You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

HLX - Helix Resources

- Thread starter YOUNG_TRADER

- Start date

-

- Tags

- helix resources hlx

- Joined

- 31 October 2006

- Posts

- 403

- Reactions

- 0

I think:

Smart Money is still >1 which means theres a net inflow, but smaller traders have been chasing the price up evident by the high ratio on the blue line

Is this how the chart works?

Smart Money is still >1 which means theres a net inflow, but smaller traders have been chasing the price up evident by the high ratio on the blue line

Is this how the chart works?

Technically yes, but I don't think it is significant at this point.clowboy said:Does the chart imply that the smart money is exiting?

If you look carefully at several examples on the SMA thread you will see that the pressure normally eases whenever the price rises. This could be for several reasons, several of them being no cause for alarm.

What we want to watch for is signs that the pressure and price rise is being driven by small buyers; ie, the blue line up strongly and the black line down below 1.0. That would be a signal for a potential correction (although quite often the correction doesn't happen, such as with SLA).

What is significant with the HLX is that the upward pressure on this stock has been long and sustained; combined with the fundamental analysis this is a strong signal for a rerating, and most everything else is noise.

But DYOR and use your own judgment.

Smart money >1 doesn't necessarily mean a smart *inflow*; it may mean that someone has a big order waiting in the wings but down low at an unrealistic price. In that case the pressure stays artificially high because the order is never filled. This is why it is important to DYOR, ie, check the buy depth for example and try to work out for yourself the quality of the buy depth.stoxclimber said:I think:

Smart Money is still >1 which means theres a net inflow, but smaller traders have been chasing the price up evident by the high ratio on the blue line

Is this how the chart works?

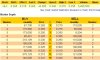

In HLX's case the buy depth looks very good; there are no silly large low priced orders, but there are lots of large orders close to the money. See below.

Attachments

moses said:Smart money >1 doesn't necessarily mean a smart *inflow*; it may mean that someone has a big order waiting in the wings but down low at an unrealistic price. In that case the pressure stays artificially high because the order is never filled. This is why it is important to DYOR, ie, check the buy depth for example and try to work out for yourself the quality of the buy depth.

In HLX's case the buy depth looks very good; there are no silly large low priced orders, but there are lots of large orders close to the money. See below.

A good example of this would probably be BYR as the top end of the buy list is quite light in quantity but there a a few bigger orders way down the list at fairly unrealistic prices (compared to current sp). Sorry just closed commsec and am heading to bed otherwise I would try (never done it before) and post the buy/sell list.

- Joined

- 18 February 2006

- Posts

- 4,200

- Reactions

- 2

Hmm TOE up almost 20% from 80c yesterday to about 96c today,

I wonder .........

What else is strange is I tried ringing the company yesterday, everyone was busy in a meeting all day, I was told to call back towards the end of the day their time, ie nightime for us, can't remember why I didn't call back, anyway just thought I'd share

I wonder .........

What else is strange is I tried ringing the company yesterday, everyone was busy in a meeting all day, I was told to call back towards the end of the day their time, ie nightime for us, can't remember why I didn't call back, anyway just thought I'd share

- Joined

- 11 January 2007

- Posts

- 791

- Reactions

- 1

YOUNG_TRADER said:Hmm TOE up almost 20% from 80c yesterday to about 96c today,

I wonder .........

What else is strange is I tried ringing the company yesterday, everyone was busy in a meeting all day, I was told to call back towards the end of the day their time, ie nightime for us, can't remember why I didn't call back, anyway just thought I'd share

Page 37 of the TOE company report did suggest acquisition was on the agenda.

- Joined

- 18 February 2006

- Posts

- 4,200

- Reactions

- 2

Not sure about a T/O, but am really curious as to what the company is up to, apparantly had meetings with MEP and AQA last week, some sort of big inhouse meeting yesterday (so I was told), TOE up 20%, AQA buying up RHI, could all just be coincidence though, I really can't see a T/O unless MEPand TOE jointly took over the gold and U assets only and left HLX's other asstes alone, can't see why MEP would want Iron ore, then again you never know

- Joined

- 16 February 2007

- Posts

- 51

- Reactions

- 1

Announcement out. Just a financial statement - turned a profit!

