You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

HMX - Hammer Metals

- Thread starter sandybeachs

- Start date

greggles

I'll be back!

- Joined

- 28 July 2004

- Posts

- 4,475

- Reactions

- 4,537

is someone following this stock

It popped up on my radar back in January, but I can't say I've been following it too closely. Do you have any research or insights to share?

- Joined

- 19 October 2005

- Posts

- 4,355

- Reactions

- 6,438

I was enviously reading about Carnaby Resources (CNB) recently and saw on their presentation a tenement map which shows how intertwined CNB'S tenements east of Mt Isa are with those of Hammer Metals (HMX).

I have skilfully added a red arrow to the legend of the map below to draw attention to HMX tenements that are coloured grey. It can be seen how much area HMX controls including major fault lines. One tenement is adjacent to CNB's 'Nil Desperandum' prospect which just chalked up 41m @ 4.1% Cu, the occasion for much buying - see CNB chart attached.

HMX looks to have good management including two central figures from Gold Road (GOR) during the discovery of the 6m oz Gruyere gold deposit. I could argue that the stock is a buy on management alone.

Share price of HMX is not really cheap though when considering number of shares quoted: 813m not counting 34m options and performance shares. Using a rough factor of x8 times to consolidate the quoted shares down to 100m would result in a 50c share price, rounded.

I doubt I will be buying because of my overriding objective of increasing cash but the weekly chart shows break of downtrend in mild sympathy with Carnaby's space shot chart.

Weekly

Carnaby (CNB)

I have skilfully added a red arrow to the legend of the map below to draw attention to HMX tenements that are coloured grey. It can be seen how much area HMX controls including major fault lines. One tenement is adjacent to CNB's 'Nil Desperandum' prospect which just chalked up 41m @ 4.1% Cu, the occasion for much buying - see CNB chart attached.

HMX looks to have good management including two central figures from Gold Road (GOR) during the discovery of the 6m oz Gruyere gold deposit. I could argue that the stock is a buy on management alone.

Share price of HMX is not really cheap though when considering number of shares quoted: 813m not counting 34m options and performance shares. Using a rough factor of x8 times to consolidate the quoted shares down to 100m would result in a 50c share price, rounded.

I doubt I will be buying because of my overriding objective of increasing cash but the weekly chart shows break of downtrend in mild sympathy with Carnaby's space shot chart.

Weekly

Carnaby (CNB)

- Joined

- 19 October 2005

- Posts

- 4,355

- Reactions

- 6,438

Well that's it I guess. Wanted to get some HMX today on the back of CNG's Lady Fanny following on from Nil Desperandum but HMX up another 15% and don't want to chase.

- Joined

- 19 October 2005

- Posts

- 4,355

- Reactions

- 6,438

Compromised and picked up 40,000 @ .072, half of what I wanted to get below .06 but CNB's Lady Fanny announcement tripped me up.

It's pounds to peanuts HMX will pick up on something - with its tenements interlaced with those of CNB, including proximity to Nil Desperandum and Lady Fanny.

CNB could be onto something of scale only about 100kms by direct road and rail from Mt Isa and Glencore's mine and plant.

Anyway HMX has already made a decent start of getting together a copper resource from different deposits - striving for a hub and spoke operation (or a sale to a major maybe) - 400kt Cu jorc so far I think.

Tenements have significant copper workings and a very high grade gold mine to tge near south (Tick Hill)

Worth the punt for me.

It's pounds to peanuts HMX will pick up on something - with its tenements interlaced with those of CNB, including proximity to Nil Desperandum and Lady Fanny.

CNB could be onto something of scale only about 100kms by direct road and rail from Mt Isa and Glencore's mine and plant.

Anyway HMX has already made a decent start of getting together a copper resource from different deposits - striving for a hub and spoke operation (or a sale to a major maybe) - 400kt Cu jorc so far I think.

Tenements have significant copper workings and a very high grade gold mine to tge near south (Tick Hill)

Worth the punt for me.

- Joined

- 19 October 2005

- Posts

- 4,355

- Reactions

- 6,438

Doubled up @ 0.059

Bit p*ssed that I got sucked into fomo from the s.p boost from CNB nearology.

Wait out a spike in this type of stock and accept missing out unless the price reverts to before the excitement.

Bit p*ssed that I got sucked into fomo from the s.p boost from CNB nearology.

Wait out a spike in this type of stock and accept missing out unless the price reverts to before the excitement.

- Joined

- 19 October 2005

- Posts

- 4,355

- Reactions

- 6,438

HMX got a modest boost today on the back of neighbour CNB's confirmation of its spectacular Cu discovery in the Mt Isa region. If the price dwindles back to the low 5 cents I will pbly add. In the map below by HMX can be seen its tenements in close proximity to the discovery 'Nil Desperandum', which can be seen arrowed from a blue/grey box.

