- Joined

- 19 October 2005

- Posts

- 4,561

- Reactions

- 6,775

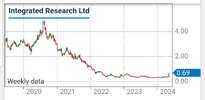

IRI @ 0.385

Pleased to see I'm not the only one speccing on this. Up 11% so far today, I'm only down 5% now.

Not recommending

Volume moving average rising. Illiquid stock.

Held

DAILY

Pleased to see I'm not the only one speccing on this. Up 11% so far today, I'm only down 5% now.

Not recommending

Volume moving average rising. Illiquid stock.

Held

DAILY