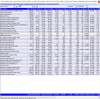

Hello, I have a question based on market depth. It might be easier to show it on a screen shot.

I am not looking for specific investment guidance that is why I did not specify the share code.

I am confused as to what to make of this. So I will put my thoughts in point form.

There are nearly double the bids for purchase than there are shares available for sale. This seems good.

The average buy bid size is bigger than the average sell bid size. This seems good.

The buy bid price tapers off down to 0.02 reasonably quickly. This seems bad.

Assuming that the ASX in general will not be moving much in either direction in the coming days and no announcements for the particular stock are forthcoming, with the limited data available in this post, what would you think would be a likely scenario for this share in the next trading day and please advise why you think whatever you do.

Thank you

I am not looking for specific investment guidance that is why I did not specify the share code.

I am confused as to what to make of this. So I will put my thoughts in point form.

There are nearly double the bids for purchase than there are shares available for sale. This seems good.

The average buy bid size is bigger than the average sell bid size. This seems good.

The buy bid price tapers off down to 0.02 reasonably quickly. This seems bad.

Assuming that the ASX in general will not be moving much in either direction in the coming days and no announcements for the particular stock are forthcoming, with the limited data available in this post, what would you think would be a likely scenario for this share in the next trading day and please advise why you think whatever you do.

Thank you