Funny how in the Dec Qtrly published Jan 31, Hammer management made no mention of Carnaby's discovery. Perhaps they see them as new arrivals to the area. Pretty sure HMX got first pick of tenements.

CNB after today has roughly a market cap of over $265m (cash maybe $25m), HMX has market cap of ~$50m (cash $8m)

HMX has been building another tenement package along 31km of Mt Isa fault and when they collate historical data they will advertise for a jv partner. See aqua/tan tenements named 'Resolve'. They aready have Sumitomo jv'ing on a tenement. Other majors have interests in the near region: Glencore at Mt Isa. OZL I notice participated in CNB's recent placement.

Not topical, but not to be completely overlooked, HMX also has active tenements alongside the Bronzewing gold mine in the Yandal greenstone belt.

Funny how in the Dec Qtrly published Jan 31, Hammer management made no mention of Carnaby's discovery. Perhaps they see them as new arrivals to the area. Pretty sure HMX got first pick of tenements.

CNB after today has roughly a market cap of over $265m (cash maybe $25m), HMX has market cap of ~$50m (cash $8m)

HMX has been building another tenement package along 31km of Mt Isa fault and when they collate historical data they will advertise for a jv partner. See aqua/tan tenements named 'Resolve'. They aready have Sumitomo jv'ing on a tenement. Other majors have interests in the near region: Glencore at Mt Isa. OZL I notice participated in CNB's recent placement.

Not topical, but not to be completely overlooked, HMX also has active tenements alongside the Bronzewing gold mine in the Yandal greenstone belt.

- Joined

- 19 October 2005

- Posts

- 4,355

- Reactions

- 6,438

Moving up - on CNB's 'Nil Desperandum' nearology presumably.

The plan was to dump the tranche I bought too early if my buy price was regained, but as usual intention does not equal action.

Daily

The plan was to dump the tranche I bought too early if my buy price was regained, but as usual intention does not equal action.

Daily

- Joined

- 19 October 2005

- Posts

- 4,355

- Reactions

- 6,438

HMX looks finely balanced here. I read a comment that the hammer candle today was a good sign as it showed the low of the day being rejected but conventionally I believe a hammer in an uptrend can be bearish. The price is hesitating at the level of the prior high. I will be watching in case it fails here and can be picked up at 6c or lower. I haven't seen much interest in Cu explorers here when it comes to discussion of how to benefit from the copper price. Nor mixed commodity miners for that matter, like Newcrest (NCM). Sandfire (SFR) doesn't get mentioned and its chart had its highest weekly close in 3 years.

Held

HMX Daily

Held

HMX Daily

Sean K

Moderator

- Joined

- 21 April 2006

- Posts

- 22,131

- Reactions

- 11,230

HMX looks finely balanced here. I read a comment that the hammer candle today was a good sign as it showed the low of the day being rejected but conventionally I believe a hammer in an uptrend can be bearish. The price is hesitating at the level of the prior high. I will be watching in case it fails here and can be picked up at 6c or lower. I haven't seen much interest in Cu explorers here when it comes to discussion of how to benefit from the copper price. Nor mixed commodity miners for that matter, like Newcrest (NCM). Sandfire (SFR) doesn't get mentioned and its chart had its highest weekly close in 3 years.

Held

HMX Daily

View attachment 137392

Having a watchlist of prospective copper developers is a very good thing at the moment. Well, should have been for the past couple of years really. There's a structural issue with supply demand and new discoveries to cover the looming shortfall while demand is more likely to significantly increase. Add that to Sth American west coast communistas and indigenous communities making it risky to even explore for copper and the price of copper in the short to mid term should be well supported, pending any short term major economic shocks.

- Joined

- 19 October 2005

- Posts

- 4,355

- Reactions

- 6,438

Shallow and high grade. It's only one hole, the first, but it's a prospect that's never been drilled and is situated in a 12km trend. Unfortunately they don't describe what sort of trend. They'll do a downhole electro-mag survey of this hole. This 'Ajax' prospect is on 100% HMX ground, just outside the joint venture area -30%-70% in Sumitomo Metals' favour in return for Sumitomo spending a lot of money. Hammer seems to have a hell of a lot going on which will include an induced polarisation team surveying prospects in Mar/April.

Also in today's announcement, at last a 'grudging' acknowledgment of Carnaby's results. They have taken their location and methods onboard:

Also in today's announcement, at last a 'grudging' acknowledgment of Carnaby's results. They have taken their location and methods onboard:

"Following the nearby “Major Copper Discovery” by Carnaby Resources (ASX: CNB) at Nil Desperandum, Hammer has instigated a geological review of its neighbouring tenements and targets including Revenue prospect (~5km to the East of Nil Desperandum) and Overlander deposits.

