- Joined

- 14 February 2005

- Posts

- 15,534

- Reactions

- 18,257

Average annual wholesale spot prices (calendar years):Electricity costs will not rise significantly, there is new competition coming, wait and see. There could also be a drop in prices.

Queensland:

2019 = $86.30

2020 = $52.65

2021 = $119.89

NSW:

2019 = $90.29

2020 = $74.30

2021 = $85.82

Victoria:

2019 = $129.38

2020 = $66.07

2021 = $59.84

Tasmania:

2019 = $111.37

2020 = $53.96

2021 = $49.96

SA:

2019 = $135.99

2020 = $53.98

2021 = $70.45

WA (South-West Interconnected System only):

2019 = $48.18

2020 = $50.95

2021 = $52.33

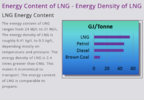

The big inflationary pressure in the industry at present is fuel costs. The present LNG netback price being $41.24 / GJ (ACCC data) and projected to remain over $30 through to the end of March 2030.

Putting that into perspective, $40 is simply "off the charts" sort of crazy, indeed the $20 reached briefly last year was off the charts at the time and seen as a crisis of sorts when it happened. Price in December 2019 was $6.53 and the low point was $2.29 in July 2020.

LNG netback prices don't directly flow through to the domestic market but they do influence it in the context of uncontracted gas. If someone can export something for $30 - $40 then it's a tough gig to persuade them to sell it for less - they'll only do that if demand stays down low enough that there's no physical means to export it due to capacity constraints which puts a volume cap on the quantity available at lower prices.

The thermal coal price presently in the high AUD $200's per tonne is likewise a very real cost pressure especially in Queensland and, when contracts expire or for above contract volumes, NSW. It's cheaper than gas at those prices,

There's some very real inflationary pressure there, presently being hidden by fixed price contracts and so on but it's there that's for sure and will flow through in due course if the underlying circumstances don't change since contracts don't run forever.

In due course fossil fuels will become mostly irrelevant to the input costs for electricity but we're a long way from that at present, in practice black coal and gas set the marginal price much of the time and right now they're getting expensive.