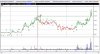

Down 12% on high volume.

Is that the end of an outstanding run until the announcement?

quite surprised it came tumbling down this much.

Profit-taking and it's hard to support those sort of prices on the back of a sudden run to get there.

I was contemplating getting out at 6c, but I'll hang around.