TechnoCap

Life is one hell of a ride

- Joined

- 14 February 2021

- Posts

- 152

- Reactions

- 99

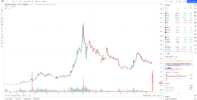

Travelling to orbitRemiss of me not to add a chart.

It's had a very good run.

Not one I've traded though, only owing to not having looked at it, and some confusion about the HIO or HAW thing.

Will be keeping an eye on it to see how it travels from here.

View attachment 140788