You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

- Joined

- 12 January 2008

- Posts

- 7,348

- Reactions

- 18,345

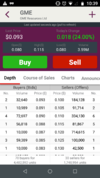

Yep and I've been watching the price action of Gamestop (GME) during the US session.

Monday, GME opened up 36% at $97. I watched it go to $160 before falling back down to close at $76. Thought the action was all over after that. Very surprised to see that yesterday it opened at $88 and closed at $148.

It's amazing, as in Aug GME was the butt of short sellers having traded down to 2.60. Until Dave Cohen joined to the board and stirred up all the geeks at Wallstreetbets (called Tendies). Many of these Tendies bought call options with all their money and many of them are sitting on HUGE open profits.

GME is being reported by more mainstream media now. It's a very interesting read.

GME trades as EB Games in Aust.

Monday, GME opened up 36% at $97. I watched it go to $160 before falling back down to close at $76. Thought the action was all over after that. Very surprised to see that yesterday it opened at $88 and closed at $148.

It's amazing, as in Aug GME was the butt of short sellers having traded down to 2.60. Until Dave Cohen joined to the board and stirred up all the geeks at Wallstreetbets (called Tendies). Many of these Tendies bought call options with all their money and many of them are sitting on HUGE open profits.

GME is being reported by more mainstream media now. It's a very interesting read.

GME trades as EB Games in Aust.

- Joined

- 13 September 2013

- Posts

- 988

- Reactions

- 531

GME is over $200 in after hours trade, at one stage it was up nearly 200% from the last open! It's crashed way back to 180% now lol.

Some of the Russell 3000 stocks are crazy right now, rough for shorts =|

What bubble?

Some of the Russell 3000 stocks are crazy right now, rough for shorts =|

What bubble?

- Joined

- 2 April 2020

- Posts

- 119

- Reactions

- 182

Hit over $370 in premarke and over $300 in early trade.

- Joined

- 12 January 2008

- Posts

- 7,348

- Reactions

- 18,345

The original shorters say they've exited their short positions but GME is going back down to $20. We all know it but haven't the money to hold positions through this extraordinary volatility. Some rich fund is going to clean up. My US broker won't allow me to short it (too hard to borrow). Not even one share. AMC is another that's gone crazy high (>$20). AMC manage movie theatres. When was the last time we went to the theatre to see a movie?

It's fun to watch the price action and see the market commentators gobsmacked.

It's fun to watch the price action and see the market commentators gobsmacked.

- Joined

- 8 June 2008

- Posts

- 13,137

- Reactions

- 19,332

Just social media in action

https://finance.yahoo.com/news/gamestop-memestocks-revenge-retail-trader-142719034.html

Last i looked $340 or 130% gain this session..

https://finance.yahoo.com/news/gamestop-memestocks-revenge-retail-trader-142719034.html

Last i looked $340 or 130% gain this session..

greggles

I'll be back!

- Joined

- 28 July 2004

- Posts

- 4,494

- Reactions

- 4,598

I haven't been following this story but I just caught up on it. If I understand the situation correctly, those at wallstreetbets on reddit are trolls trying to screw those publicly taking short positions on stocks by buying the stock being shorted. In this case, the target is Andrew Left at Citron Research and Gamestop, a struggling game retailer.

I am surprised that those at wallstreetbets are being so open about what they are doing given the scale of the market manipulation they are engineering.

But it sets an interesting precedent. This sort of thing could easily be done via a private messaging app such as Telegram and be much more discreet and harder to identify. If this sort of market manipulation becomes a thing we could see a lot more market volatility, which is great for traders but not so good for confidence in the market as a lot of people are going to lose their shirts as a result of these kind of shenanigans.

I will watch the fallout of this Gamestop saga with interest.

I am surprised that those at wallstreetbets are being so open about what they are doing given the scale of the market manipulation they are engineering.

But it sets an interesting precedent. This sort of thing could easily be done via a private messaging app such as Telegram and be much more discreet and harder to identify. If this sort of market manipulation becomes a thing we could see a lot more market volatility, which is great for traders but not so good for confidence in the market as a lot of people are going to lose their shirts as a result of these kind of shenanigans.

