HLX - Helix Resources

- Thread starter YOUNG_TRADER

- Start date

-

- Tags

- helix resources hlx

- Joined

- 1 February 2007

- Posts

- 1,068

- Reactions

- 0

Ive had a buy order sitting at .20c for the HLX options but cancelled it this arvo...and gee it looks like I made the right choice...for a change

The share price did look like it was starting to stagnate a bit.

Perhaps my time to buy back in is approahing, however...as we all know there does feel to be some insider knowledge passed around among people in the know with HLX and their announcements

The share price did look like it was starting to stagnate a bit.

Perhaps my time to buy back in is approahing, however...as we all know there does feel to be some insider knowledge passed around among people in the know with HLX and their announcements

- Joined

- 12 July 2006

- Posts

- 214

- Reactions

- 0

Can't think that this is anything more then some low volume frustration creeping in from the lack of news.

Company seems to take forever to make an announcement on anything so it's nautural that some will become disillusioned.

I think it is a temporary sell-off though and we will see it bounce up again in the next few days as the lower price is stabilised and attracts those waiting on the sidelines.

We know that the company has got it's finger in a number of pies and that AQA has been buying it.

I'm going to hold in the medium term.

Company seems to take forever to make an announcement on anything so it's nautural that some will become disillusioned.

I think it is a temporary sell-off though and we will see it bounce up again in the next few days as the lower price is stabilised and attracts those waiting on the sidelines.

We know that the company has got it's finger in a number of pies and that AQA has been buying it.

I'm going to hold in the medium term.

- Joined

- 8 March 2007

- Posts

- 3,225

- Reactions

- 4,559

Can't think that this is anything more then some low volume frustration creeping in from the lack of news.

Company seems to take forever to make an announcement on anything so it's nautural that some will become disillusioned.

I think it is a temporary sell-off though and we will see it bounce up again in the next few days as the lower price is stabilised and attracts those waiting on the sidelines.

We know that the company has got it's finger in a number of pies and that AQA has been buying it.

I'm going to hold in the medium term.

Like Me

Do you really think you have any other choice?

I'd be interested to hear of anything favourable

I can't handle BAD things

Salute and Gods' speed

HLX was just dumped the past few minutes. Lines of buys taken out, to take it from 49 to 40 cents. Quite bizaar. Smells fishy to me. If a poor ann comes out there'll be questions...

Evening HLX'ers,

What happened here today?

Just had a look at the course of trades and there were 84 trades for 750k shares (<9000 shares average per trade

Ken Talbot didn't have 750 thousand shares did he?

660 options ($125 worth) sold at 19c looks a bit suss after someone was happy to pay 21.5c for 100k of them as the next lowest trade

Someone looking to trigger stops?

Anyway, just having a read of the DJC Iron Book 2007 Report from the TRH site and its interesting to apply their valuation numbers to Helix-

"We estimate TRH s potential to be limited to around ~10mt of DSO

ore which gives it an EV/t of roughly $1.58/t

surprisingly cheap for the sector that is averaging $4 for explorers.....they are one of the cheapest (if not the cheapest) focussed iron ore plays on the stock market."

Seeing as their using undiluted numbers then coincidently HLX also shares that $1.58 EV.(assuming minimum case 30MT) @ 42c

If we talk fully diluted than we're even cheaper.

If the sector average is applied then we should be at $1.05 undiluted or 94c fully diluted.

If KC is a big as it looks and Robe exit/Bonham etc results are good then

Sean K

Moderator

- Joined

- 21 April 2006

- Posts

- 22,946

- Reactions

- 12,997

At this stage, nothing has changed funnymentally, so I am happy to hold and will take the opportunity to top up around these levels I think. I'll wait and see how it responds Monday first.If the sector average is applied then we should be at $1.05 undiluted or 94c fully diluted.

If KC is a big as it looks and Robe exit/Bonham etc results are good then

However, I still think this sell off was a bit fishy, unless it was stops triggered, and because of the low number of orders out there, they just got wiped out. All will be revealed I suppose.

