How is a year measured?

- Thread starter RamonR

- Start date

skc

Goldmember

- Joined

- 12 August 2008

- Posts

- 8,277

- Reactions

- 329

Re: How is a year measured.

Your spreadsheet calculation is wrong... or you had typo in your post.

Correct answer 367 days. Which should be over 1 year regardless of how CGT treat 1 year.

I bought some shares on 11/7/08 and sold them on 13/7/09.

My spreadsheet tells me I have had them 362 days.

Have I had these shares 1 year for Capital Tax purposes.

Your spreadsheet calculation is wrong... or you had typo in your post.

Correct answer 367 days. Which should be over 1 year regardless of how CGT treat 1 year.

- Joined

- 24 April 2009

- Posts

- 1,114

- Reactions

- 0

did you take into account that 08 was a leap year?

- Joined

- 2 September 2008

- Posts

- 1,038

- Reactions

- 1

You held them 367 days

Claim it as having a capital gains discount,

If you get audited show that you had them for 367 days which is greater than one year.

Claim it as having a capital gains discount,

If you get audited show that you had them for 367 days which is greater than one year.

Timmy

white swans need love too

- Joined

- 30 September 2007

- Posts

- 3,457

- Reactions

- 3

You held them 367 days

Claim it as having a capital gains discount,

If you get audited show that you had them for 367 days which is greater than one year.

Yep.

& get a better spreadsheetI bought some shares on 11/7/08 and sold them on 13/7/09.

My spreadsheet tells me I have had them 362 days.

Trembling Hand

Can be found on the bid

- Joined

- 10 June 2007

- Posts

- 8,852

- Reactions

- 205

& get a better spreadsheet

Maybe another business in this untapped opportunity Timmy?

skc

Goldmember

- Joined

- 12 August 2008

- Posts

- 8,277

- Reactions

- 329

Maybe another business in this untapped opportunity Timmy?

What? Combining the average cost feature with holding duration?

I fear your typical desktop computers will not have enough power for such calculations.

Timmy

white swans need love too

- Joined

- 30 September 2007

- Posts

- 3,457

- Reactions

- 3

TH, I did suspect the Chinese government of having bugs in my software development department, but not you too!

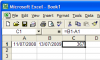

Ah well, the cat is out of the bag, here is my until now secret spreadsheet especially designed for investors on the ASX who do not want to be subject to CGT.

I was going to sell it to Goldmans but they said "What's an ASX?"

Ah well, the cat is out of the bag, here is my until now secret spreadsheet especially designed for investors on the ASX who do not want to be subject to CGT.

I was going to sell it to Goldmans but they said "What's an ASX?"

Attachments

Timmy

white swans need love too

- Joined

- 30 September 2007

- Posts

- 3,457

- Reactions

- 3

Combining the average cost feature with holding duration?

I didn't think of that.

BRB

- Joined

- 2 September 2008

- Posts

- 1,038

- Reactions

- 1

Just be careful selling it to goldman..

It may be public sooner than you think

It may be public sooner than you think

- Joined

- 27 February 2009

- Posts

- 152

- Reactions

- 0

Lol I have found a fatal flaw in your spreadsheet... it is still half the CGT for them....

Timmy

white swans need love too

- Joined

- 30 September 2007

- Posts

- 3,457

- Reactions

- 3

- Joined

- 28 October 2008

- Posts

- 8,609

- Reactions

- 39

The ATO does not count the day of aqusition or disposal as part of the holding period.I bought some shares on 11/7/08 and sold them on 13/7/09.

My spreadsheet tells me I have had them 362 days.

Have I had these shares 1 year for Capital Tax purposes.

In determining whether you acquired the CGT asset at least 12 months before the CGT event, both the day of acquisition and the day of the CGT event are excluded.

Example

Sally acquired a CGT asset on 2 February 2008. If a CGT event happened in relation to that asset before 3 February 2009, she had owned it for less than 12 months.

If the CGT event happens on or after 3 February 2009, then she has owned the asset for more than 12 months.

http://www.ato.gov.au/individuals/content.asp?doc=/content/36542.htm

Based on your dates above you are entitled to use the discount method with a day to spare.

- Joined

- 28 October 2008

- Posts

- 8,609

- Reactions

- 39

Ramon,

I'm trying to fathom how having purchased and disposed of shares on the above dates the total days held comes up to 362.

For both the purchase and disposal, what days were the orders were executed and what days were they settled ?

I'm trying to fathom how having purchased and disposed of shares on the above dates the total days held comes up to 362.

For both the purchase and disposal, what days were the orders were executed and what days were they settled ?

I'm trying to fathom how having purchased and disposed of shares on the above dates the total days held comes up to 362.

For both the purchase and disposal, what days were the orders were executed and what days were they settled ?

Days mentioned would have been execution date.

I think error in spreadsheet calculation is problem here.

For both the purchase and disposal, what days were the orders were executed and what days were they settled ?

Days mentioned would have been execution date.

I think error in spreadsheet calculation is problem here.

Similar threads

- Replies

- 6

- Views

- 678

- Replies

- 22

- Views

- 2K

- Replies

- 2

- Views

- 1K