I will watch the fallout of this Gamestop saga with interest.

Wsb is pushing this thing to $1000. It has literally created millionaires that were previously broke and unemployed. I think the "mooch" got it right when he said "This is the French revolution for finance".

Wall Street types are calling for fines and regulations. If wsb beat the shorts then the whole game changes and wall Street is on edge. Media has been demonising the movement. I actually think its fantastic.

Wall Street types are calling for fines and regulations. If wsb beat the shorts then the whole game changes and wall Street is on edge. Media has been demonising the movement. I actually think its fantastic.

I think its also millions of people catching up to the bs of "investing for piss returns and thinking you can retire" pushed by Kramer types. These are the ridiculous trades im constantly scanning the net for.I haven't been following this story but I just caught up on it. If I understand the situation correctly, those at wallstreetbets on reddit are trolls trying to screw those publicly taking short positions on stocks by buying the stock being shorted. In this case, the target is Andrew Left at Citron Research and Gamestop, a struggling game retailer.

I am surprised that those at wallstreetbets are being so open about what they are doing given the scale of the market manipulation they are engineering.

But it sets an interesting precedent. This sort of thing could easily be done via a private messaging app such as Telegram and be much more discreet and harder to identify. If this sort of market manipulation becomes a thing we could see a lot more market volatility, which is great for traders but not so good for confidence in the market as a lot of people are going to lose their shirts as a result of these kind of shenanigans.

I will watch the fallout of this Gamestop saga with interest.

Its also the change of behaviour of how an investment instrument operates that I look for. Cryptocoins was the last major disruption.

I think it will get regulated. But has tech advanced to the point of no return?

Dona Ferentes

Pengurus pengatur

- Joined

- 11 January 2016

- Posts

- 16,368

- Reactions

- 22,353

Then we are the tricoteuses"This is the French revolution for finance".

I always have skin in the game when it comes to ridiculous troll trades. I have a reputation to uphold.Then we are the tricoteuses

greggles

I'll be back!

- Joined

- 28 July 2004

- Posts

- 4,494

- Reactions

- 4,598

Wsb is pushing this thing to $1000. It has literally created millionaires that were previously broke and unemployed.

The problem is, Gamestop is still a failing business and the share price will eventually go back down to where it started. Some may have made out like bandits, but when the share price collapse inevitably comes, a lot of people with long positions are going to lose their shirts.

- Joined

- 8 June 2008

- Posts

- 13,137

- Reactions

- 19,332

Sadly, i think many will see their wallet cut drastically when, not if gravity laws returns, probably even helped by a finance revenge push.Then we are the tricoteuses

When a trader in an edge fund gamble a million, it is not his money so who cares? Not him..., when students gamble $1k, it is their bank accounts.

Will end in bloodshed imho

Of course, its basically a pyramid scheme. At this point anyone getting in has really already missed the initial pump. If enough fanatics got in they could hold the stock.The problem is, Gamestop is still a failing business and the share price will eventually go back down to where it started. Some may have made out like bandits, but when the share price collapse inevitably comes, a lot of people with long positions are going to lose their shirts.

But right now its just to shake the shorts which will have to cover their positions.

Even elon musk got in the action.

There was a meme floating about went something like " what was my $5k every really going to do". This is more than just a retarded trade. But there will be tears.

Just to add: people around the world are now buying in small amounts. Not sure where this will go. But people do want to stick it to wall Street so the moons the limit.

Anyone who goes against the movement is getting hacked and their families are apparently being threatened. Behind the scenes I'm sure they are lobbying the sec.Sadly, i think many will see their wallet cut drastically when, not if gravity laws returns, probably even helped by a finance revenge push.

When a trader in an edge fund gamble a million, it is not his money so who cares? Not him..., when students gamble $1k, it is their bank accounts.

Will end in bloodshed imho

- Joined

- 6 January 2009

- Posts

- 2,300

- Reactions

- 1,130

Bloomberg - Are you a robot?

www.bloomberg.com

Interesting mass social media strategy. Sounds like a casino.

- Joined

- 3 May 2019

- Posts

- 6,324

- Reactions

- 9,993