- Joined

- 28 March 2006

- Posts

- 3,572

- Reactions

- 1,320

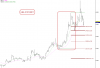

Going off the topic of PRR for this post just to expand on the 50%, back to PRR then.

Fully aware of that, it is however a significant level that must be considered when looking at retracements.

Example below (click to expand)

Important to point out here, that as interesting as the 50% level is, it is NOT a Fibonacci retracement level. Presume its included as a guide.

Fully aware of that, it is however a significant level that must be considered when looking at retracements.

Example below (click to expand)