- Joined

- 20 July 2021

- Posts

- 12,713

- Reactions

- 17,660

China will be quite willing to help and JV , with their ( new ) major supplier ( in many commodities )Because a lot of it is beyond their control. When the infrastructure for 3 million barrels a day of russian oil is either blown up or crumbles from lack of maintenance, what then?

Remember back when the lockdowns first hit: Everything, but most of all, energy, PLUMMETED. We didn't see any big inflation in anything other than tech really, precisely because everyone were at home and therefore NOT going out and doing stuff/consuming energy.

Bring that demand back online with 25% of the world's oil offline and it's a massacre. You might have increased the supply of whatever you're producing (microchips or steel or whatever) but you've increased demand for the very energy necessary to produce them.

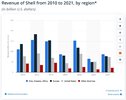

Green energy is no substitute for coal/oil and this is something all the woke countries have learned the very hard way over the last few months. Take a look at ICLN (clean energy etf) vs IXC (big oil etf) year to date to get an idea:

View attachment 141267

If anything, the last 4 months has actually exposed green energy for the complete fool's errand that it is.

Russia isn't exacting a stone-age economy , but they build things that are robust and durable ( and sure they look crude and lack refinement but they will do so for 20 years or more , with minimal upkeep ) they will create the infrastructure need , and the Chinese will see it is in their best interests to help where they can

the confounding factor will be how much will India participate in the mix ( they are sending exploration probes to Mars , so they are quite technologically capable as well )