- Joined

- 7 December 2014

- Posts

- 357

- Reactions

- 0

While things look to be steadying at the moment.

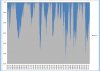

Keep in mind in the last 100 years, a -30% decline period has passed across every decade in the ASX, and we haven't had one yet this decade and there's 4 years to go.

To illustrate some figures, from an XAO peak of 5950 in April, -30% takes us to about 4200.

If that doesn't occur and we reach a new peak, for a -30% decline to bottom out at current XAO of 5200 it'd need to reach 7400.

The caveat to all that is that the Dow Jones once went 28 years without a -30% decline, so there is no certainty of the trend continuing on the ASX.

Milestones of the Australian Share Market

Australia's first stock exchange was established in Melbourne in 1861. Over the next few decades, additional regional exchanges were established in Sydney (1871), Hobart (1882), Brisbane (1884), Adelaide (1887) and Perth (1889).

All exchanges traded independently of each other until 1937 when the Australian Associated Stock Exchanges (AASE) was established, bringing with it uniformed listing and commission rules.

The following year, in 1938, the first share price index was published

AASE established in 1938

While things look to be steadying at the moment.

Keep in mind in the last 100 years, a -30% decline period has passed across every decade in the ASX, and we haven't had one yet this decade and there's 4 years to go.

To illustrate some figures, from an XAO peak of 5950 in April, -30% takes us to about 4200.

If that doesn't occur and we reach a new peak, for a -30% decline to bottom out at current XAO of 5200 it'd need to reach 7400.

The caveat to all that is that the Dow Jones once went 28 years without a -30% decline, so there is no certainty of the trend continuing on the ASX.

Hi Craft,

I think the thin 30% drawdown around 1970 on your graph, is the one I counted as starting in 1969.

On the drawdowns, I've used data from the ASX historical:

black dots = 30% drawdown

pink dots = 20% drawdown

Click to enlarge:

View attachment 64712

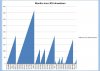

Interesting.You can see when there is a house price peak, there is an ASX Peak leading to a 20%+ decline close by.

Hello and welcome to Aussie Stock Forums!

To gain full access you must register. Registration is free and takes only a few seconds to complete.

Already a member? Log in here.