pixel

DIY Trader

- Joined

- 3 February 2010

- Posts

- 5,359

- Reactions

- 345

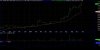

Six months ago, I gave the signals a miss because the low volume made the alert less convincing.

The ensuing rally of 50%+ has set the frame for the new signal, which is now also underpinned by better volume.

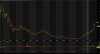

Although I haven't placed a bid yet - the stock only showed up in my eod scan - I'll definitely put it in the watchlist for tomorrow and next week.

Zooming in to the recent days, as long as 58c keeps holding, a bid around current levels looks promising.

The ensuing rally of 50%+ has set the frame for the new signal, which is now also underpinned by better volume.

Although I haven't placed a bid yet - the stock only showed up in my eod scan - I'll definitely put it in the watchlist for tomorrow and next week.

Zooming in to the recent days, as long as 58c keeps holding, a bid around current levels looks promising.