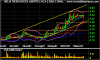

Technically, disappointed it broke through 45 which had formed up as some intitial support, and is now around about the medium term uptrend line identified earlier.

- Joined

- 8 March 2007

- Posts

- 3,225

- Reactions

- 4,559

Think maybe the odds are that this one has a high probability of going lower !

The weekly chart shows it as a parabolic trade - unsustainable, and last weeks price action confirmed it. If Mondays price gets below the low of Fridays bar - look out

Peter

The weekly chart shows it as a parabolic trade - unsustainable, and last weeks price action confirmed it. If Mondays price gets below the low of Fridays bar - look out

Peter

Sean K

Moderator

- Joined

- 21 April 2006

- Posts

- 22,946

- Reactions

- 12,997

You are right for the minute. There are just no buyers of this stock at present. Quite creapy. I have an aweful feeling some bad news is on the horizon.Think maybe the odds are that this one has a high probability of going lower !

The weekly chart shows it as a parabolic trade - unsustainable, and last weeks price action confirmed it. If Mondays price gets below the low of Fridays bar - look out

Peter

- Joined

- 12 July 2006

- Posts

- 214

- Reactions

- 0

Yeah that's all good. Share placement secured at 48.5cents. Who can argue with that? This thing is going places.

Sean K

Moderator

- Joined

- 21 April 2006

- Posts

- 22,946

- Reactions

- 12,997

I haven't seen the effect of something like this, where the placement is well above current sp. Can we assume the stock will now trade up to that psychological level? Maybe.Yeah that's all good. Share placement secured at 48.5cents. Who can argue with that? This thing is going places.

- Joined

- 12 July 2006

- Posts

- 214

- Reactions

- 0

Yes should do. But more then that - there is confidence out there in the future for this company. They clearly have something worth investing in.

- Joined

- 29 November 2006

- Posts

- 568

- Reactions

- 5

One would have to seriously think about the oppies, wouldn't they? Looks like they are tightly held though. Don't have a lot of time to research it right now but will have to definitely have a closer look this arvo.

I haven't seen the effect of something like this, where the placement is well above current sp. Can we assume the stock will now trade up to that psychological level? Maybe.

Yeah that's all good. Share placement secured at 48.5cents. Who can argue with that? This thing is going places.

Afternoon helixers,

Interesting ann' today.

Has anyone got their heads around the AQA, CVRD, AMCI legal wrangle?

Seems very interesting that AMCI have now taken a big stake in HLX while their still in dispute with AQA over coal and API stuff??????

Hey dudes,

Something I mentioned previously that caught my ear at the time was Mick Wilsons statements regarding other opportunities in S.A.

http://www.brr.com.au/event/HLX/938/25197/wmp/8ox5fhpj9r

I see that the point is made boldly in the latest ann' that some of the funds raised will be used to progress base metal exploration in S.A and then they state that Toro and Minotaur are fully funding the uranium / gold programs.

So I assume we're talking something else entirely .

.

Due to our new substantial holders affinity for coal, I wonder if we haven't got some kind of monster Sapex type coal targets going on???

Something I mentioned previously that caught my ear at the time was Mick Wilsons statements regarding other opportunities in S.A.

http://www.brr.com.au/event/HLX/938/25197/wmp/8ox5fhpj9r

I see that the point is made boldly in the latest ann' that some of the funds raised will be used to progress base metal exploration in S.A and then they state that Toro and Minotaur are fully funding the uranium / gold programs.

So I assume we're talking something else entirely

Due to our new substantial holders affinity for coal, I wonder if we haven't got some kind of monster Sapex type coal targets going on???

Attachments

Sean K

Moderator

- Joined

- 21 April 2006

- Posts

- 22,946

- Reactions

- 12,997

This doesn't look all that exciting to me jtb. I think they're referring to the Adelaidean prospects.Hey dudes,

Something I mentioned previously that caught my ear at the time was Mick Wilsons statements regarding other opportunities in S.A.

