professor_frink

Moderator

- Joined

- 16 February 2006

- Posts

- 3,252

- Reactions

- 5

How far back is your back testing sample period Professor?

17 years for today's test

How far back is your back testing sample period Professor?

Any particular reason why 20 days?Test below is looking for price coming off a 20 day high(which we made yesterday)

Any particular reason why 20 days?

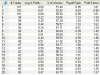

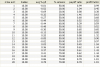

Test below is looking for price coming off a 20 day high(which we made yesterday), today's range is in the bottom 10% of readings for the past 3 weeks:

You must be using exit criteria which determines % profit. Does this not skew results to exit criteria?

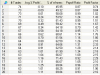

Buy at the close of price on the 9th day, and sell when price closes back above the 5 day MA.

No but is the bold type the exit criteria for all back tests?

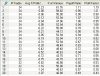

General idea is this: find a pattern/point of interest in price,volume,range, breadth,etc and then test it out as a buy signal. Instead of looking at a pattern and using a predefined exit to go along with it, the performance of the market following the pattern is logged to get an idea of what can be expected.

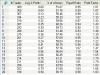

So, onto a basic test. If we have a look at Friday's bar for the S&P500, we can see that it was an inside day(see chart here). So our first test will be to see if an inside day has typically lead to any strength or weakness in the past. So we will code up an inside day and run it as the buy signal by itself, and see how the market has performed 'x' amount of days out from one.:

Hopefully my ramblings here have made sense

All thoughts, comments and criticism welcome

Yep, got the gist now. Thanks for clearing up my misunderstanding.

Hello and welcome to Aussie Stock Forums!

To gain full access you must register. Registration is free and takes only a few seconds to complete.

Already a member? Log in here.