- Joined

- 30 May 2017

- Posts

- 2,513

- Reactions

- 4,140

Since the last post, I have had a lot of guidance from fellow ASF members in terms of going about longer-term investing. Few of the highly regarded members: @tech/a , @peter2 and @Skate have been generous to share some of their knowledge and experience with me over the last few days.

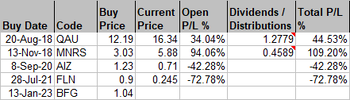

Basic conclusion at this stage is to stick to top quality blue chips like the latest buy in BHP and similar. Everything else (for example AIZ and FLN in this portfolio) should be considered as stocks for trading, something that I do in my other portfolio Speculative Stock Portfolio here at ASF.

But what do I do with AIZ and FLN ? I will continue to hold in this portfolio, even though they are down heavily. They may recover slowly over time if my original thoughts on buying them were good enough.

I haven't mastered the illusive art (or the science) of finding those smaller companies with sufficient consistency to make it worthwhile investing in. Yes, I have had the odd luck with a multi-bagger on an undervalued stock, but that's the problem, it was based mostly on luck than the time spent looking at the company fundamentals. There are a few ASF members that I know of who has some success in this area such as @galumay and @Value Collector but it's a tough gig.

I will continue to privately learn at my own pace and if I build up sufficient consistency, I may bring little gems into this portfolio again one day...

So, for the time being it will be just blue chips and dividend paying big caps that will be bought in this portfolio going forward.

Basic conclusion at this stage is to stick to top quality blue chips like the latest buy in BHP and similar. Everything else (for example AIZ and FLN in this portfolio) should be considered as stocks for trading, something that I do in my other portfolio Speculative Stock Portfolio here at ASF.

But what do I do with AIZ and FLN ? I will continue to hold in this portfolio, even though they are down heavily. They may recover slowly over time if my original thoughts on buying them were good enough.

I haven't mastered the illusive art (or the science) of finding those smaller companies with sufficient consistency to make it worthwhile investing in. Yes, I have had the odd luck with a multi-bagger on an undervalued stock, but that's the problem, it was based mostly on luck than the time spent looking at the company fundamentals. There are a few ASF members that I know of who has some success in this area such as @galumay and @Value Collector but it's a tough gig.

I will continue to privately learn at my own pace and if I build up sufficient consistency, I may bring little gems into this portfolio again one day...

So, for the time being it will be just blue chips and dividend paying big caps that will be bought in this portfolio going forward.

....

....