RichKid

PlanYourTrade > TradeYourPlan

- Joined

- 18 June 2004

- Posts

- 3,031

- Reactions

- 5

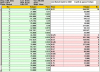

Mentioned this ealier in the breakouts thread, has pulled back now to restest resistance/support. A classic set up in my view is either here or approaching (ie the swing low retest on low volume). Once that support level around 61c is reestablished I expect the next stop to be the all time highs.

This stock is one of those smaller niche companies that have exposure to the resources boom imo so I like it long term.

Just my views, as shown in charts, not advice of any kind.

This stock is one of those smaller niche companies that have exposure to the resources boom imo so I like it long term.

Just my views, as shown in charts, not advice of any kind.