. = 2.5

I get 7.5Mt's of dirt

Now using the 2g/t head grade I get

7.5Mt's@2g/tAu = 535K oz's Gold

If we use a head grade of 1g/t Au I still get

7.5Mt's@1g/tAu = 270K oz's Gold

Even this figure would be enough for 10years of production, but as the company expressed Sellhiem to be a short term Cash Cow I actually think such a large deposit is unlikely, I would be happy with a JORC of 150koz's as this would be enough for 5yrs+ of production

- Joined

- 8 March 2008

- Posts

- 96

- Reactions

- 0

Hey guys

I am interested in the Bird-in-Hand Gold more than Selllheim.

Bird in hand looks to have better grade and looks to be more concentrated as per the announcement on the 4/3/08. Sellheim gold seems to be shallow and dispersed through a large area, which usually costs more?.

The nardee project may have a reserve of more than 200mt, but its magnetite, you cant use that for steel production. I think the only thing u can do with it is sell it off to Korea for coal. Does anyone know if they will get alot for it?

Anyhow this share with the reserves and projects looks to be better than NGF, which really has only one mine at Padington. Its sp is $.40

Whats your thoughts guys?

I am interested in the Bird-in-Hand Gold more than Selllheim.

Bird in hand looks to have better grade and looks to be more concentrated as per the announcement on the 4/3/08. Sellheim gold seems to be shallow and dispersed through a large area, which usually costs more?.

The nardee project may have a reserve of more than 200mt, but its magnetite, you cant use that for steel production. I think the only thing u can do with it is sell it off to Korea for coal. Does anyone know if they will get alot for it?

Anyhow this share with the reserves and projects looks to be better than NGF, which really has only one mine at Padington. Its sp is $.40

Whats your thoughts guys?

Hey guys

I am interested in the Bird-in-Hand Gold more than Selllheim.

Bird in hand looks to have better grade and looks to be more concentrated as per the announcement on the 4/3/08. Sellheim gold seems to be shallow and dispersed through a large area, which usually costs more?.

The nardee project may have a reserve of more than 200mt, but its magnetite, you cant use that for steel production. I think the only thing u can do with it is sell it off to Korea for coal. Does anyone know if they will get alot for it?

Anyhow this share with the reserves and projects looks to be better than NGF, which really has only one mine at Padington. Its sp is $.40

Whats your thoughts guys?

You can't look at share price as an indicator of it's worth.

I havn't look at NGF, but it's market capital (share price * number of shares on issue) is ~$130m

MXR is $24m, so yes MXR has a significantly lower market capital then this NGF you speak of. If NGF is comparable, then it does go further to say MXR is undervalued. (That said, I havn't look at anything other then it's market capital).

I am sorry but it really urks me when people compare companies by their share price.

- Joined

- 18 February 2006

- Posts

- 4,200

- Reactions

- 2

Hey guys

I am interested in the Bird-in-Hand Gold more than Selllheim.

Bird in hand looks to have better grade and looks to be more concentrated as per the announcement on the 4/3/08. Sellheim gold seems to be shallow and dispersed through a large area, which usually costs more?.

Mate have you read the research put forward?

For the last time Sellhiem is an ALLUVIAL deposit http://en.wikipedia.org/wiki/Alluvium

Alluvial deposits are very cheap to operate because they consist of large areas of LOOSE dirt, now within this loose dirt is the gold

See the company extract if you don't believe me re the Cost of extraction at Sellhiem

The nardee project may have a reserve of more than 200mt, but its magnetite, you cant use that for steel production. I think the only thing u can do with it is sell it off to Korea for coal. Does anyone know if they will get alot for it?

Mate again you haven't done much reading,

Firstly Magnetite Ore is a type of Iron Ore that can and is used for STEEL PRODUCTION, the only difference between Magnetite and Heamatite is that Magnetite requries BENEFICATION which can be quite costly both in terms of operating expenses and CAP EX

But at Narndee, MXR are targeting a FERROVANADIUM deposit, FERROVANADIUM IS USED FOR STEEL PRODUCTION,

Aurox is one of the leading Aussie FerroVanadium plays so take a look at them http://www.aurox.com.au/

Als MXR surround WVL's Winimurra Vanadium Operation, do some reading on that to get a proper idea of what Vanadium is

http://www.pmal.com.au/about_windimurra.16.html

http://en.wikipedia.org/wiki/Vanadium

It annoys me when I and others go to the effort of posting info and people just don't bother reading it

Attachments

- Joined

- 8 March 2008

- Posts

- 96

- Reactions

- 0

cheers YT, sorry, made a fool of myself, still learning the ropes...

I will do more extensive reading

:couch

I will do more extensive reading

:couch

- Joined

- 18 February 2006

- Posts

- 4,200

- Reactions

- 2

Hey Urgalz,

Thats fine mate, its jsut your questions where really more statments, always happy to help people to find the right info,

Anyway all that a side if you check you'll see I put up some rough calculations on what a production profile at Sellhiem could be worth to Maximus, and with gold close to $1000us/oz you can see why I'm so bullish on Sellhiem as its margins could be like 400%

This is why I think the Sellhiem JORC if it is over say 100koz will be a cuase of a re-rating on MXR, depending on how large the resource will determine how large the re-rating

Thats fine mate, its jsut your questions where really more statments, always happy to help people to find the right info,

Anyway all that a side if you check you'll see I put up some rough calculations on what a production profile at Sellhiem could be worth to Maximus, and with gold close to $1000us/oz you can see why I'm so bullish on Sellhiem as its margins could be like 400%

This is why I think the Sellhiem JORC if it is over say 100koz will be a cuase of a re-rating on MXR, depending on how large the resource will determine how large the re-rating

- Joined

- 17 May 2007

- Posts

- 55

- Reactions

- 0

Hey YT,

Always enjoy reading your analysis. Care to share what you reckon would be the downside for this one, apart from the current market turmoil?

Always enjoy reading your analysis. Care to share what you reckon would be the downside for this one, apart from the current market turmoil?

- Joined

- 14 April 2007

- Posts

- 158

- Reactions

- 0

Just been informed results for sellhelm will now be released after Easter and before the end of the month.

So a re rating will be a welcome Easter present

Pre production is still on track for commencement in the second qtr

SEMPER UBI SUB UBI

So a re rating will be a welcome Easter present

Pre production is still on track for commencement in the second qtr

SEMPER UBI SUB UBI

- Joined

- 1 August 2007

- Posts

- 71

- Reactions

- 0

sting who informed you of this?

Did you phone the company and talk to them or is this just a hunch?

Did you phone the company and talk to them or is this just a hunch?

Jman, could you please help do a Craig David and Fill Me In on this issue I have...

Can you explain what Alluvial mining is and the effect it has on grades / as opposed to Deep Quartz Vein mining (i think its called)!

Hopefully your answer can help to clarify the costs to non-believers of the $2m capex

Can you explain what Alluvial mining is and the effect it has on grades / as opposed to Deep Quartz Vein mining (i think its called)!

Hopefully your answer can help to clarify the costs to non-believers of the $2m capex