ADELAIDE GEOSYNCLINE

Helix Resources Limited - 100%

ELA570/06 EL3814, ELA299/07

A series of conceptual gold and base metal targets in the Adelaide Geosyncline of South Australia have been identified from reprocessed geophysical data including magnetics, gravity and radiometric images. Mapping and sampling of areas of outcrop has been conducted over the Fleurieu Project (ELA570/06) for incorporation with historic stream sediment sampling data and geophysical data interpretations. The results of a more detailed sampling program are expected later in the year. The compilation of this work will identify priority areas for further exploration during the 2007-2008 field season.

Target zones for base metal mineralisation have been identified within the Parachilna Project (EL3814). These priority areas are based on historical data and additional interpretation of geophysical and mapping datasets.

The Olary Project consists of two licence applications and covers an area of 1400km² located SW of the historical rare-earth/uranium Radium Hill Mine (produced 852 tonnes U³O8 to 1960). Although a similar style of bedrock mineralisation is unlikely to outcrop on the Helix application areas, there remains potential for areas undercover and also has scope for palaeo-channel Uranium.

The exploration model for the Olary project suggests several late-stage granites are associated with the gold and base metal occurrences in the district. Several prospects and historical workings containing gold, copper, silver and bismuth are located within the application areas and provide encouragement that the granites may have influenced the development of larger mineral deposits. These targets will be assessed and systematically explored upon granting of the tenements.

Boring....

Chart wise bashing up against 50 cents again.

Attachments

This doesn't look all that exciting to me jtb......

Boring....

Obviously my rose coloured glasses K.

The First Reserve link has me intrigued

They've obviously been brought in/attracted via their JV with AMCI but iron really doesn't appear to be their thing?

"First Reserve targets investments of $50 million to $500 million in middle-market energy companies with enterprise values of $100 million to $4 billion......"

Uranium doesn't seem to be a factor and minus any phantom coal related stuff we can only assume the iron ore prospectivity is the sole reason

Must be good hey?

Same sort of % as our friends at RHI/AQA too

?

?The First Reserve link has me intrigued

They've obviously been brought in/attracted via their JV with AMCI but iron really doesn't appear to be their thing?

JTB,

When I read the announcement I quickly did my research on First Reserve. And yes, a very strong relationship with AMCI!

I think Greg Wheeler has read a long way out what was going to eventuate with Helix, hence his constant buying over the past 12 months.

And now with AQA, First Reserve, and Whythenshawe/Waramboo (CUL Nonexec-direc - Graham Hamilton) all popping up on the register since August the amount of inside buying supports the 50c price tag quite well imo. How many people are going to be waiting now to buy on the dips...?

AMCI/AQA manage the w.pilbara project so who better to follow than them in buying Helix shares??:dunno:

RHI up through $5.00 today Helixers

By my reckoning thats around 200mil fully diluted MC on 27 Mil tonnes Fe plus upgrade due in our upcoming PFS.

Nice

On that note my HLXO (can't believe I got some more at 19c last week) could be worth upwards of a dollar shortly

Jimminy, If you go back through the thread you'll see I made a blue in regard to the call on Wythenshawe/Warramboo link to CUL (due to comparing share numbers owned to Top 20 holders on the most recent 3B's I could find )

)

They are actually vehicles of Josh Pitt of RHI (among others) fame.

Even better imo

Although I see we're back to lagging CUL in market cap race

Go HLX

By my reckoning thats around 200mil fully diluted MC on 27 Mil tonnes Fe plus upgrade due in our upcoming PFS.

Nice

On that note my HLXO (can't believe I got some more at 19c last week) could be worth upwards of a dollar shortly

Jimminy, If you go back through the thread you'll see I made a blue in regard to the call on Wythenshawe/Warramboo link to CUL (due to comparing share numbers owned to Top 20 holders on the most recent 3B's I could find

They are actually vehicles of Josh Pitt of RHI (among others) fame.

Even better imo

Although I see we're back to lagging CUL in market cap race

Go HLX