- Joined

- 4 March 2010

- Posts

- 193

- Reactions

- 0

Hi Everybody,,,

I always interested in both Technical analysis and Fundamental analysis

In this topic I will try to focus on fundamental of few shares (Companies)

It will be more time consuming and boring than TA of course and I won’t be able to post as fast and as many as I am posting for TA...

I hope this topic would be useful but as always, regardless of my analyses, I don’t have any suggestion for buying nor selling any shares ...all investors should decide and make their own decision themselves...

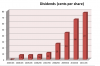

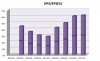

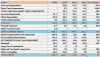

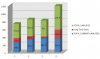

For the first try I will work on JBH (JB HiFi)

Regards

Mohsen

I always interested in both Technical analysis and Fundamental analysis

In this topic I will try to focus on fundamental of few shares (Companies)

It will be more time consuming and boring than TA of course and I won’t be able to post as fast and as many as I am posting for TA...

I hope this topic would be useful but as always, regardless of my analyses, I don’t have any suggestion for buying nor selling any shares ...all investors should decide and make their own decision themselves...

For the first try I will work on JBH (JB HiFi)

Regards

Mohsen