- Joined

- 30 May 2017

- Posts

- 2,513

- Reactions

- 4,140

Been sifting through a lot of hay lately...

..To find that needle in a haystack, mainly in the speculative space to add a position to the speculative portfolio. Few stories here and there but bit risky at this stage with prices jumping around all over the place and trading at cents...

The more established companies are a different story and well run companies can attract a premium to it's trading price as can be seen with the hefty premium offered to Programmed Maintenance (PRG) take-over.

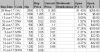

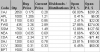

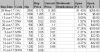

So I've been looking at similar industrial stocks in the service sector and noticed that mining services companies are making a come-back. Couple of the heavy-weights in this sector Monadelphous Grp (MND) and WorleyParsons Ltd (WOR) for example seems to be on the up up and away...

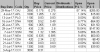

So looked at a few of the small to mid cap companies and narrowed the selection down to NRW Holdings Limited (NWH) to add to this longer term portfolio. Like it's peers the revenues has been in decline since the mining/exploration slow down, but starting to turn it around. Net debt also reduced by almost half from around $80m to around $40m. Preserving capital by having the dividend cut at the moment. Also bought a drill and blast business to grow the revenue streams.

..To find that needle in a haystack, mainly in the speculative space to add a position to the speculative portfolio. Few stories here and there but bit risky at this stage with prices jumping around all over the place and trading at cents...

The more established companies are a different story and well run companies can attract a premium to it's trading price as can be seen with the hefty premium offered to Programmed Maintenance (PRG) take-over.

So I've been looking at similar industrial stocks in the service sector and noticed that mining services companies are making a come-back. Couple of the heavy-weights in this sector Monadelphous Grp (MND) and WorleyParsons Ltd (WOR) for example seems to be on the up up and away...

So looked at a few of the small to mid cap companies and narrowed the selection down to NRW Holdings Limited (NWH) to add to this longer term portfolio. Like it's peers the revenues has been in decline since the mining/exploration slow down, but starting to turn it around. Net debt also reduced by almost half from around $80m to around $40m. Preserving capital by having the dividend cut at the moment. Also bought a drill and blast business to grow the revenue streams.