The review encompasses historical drilling and residual geophysical targets including historical IP surveys which appear to be a factor in Carnaby’s recent exploration success.

An IP team has been secured for work in March/April to complete initial surveys across several Hammer and Mount Isa East JV targets."

Dona Ferentes

Abrió la caja, vio al gatito, y sonrió

- Joined

- 11 January 2016

- Posts

- 15,592

- Reactions

- 21,202

NEW DRILL TARGETS DEFINED ACROSS MOUNT ISA PROJECTS

• High-priority IP anomaly defined at Overlander South, with drilling expected to commence this week.

• The interpreted IP anomaly is situated 200m below the existing Overlander South copper-cobalt JORC resource (649,000t @ 1.0% Cu and 500ppm Co*).

• Down-hole and fixed loop EM surveys currently underway at the Ajax prospect, with results imminent.

• Laboratory assays from initial drilling at Ajax expected within the next seven days – preliminary portable-XRF intersection of 10m at 3.5% Cu from 27m in HMLVRC014 (ASX Announcement 14 February 2022).

• Follow-up drilling at Ajax to commence following completion of drilling at Overlander South.

• Broad copper-gold soil anomaly over 600m of strike defined at Ajax along with multiple anomalies along the Lakeview trend.

• Several broad copper-gold target zones identified by geochemical soil surveys at Shadow North, Fountain Range and Dronfield, part of the Mount Isa East JV.

......... up some 10%, as is CNB (joined at hip)

• High-priority IP anomaly defined at Overlander South, with drilling expected to commence this week.

• The interpreted IP anomaly is situated 200m below the existing Overlander South copper-cobalt JORC resource (649,000t @ 1.0% Cu and 500ppm Co*).

• Down-hole and fixed loop EM surveys currently underway at the Ajax prospect, with results imminent.

• Laboratory assays from initial drilling at Ajax expected within the next seven days – preliminary portable-XRF intersection of 10m at 3.5% Cu from 27m in HMLVRC014 (ASX Announcement 14 February 2022).

• Follow-up drilling at Ajax to commence following completion of drilling at Overlander South.

• Broad copper-gold soil anomaly over 600m of strike defined at Ajax along with multiple anomalies along the Lakeview trend.

• Several broad copper-gold target zones identified by geochemical soil surveys at Shadow North, Fountain Range and Dronfield, part of the Mount Isa East JV.

......... up some 10%, as is CNB (joined at hip)

- Joined

- 19 October 2005

- Posts

- 4,355

- Reactions

- 6,438

Pipped 10c today, a breather not unlikely I guess. Mt Isa terrane.

Strong looking copper prospects: Ajax, greenfield prospect 10m @ 3%Cu first hole, now doing downhole EM at Ajax then follow up drilling

Copying Carnaby's IP approach to selected areas.

Daily

Strong looking copper prospects: Ajax, greenfield prospect 10m @ 3%Cu first hole, now doing downhole EM at Ajax then follow up drilling

Copying Carnaby's IP approach to selected areas.

Daily

- Joined

- 19 October 2005

- Posts

- 4,355

- Reactions

- 6,438

Mixed results announced but the market liked it, HMX ^16%

The assay for the Ajax discovery hole (HMRC014) came back even richer than the portable XRF field estimate announced a couple of posts back (Feb 13). The assay reading for HMRC014 is 11m @ 5% Cu, 2.5g/t Au.

A splay hole drilled to the west of HMRC014 came up with zip.

Downhole EM for HMRC014 came up with nothing immediate but did apparently echo the fixed loop Electro-Magnetic (FLEM) survey completed to the east of this discovery hole. This FLEM has registered a large EM conductor that lies directly beneath a strong Cu-in-soil trend. You can see the soil samples with readings of greater than 1,000 ppm as small purple squares in the attached diagram. The EM 'plate' is only 350m to the east of Ajax hole HMRC014. It measures 500m x 500m dipping west and starts from 100m depth. Only three historic holes have been drilled into the Cu-in-soil prospect by a previous explorer investigating the soil geochem anomalies and those holes only went down 100m at angles narrowly missing the deeper EM conductor that HMX has just found.

In summary they have found:

The assay for the Ajax discovery hole (HMRC014) came back even richer than the portable XRF field estimate announced a couple of posts back (Feb 13). The assay reading for HMRC014 is 11m @ 5% Cu, 2.5g/t Au.

A splay hole drilled to the west of HMRC014 came up with zip.

