Garpal Gumnut

Ross Island Hotel

- Joined

- 2 January 2006

- Posts

- 13,698

- Reactions

- 10,308

Well done @finickyHope it doesn't let you down @Garpal Gumnut , I am dubious of its prospects over the next month.

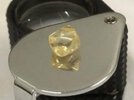

I added more yesterday @ 0.036 but now feel I gave been overly sanguine about its capital strength. This so much relies upon Burgundy Diamonds (BDM) coming through with the third tranche of its purchase of the Ellendale diamond project - $4m plus shares due in March 2023. I have thought before, "how likely is it that BDM, after already paying $2.7m and a chunk of shares for the project, will just walk away from the option?" But with the climate lately I'm reminded there's such a thing as 'cutting your losses'. Burgundy might simply not be able to source the money in a crashed market. Or maybe after a year of investigating the project they'll have a change of mind about its value.

Held

Timing is everything.

gg