I wanted to see how my systems would perform if I were to run them at the same time and see if I would be better off to do so. And I thought I would share this with others as well.

First: there is a tutorial here, https://decodingmarkets.com/combine-equity-curves-in-amibroker/ . Please note that the majority of what I am showing came from that tutorial but I am showing you what I had to do differently.

Hope that helps some people who are contemplating running multiple systems.

First: there is a tutorial here, https://decodingmarkets.com/combine-equity-curves-in-amibroker/ . Please note that the majority of what I am showing came from that tutorial but I am showing you what I had to do differently.

- Open up Formula Editor for one of the systems you would like to compare. In there add the following CBT (custom backtest)

Code:

// The code for AmiBroker 5.50 and above

// YOUR TRADING SYSTEM HERE

// ....

SetCustomBacktestProc("");

if( Status("action") == actionPortfolio )

{

bo = GetBacktesterObject();

bo.Backtest();

AddToComposite( bo.EquityArray, "~~~SYSTEM_NAME", "X", atcFlagDeleteValues | atcFlagEnableInPortfolio ;

}- Do the above step for all the systems you would like to compare

- The equity for your system will now be saved as "~~~SYSTEM_NAME" and can be seen in the ticker symbol area.

- Create a new formula in Formula Editor with the following (this is to give us the data to copy into an excel sheet or export as a CSV):

Code:

Filter=1;

AddColumn(O,"Open");

AddColumn(H,"High");

AddColumn(L,"Low");

AddColumn(C,"Close");

AddColumn(V,"Volume",1.0);

AddColumn(OI,"Open Interest",1.0);- Go to a new analysis window, run the code above on your systems ticker.

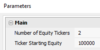

- You can see that my ticker ~~~MAP_1_6 is selected, which is for my MAP system, v1.6. I also have selected in the settings Weekly. This will give you the weekly values for the system.

- From here you can either CTL + A, and paste into excel, or you can "Export as HTML/CSV".

- Repeat the above for all of the systems you want to compare. I just did 2, but you can do more.

- I kept all my systems with the same amount of starting equity. Now that you have the data in excel you can run your metrics: individual gains, combined gains, maxDD for the same, and then you can put these into charts.

Hope that helps some people who are contemplating running multiple systems.