- Joined

- 1 October 2008

- Posts

- 3,733

- Reactions

- 391

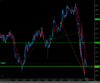

Sitting on PAR. After the big deal!

You'd think if it was great for GBD it would be bad for EUR.

But then I guess when people analyse the actual deal they will make an assessment,

Then there will be the unforeseen consequences. Like people suddenly thinking OMG they are actually doing it, we thought they would wriggle out of it. 'Sell the pound' or maybe not.

You'd think the Italian thing would be rattling the EURO a little more than it is too.

It's falling apart.

You'd think if it was great for GBD it would be bad for EUR.

But then I guess when people analyse the actual deal they will make an assessment,

Then there will be the unforeseen consequences. Like people suddenly thinking OMG they are actually doing it, we thought they would wriggle out of it. 'Sell the pound' or maybe not.

You'd think the Italian thing would be rattling the EURO a little more than it is too.

It's falling apart.