Garpal Gumnut

Ross Island Hotel

- Joined

- 2 January 2006

- Posts

- 13,344

- Reactions

- 9,449

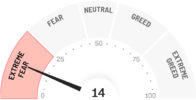

I have decided to loosen the purse strings on my cash and will be buying on the ASX next week. Not necessarily Monday, but definitely not Friday.

There is so much negativity about. People selling quality shares at less than 2/3 of the price they paid just a few weeks ago.

"The where is the Price of Gold Heading" thread resembles the FMG thread it is so off topic. All is gloom.

MEmbers are talking about nuclear warheads hitting my Gold bar, and battalions and whatnot picking up the flakes. Arguing over gigahertz or whatever Knuckler Arms are measured in, Radiation and Preppers, Metal cases and Nut cases, it is all there.

Madness abounds, and Fear is all about.

Time to buy.

gg

There is so much negativity about. People selling quality shares at less than 2/3 of the price they paid just a few weeks ago.

"The where is the Price of Gold Heading" thread resembles the FMG thread it is so off topic. All is gloom.

MEmbers are talking about nuclear warheads hitting my Gold bar, and battalions and whatnot picking up the flakes. Arguing over gigahertz or whatever Knuckler Arms are measured in, Radiation and Preppers, Metal cases and Nut cases, it is all there.

Madness abounds, and Fear is all about.

Time to buy.

gg