- Joined

- 28 August 2010

- Posts

- 1,158

- Reactions

- 1,733

the media are really starting to ramp up the inflation fear, well news.com.au is not media however it is viewed by the general public so alot of people are getting scared?

www.news.com.au

www.news.com.au

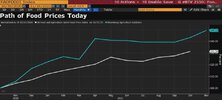

Fears as ‘hyperinflation’ strikes

Former US President Ronald Reagan once said, “Inflation is as violent as a mugger, as frightening as an armed robber and as deadly as a hit man.”