Downhole EM for HMRC014 came up with nothing immediate but did apparently echo the fixed loop Electro-Magnetic (FLEM) survey completed to the east of this discovery hole. This FLEM has registered a large EM conductor that lies directly beneath a strong Cu-in-soil trend. You can see the soil samples with readings of greater than 1,000 ppm as small purple squares in the attached diagram. The EM 'plate' is only 350m to the east of Ajax hole HMRC014. It measures 500m x 500m dipping west and starts from 100m depth. Only three historic holes have been drilled into the Cu-in-soil prospect by a previous explorer investigating the soil geochem anomalies and those holes only went down 100m at angles narrowly missing the deeper EM conductor that HMX has just found.

In summary they have found:

- the intense Cu/Au mineralisation in Ajax discovery hole MHRC014,

- the Cu-in-soil anomalies only 350m to the east of HMRC014

- the EM conductor 100m beneath the Cu-in-soil anomalies

- Joined

- 19 October 2005

- Posts

- 4,355

- Reactions

- 6,438

Wishful thinking probably but the HMX daily chart is getting a bit of an early parabolic look to it. It's made good progress recovering the ground lost after the 5 bagger Jan/Feb 2021 spike and has reattained the center level of the consolidation triangle that followed the spike.

On the ground the next drilling activity at Ajax discovery hole has probably already commenced, or will very soon. Diamond drilling into Ajax HMRC014 at depth and along strike will be done. But the most alluring target is the EM anomaly 350 metres to the east of the Ajax hole. As reported this large EM anomaly starts at 100m and is below a known mineralised trend. The lnference I draw is that this conductive plate, which is believed to be sulphide, could reflect the feeder source for the Ajax mineralisation? Drilling this has been prioritised but must get past 'cultural' and land access clearances.

On the ground the next drilling activity at Ajax discovery hole has probably already commenced, or will very soon. Diamond drilling into Ajax HMRC014 at depth and along strike will be done. But the most alluring target is the EM anomaly 350 metres to the east of the Ajax hole. As reported this large EM anomaly starts at 100m and is below a known mineralised trend. The lnference I draw is that this conductive plate, which is believed to be sulphide, could reflect the feeder source for the Ajax mineralisation? Drilling this has been prioritised but must get past 'cultural' and land access clearances.

- Joined

- 19 October 2005

- Posts

- 4,355

- Reactions

- 6,438

- Joined

- 19 October 2005

- Posts

- 4,355

- Reactions

- 6,438

Very lame looking result from the DD into the big EM conductor east of the Ajax discovery.

Absolutely nothing is panning out for my spec stocks lately - KWR is actually lower than my average price and that's with a critical DD operation ongoing. HRZ crashed back to my buy-in level. CHN smashed.

I have bought nothing in anything during this rout which is largely why I can't post. Anyone would think there's an horrfic war going on with nuclear rumblings. Just ignore anything I say in future would be the best policy ?

Absolutely nothing is panning out for my spec stocks lately - KWR is actually lower than my average price and that's with a critical DD operation ongoing. HRZ crashed back to my buy-in level. CHN smashed.

I have bought nothing in anything during this rout which is largely why I can't post. Anyone would think there's an horrfic war going on with nuclear rumblings. Just ignore anything I say in future would be the best policy ?

- Joined

- 19 October 2005

- Posts

- 4,355

- Reactions

- 6,438

Woohoo, back to break even if you don't count brokerage. Temporarily anyway. Any excuse will do for celebration these days.

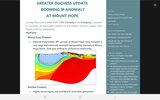

Hammer Metaks has been horning in on Carnaby's Mt Hope I.P discovery. The Carnaby geophysics crew had to come on to HMX's ground to flesh out the discovery and found that CNB's strongly anomalous IP chargeability does indeed extend well into HMX's tenement. Further, since CNB's interest in HMX's ground was obviously limited in scope, the I.P (induced polarization) print is open and untested north, south and east.

Held

Daily

Carnaby's announcement 14 July

Hammer Metaks has been horning in on Carnaby's Mt Hope I.P discovery. The Carnaby geophysics crew had to come on to HMX's ground to flesh out the discovery and found that CNB's strongly anomalous IP chargeability does indeed extend well into HMX's tenement. Further, since CNB's interest in HMX's ground was obviously limited in scope, the I.P (induced polarization) print is open and untested north, south and east.

Held

Daily

Carnaby's announcement 14 July

- Joined

- 19 October 2005

- Posts

- 4,355

- Reactions

- 6,438

Added 40,000 @ 0.049

My cheapest HMX buy yet!

Buying specs feels like a lotto ticket, a shot in the arm, a tonic.

Have to post about something.

Held

My cheapest HMX buy yet!

Buying specs feels like a lotto ticket, a shot in the arm, a tonic.

Have to post about something.

Held

- Joined

- 19 October 2005

- Posts

- 4,355

- Reactions

- 6,438

First hole at South Hope, 650 mtrs south of Carnaby's Mt Hope prospect, delivering a decent intersection of copper. The grade is an XRF reading and true width looks to be between 15m-20m from a diagram in the announcement.

Held

Held