- Joined

- 28 May 2020

- Posts

- 127

- Reactions

- 229

Say you're trading multiple strategies, A, B, and C. Say A & B are weekly and C is daily. Say each has $100K initial equity, but could have different position sizes and other criteria.

Each strategy would create its own portfolio, so strategy == portfolio - they are synonymous.

Each strategy would have its own portfolio of stocks, backtests, metrics, performance expectations/targets, perhaps different risk management, etc., etc.

How do you manage this scenario?

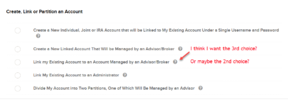

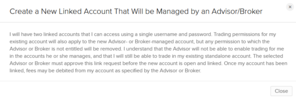

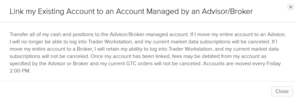

What I'm thinking is you have to create one broker account per strategy. Otherwise the profits would conflate, the performance would be harder to track, etc.

I suppose it would be possible to track this in an external program, such as the old share trade tracker, Sharesight.com, etc. But each time you place a trade you'd still have to know if $xxx was available for this strategy from $yyy in the total brokerage account.

To me a separate account for each strategy/portfolio would be easier. But I'm interested in your thoughts and how you manage this scenario.

Thanks!

Each strategy would create its own portfolio, so strategy == portfolio - they are synonymous.

Each strategy would have its own portfolio of stocks, backtests, metrics, performance expectations/targets, perhaps different risk management, etc., etc.

How do you manage this scenario?

What I'm thinking is you have to create one broker account per strategy. Otherwise the profits would conflate, the performance would be harder to track, etc.

I suppose it would be possible to track this in an external program, such as the old share trade tracker, Sharesight.com, etc. But each time you place a trade you'd still have to know if $xxx was available for this strategy from $yyy in the total brokerage account.

To me a separate account for each strategy/portfolio would be easier. But I'm interested in your thoughts and how you manage this scenario.

Thanks!