- Joined

- 3 July 2009

- Posts

- 28,170

- Reactions

- 25,408

Just as a footnote to the above, I was out for the weekly catchup with the mates and my best mate was telling me his son and DIL are are in the hole for over $2m on investment properties, I said I wish them well and the way things are going they should double their money.But housing adds very little ongoing employment, as opposed to industrial investment, once it is built it supplies very little employment, but it has had a huge amount of stimulus.

Anyway it is what it is, a huge and ever growing gap between the haves and the have nots, which in turn leads to a very divided population.

It will just end up like most other countries in the world, which IMO is very sad.

But that's life.

What differentiates a great Government, from a Government which is just full of people who really don't want a real job, is one which actually makes changes to fit with the times.

The economy is dynamic as China is finding out, it wasn't long ago they had a one child policy, now 30 years later it isn't fit for purpose and has ended up with unintended consequence. They are now paying people to have children.

The same in Australia, rolling out the same old taxes and and policies, for a changing economy, isn't going to work, politicians are way too focused on the next election, rather than the next phase in Australia's journey.

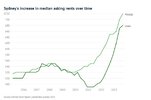

Now the only blue chip investment in Australia is property, which is strange, when we have so much free space and such a small population. It tells you the market is being manipulated, which tells us that the Government should be doing something about it.

Shelter is a basic need and when a country like Australia, has shelter as an unaffordable commodity, something is seriously wrong.

The countries of the world we smugly look down upon, due to their terrible living conditions, we are fast becoming.

This situation wasn't unintended, it is actively encouraged.

I wouldn't do it, but this is what the younger generation are obviously seeing a s a sure bet, maybe I'm just too old fashioned and risk averse.

But if it turns to $hit no doubt it will be my fault.