In the vein of starting more stock related discussions, I asked this on the VLT thread but never got an answer.

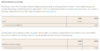

How does the accounting work for "deferred revenue"? I get it's revenue for coming quarters but what's the other side of it in double entry?

How does the accounting work for "deferred revenue"? I get it's revenue for coming quarters but what's the other side of it in double entry?