- Joined

- 18 February 2006

- Posts

- 4,200

- Reactions

- 2

So this is what the big meeting was about yesterday (all the docs are signed and dated 19th Feb) I thought it was just crappy numbers etc, but at the start theirs a directors report which follows as

Gold - Tunkillia

Joint venture partner Minotaur Exploration Ltd has commenced the process of calculating a new JORC resource for the Area 223 ore-body taking into account the recent Diamond, RC and Slimline RC drilling completed by Minotaur up to December 2006. This drilling included some significant intersections in the oxide portion of the ore-body outside the previously defined resource as well as covering gaps in the 50m X 30m drilling grid. The additional mineralisation discovered in the shallow oxide zone has the potential to provide the project with additional shallow ounces to the

resource, as well as converting previous waste to resources.

In addition, ounces identified at Area 191 from recent drilling have the potential to add positively to the project economics.

Minotaur is continuing a program of slim-line RC drilling to add to knowledge of gold mineralisation in the oxide zone at Area 223, together with a metallurgical study into the leaching characteristics of both the oxide and primary ore types. Initial bottle roll tests have shown that both ore types have positive leaching characteristics, further column tests are now required to confirm this and calculate the expected recovery percentage for both ore types. Whilst these programs are expected to be completed during the first quarter of 2007 and assist in any development decision, Minotaur expend money at their discretion under the JV earn-in, have until March 2009 to expend the $5 million to earn their 51% and Helix can only release results when made available by Minotaur.

Uranium

Toro Energy Ltd has carried out a regional airborne AEM survey on 1 kilometre line spaces covering approximately 920 square kilometres of Helix’s Gawler tenements in South Australia. The AEM dataset was processed and a depth to basement-palaeochannel location interpretation was conducted by Toro’s geophysical consultants. The survey has identified an approximately 25

kilometre long portion of palaeochannel that appears prospective for uranium. From the AEM survey five (5) priority palaeochannel uranium targets have been identified, and each area will have in the vicinity of 200 holes drilled in fence lines to transect the palaleochannels to fresh basement. The target area is located on the eastern edge of South Australia’s Yellabinna nature reserve, therefore a series of access conditions must be met prior to drilling. Drill planning is currently underway, with fieldwork expected to commence at the end of the fire-ban season. Drilling is expected to commence in the Q2 of 2007, however Toro expend money at their discretion under the JV earn-in, have until mid 2009 to expend the $2 million to earn their 51% and Helix can only release results when made available by Toro.

Iron Ore

Joint Venture partner Australian Premium Iron [“API”], which comprises AMCI Holdings Australia Pty Ltd and Aquila Resources Ltd, announced in December 2006 the discovery of buried channel iron mineralisation at the West Pilbara – Yalleen Iron Ore JV, which is located approximately 50kilometres east south-east of the Pilbara township of Pannawonica. API is spending $1.5 million prior to April 2009 to earn a 70% interest in the iron ore rights of the tenements held by Helix. Helix can thereafter elect to contribute pro-rata or dilute at $50,000 per 1% until its JV interest reaches 10%, wherein the Helix interest converts to a royalty of 50 cents per tonne.

The initial drilling results from the 1st target area confirms a mineralised zone of 2,700 metres by 900 metres. Whilst we expect API to commence drilling the other target areas from the Hoist EM survey and prepare a resource estimate as they move down the development path during 2007, API expend money at their discretion under the JV earn-in and Helix can only release results when made available by API.

Gold - Tunkillia

Joint venture partner Minotaur Exploration Ltd has commenced the process of calculating a new JORC resource for the Area 223 ore-body taking into account the recent Diamond, RC and Slimline RC drilling completed by Minotaur up to December 2006. This drilling included some significant intersections in the oxide portion of the ore-body outside the previously defined resource as well as covering gaps in the 50m X 30m drilling grid. The additional mineralisation discovered in the shallow oxide zone has the potential to provide the project with additional shallow ounces to the

resource, as well as converting previous waste to resources.

In addition, ounces identified at Area 191 from recent drilling have the potential to add positively to the project economics.

Minotaur is continuing a program of slim-line RC drilling to add to knowledge of gold mineralisation in the oxide zone at Area 223, together with a metallurgical study into the leaching characteristics of both the oxide and primary ore types. Initial bottle roll tests have shown that both ore types have positive leaching characteristics, further column tests are now required to confirm this and calculate the expected recovery percentage for both ore types. Whilst these programs are expected to be completed during the first quarter of 2007 and assist in any development decision, Minotaur expend money at their discretion under the JV earn-in, have until March 2009 to expend the $5 million to earn their 51% and Helix can only release results when made available by Minotaur.

