- Joined

- 17 January 2007

- Posts

- 2,986

- Reactions

- 32

Which way and by how much; or is it a question of how much it will go up by - 0.25% or 0.5%

You will get 0.5 either way

If RBA increase by 0.25 banks will tag a long to push it close to 0.5

If RBA increase 0.5, bank may cope a little more and increase independently in May or June

Radio reports today Kev07 has told the major banks he will be really cross if they exceed any RBA increase. That should do the trick.

INFLATION data released on the eve of today's Reserve Bank board meeting strengthens the chance of an interest rate rise in May to follow an expected announcement this afternoon of a rise in the cash rate from 7% to 7.25%.

Inflation powered to a six-year high in the 12 months to February 29, according to the TD Securities-Melbourne Institute Monthly Inflation Gauge.

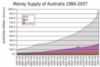

hahahaha, RBA taming the inflation that they cause by printing more money, hahahaha...Seen as the banks have indicated they will probably bashing on an extra .1 or .15 , I think the RBA will only go the .25.

Got to tame the Inflation beast !

If Mr Rudd genuinely had the best interests of the country at heart, he would cancel the $31B of tax cuts and as an alternative put it into super.

Isn't the RBA going to be looking at counteracting the inflationary effect this extra spending power will have? The next interest rate rise won't be too far away.

Hello and welcome to Aussie Stock Forums!

To gain full access you must register. Registration is free and takes only a few seconds to complete.

Already a member? Log in here.