- Joined

- 9 May 2006

- Posts

- 76

- Reactions

- 0

Hey peeps

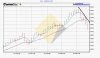

I'm a mix of irritated and freaked out by the past month or two of market activity. The wild swings down and up have really stuffed my trading plan around and being fairly inexperienced with bearish turns I lost a fair amount.

The losses sucked, but I guess I'm really looking for some opinions on the bigger picture here.

Three days ago, the US market was completely spooked by the threat of higher inflation + interest rates. Then the CPI stats come out - and they're worse than expected! - and the market bounces 3% for two days?

What the hell?

As a fundamentalist, I felt that the bearish turn was overdone, but at the same time felt the correction was needed to shake out the overvaluing that was going on in early May.

But such wild, fast fluctations? Eg. BHP's hit a low of something like 24.50 3 days ago and today is over $27?

The underlying fluctuations in spot metal prices has also sent my demand/supply research to pot. I suspect the big funds are to blame for the price bounce, but of course that clouds what the resource situation actually is.

All this has left my previously researched support levels and projected fundamental moves in question, as I've watched support levels evaporate with little resistance.

The temptation to go for some quick day trades is strong, but I've noticed that the major moves in share prices is happening on opening...I've yet to see some signs of a major intra-day move after open...its almost like the market is having knee-jerk responses to the previous night's Dow performances and then is kind of clueless for the rest of the day.

What I'd be very interested in, is opinions on how you all deal with the volatility.

My approach at the moment is to stay my ass out the water until I've figured out a view on where this market will be in a month, let alone a year.

I'm a mix of irritated and freaked out by the past month or two of market activity. The wild swings down and up have really stuffed my trading plan around and being fairly inexperienced with bearish turns I lost a fair amount.

The losses sucked, but I guess I'm really looking for some opinions on the bigger picture here.

Three days ago, the US market was completely spooked by the threat of higher inflation + interest rates. Then the CPI stats come out - and they're worse than expected! - and the market bounces 3% for two days?

What the hell?

As a fundamentalist, I felt that the bearish turn was overdone, but at the same time felt the correction was needed to shake out the overvaluing that was going on in early May.

But such wild, fast fluctations? Eg. BHP's hit a low of something like 24.50 3 days ago and today is over $27?

The underlying fluctuations in spot metal prices has also sent my demand/supply research to pot. I suspect the big funds are to blame for the price bounce, but of course that clouds what the resource situation actually is.

All this has left my previously researched support levels and projected fundamental moves in question, as I've watched support levels evaporate with little resistance.

The temptation to go for some quick day trades is strong, but I've noticed that the major moves in share prices is happening on opening...I've yet to see some signs of a major intra-day move after open...its almost like the market is having knee-jerk responses to the previous night's Dow performances and then is kind of clueless for the rest of the day.

What I'd be very interested in, is opinions on how you all deal with the volatility.

My approach at the moment is to stay my ass out the water until I've figured out a view on where this market will be in a month, let alone a year.