Uranium

Toro Energy Ltd has carried out a regional airborne AEM survey on 1 kilometre line spaces covering approximately 920 square kilometres of Helix’s Gawler tenements in South Australia. The AEM dataset was processed and a depth to basement-palaeochannel location interpretation was conducted by Toro’s geophysical consultants. The survey has identified an approximately 25

kilometre long portion of palaeochannel that appears prospective for uranium. From the AEM survey five (5) priority palaeochannel uranium targets have been identified, and each area will have in the vicinity of 200 holes drilled in fence lines to transect the palaleochannels to fresh basement. The target area is located on the eastern edge of South Australia’s Yellabinna nature reserve, therefore a series of access conditions must be met prior to drilling. Drill planning is currently underway, with fieldwork expected to commence at the end of the fire-ban season. Drilling is expected to commence in the Q2 of 2007, however Toro expend money at their discretion under the JV earn-in, have until mid 2009 to expend the $2 million to earn their 51% and Helix can only release results when made available by Toro.

Iron Ore

Joint Venture partner Australian Premium Iron [“API”], which comprises AMCI Holdings Australia Pty Ltd and Aquila Resources Ltd, announced in December 2006 the discovery of buried channel iron mineralisation at the West Pilbara – Yalleen Iron Ore JV, which is located approximately 50kilometres east south-east of the Pilbara township of Pannawonica. API is spending $1.5 million prior to April 2009 to earn a 70% interest in the iron ore rights of the tenements held by Helix. Helix can thereafter elect to contribute pro-rata or dilute at $50,000 per 1% until its JV interest reaches 10%, wherein the Helix interest converts to a royalty of 50 cents per tonne.

The initial drilling results from the 1st target area confirms a mineralised zone of 2,700 metres by 900 metres. Whilst we expect API to commence drilling the other target areas from the Hoist EM survey and prepare a resource estimate as they move down the development path during 2007, API expend money at their discretion under the JV earn-in and Helix can only release results when made available by API.

- Joined

- 14 January 2007

- Posts

- 17

- Reactions

- 0

down 10%

Not for much longer! Some large orders coming in.falcon55 said:down 10%

ok has the dust settled? One of those last 2 large orders would have been someone who went short this morning. Spewing I didnt do the same. Anyway both sides have been thinned out now which is probably for the better in regaurds to steady growth. People expecting more from ann! I think most of it was already known!constable said:Not for much longer! Some large orders coming in.

- Joined

- 31 October 2006

- Posts

- 739

- Reactions

- 0

HLX beaten with a stick... wheres this ann HLX?

I guess the market wanted some "new" news...

I guess the market wanted some "new" news...

- Joined

- 31 October 2006

- Posts

- 403

- Reactions

- 0

I was thinking that today's selloff was from traders that jumped on the big rise yesterday and sold off today seeing the momentum stall..but I could be wrong. Just picked up 50000 more HLXO myself, so hopefully im not

The releasing of those two announcements and no other announcement means to me they have nothing else to release to the market, they werent bad announcements but the speculators who bought in just for the next "big" announcement would of sold today. I still hold but am slightly dissapointed...

- Joined

- 22 September 2006

- Posts

- 435

- Reactions

- 0

djones said:The releasing of those two announcements and no other announcement means to me they have nothing else to release to the market, they werent bad announcements but the speculators who bought in just for the next "big" announcement would of sold today. I still hold but am slightly dissapointed...

I am still expecting a number of announcements from the JV partners in the coming weeks especially on the MEP JV at Tunkilla, my understanding is that drilling data (including scout drilling) and a resource upgrade is due mid February. I am also hoping that AQA may also release some more news in the next few weeks on Yalleen. The results from the TORO EMS was very positive locating U targets and realistically I am not expecting any news here until the next quarter when drilling gets going. HLX will start drilling for gold in WA shortly. U might care to keep an eye on the gold price which tonight is trading around US$671 which is very bullish for Aussie gold shares.

- Joined

- 18 February 2006

- Posts

- 4,200

- Reactions

- 2

sydneysider said:I am still expecting a number of announcements from the JV partners in the coming weeks especially on the MEP JV at Tunkilla, my understanding is that drilling data (including scout drilling) and a resource upgrade is due mid February. I am also hoping that AQA may also release some more news in the next few weeks on Yalleen. The results from the TORO EMS was very positive locating U targets and realistically I am not expecting any news here until the next quarter when drilling gets going. HLX will start drilling for gold in WA shortly. U might care to keep an eye on the gold price which tonight is trading around US$671 which is very bullish for Aussie gold shares.

I agree, very confused by that ann, that fact they kept repeating they cannot release anything unless provided by JV,

It looks as though TOE and AQA qon't have much to say until after March,

The only wildcard left is MEP releasing its JORC upgrade soon, cause it looks like the tide of buyers vs sellers is turning,

I took half off the table opies and stock