You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Fat Prophets - Fat Free email stocks

- Thread starter RichKid

- Start date

-

- Tags

- fat prophets

- Joined

- 28 September 2007

- Posts

- 1,472

- Reactions

- 8

Nice work Roland!

no probs - it helps to have a couple of friends here and there. If you have a look at CXC and the potential, it is really an enticing prospect. Certainly worth keeping an eye on.

- Joined

- 28 September 2007

- Posts

- 1,472

- Reactions

- 8

- Joined

- 28 September 2007

- Posts

- 1,472

- Reactions

- 8

I got this in an email today and wonder if anyone can identify the stocks?

"We have more on our stronger for longer resources boom theme a little further down, including…

* Details of one of our favourite gold plays, a company that looks like it could be sitting on an amazing 3-5 million ounces of gold, and;

* A mid-sized oil exploration company set to drill 17 wells within five separate project areas during 2008, about whom we recently said "…is sure to generate exploration excitement."

But first, we have a little more on the stock market, including the name of one of our top uranium stocks, a company we think could be on the cusp of something huge. "

"We have more on our stronger for longer resources boom theme a little further down, including…

* Details of one of our favourite gold plays, a company that looks like it could be sitting on an amazing 3-5 million ounces of gold, and;

* A mid-sized oil exploration company set to drill 17 wells within five separate project areas during 2008, about whom we recently said "…is sure to generate exploration excitement."

But first, we have a little more on the stock market, including the name of one of our top uranium stocks, a company we think could be on the cusp of something huge. "

michael_selway

Coal & Phosphate, thats it!

- Joined

- 20 October 2005

- Posts

- 2,397

- Reactions

- 2

google (asx oman), you will get what you want. sometimes i dont even believe Fat gives out their stocks so easily... may it be a trap? haha

So which stock are you reffering to?

thx

MS

The oil stock would be Oilex... I took this from their website:

Fatprophets Mining & Resources 18th January 2007

18 Jan 2008 -

Exerpt from the Oilex article on the Fat Prophets website:

First well in Oman drilling program underway

Oilex has recently commenced its first drilling programme in Oman, which forms just one part of a diverse international drilling programme, with India the other major country of importance. The combined programme is likely to see the drilling of up to 14 wells within five separate project areas over the next 12 months. With oil prices continuing to trade at close to record levels of between US$90-$100 a barrel, could there be a better time to generate exploration excitement?

"Oman is an exciting exploration destination as it is one of the world's most significant oil producing nations."

Fatprophets Mining & Resources 18th January 2007

18 Jan 2008 -

Exerpt from the Oilex article on the Fat Prophets website:

First well in Oman drilling program underway

Oilex has recently commenced its first drilling programme in Oman, which forms just one part of a diverse international drilling programme, with India the other major country of importance. The combined programme is likely to see the drilling of up to 14 wells within five separate project areas over the next 12 months. With oil prices continuing to trade at close to record levels of between US$90-$100 a barrel, could there be a better time to generate exploration excitement?

"Oman is an exciting exploration destination as it is one of the world's most significant oil producing nations."

What are people's thoughts on the two oil stocks below?

Beaten Down Stock #1 - A small oil production and exploration company whose share price has fallen 50% from its recent peak, leaving the whole company valued at around $65 million.

Today the company is forecasting profits of over $16 million in 2008, putting the company on a price to earnings ratio of just 4 times. If that's not enough, the company themselves think their own shares might be worth around $1.55, some 384% above their current share price.

Beaten Down Stock #2 - The company about whom we recently told our Fat Prophets Members that "Despite continuing to add impressively to its West Australian mineral sands position through aggressive exploration, the company has recently hit a brick wall with respect to its share price."

The shares are off 40% from their recent peak*. We believe the market is missing out on a fantastic longer-term opportunity, and the company remains a core holding in our portfolio.

Beaten Down Stock #1 - A small oil production and exploration company whose share price has fallen 50% from its recent peak, leaving the whole company valued at around $65 million.

Today the company is forecasting profits of over $16 million in 2008, putting the company on a price to earnings ratio of just 4 times. If that's not enough, the company themselves think their own shares might be worth around $1.55, some 384% above their current share price.

Beaten Down Stock #2 - The company about whom we recently told our Fat Prophets Members that "Despite continuing to add impressively to its West Australian mineral sands position through aggressive exploration, the company has recently hit a brick wall with respect to its share price."

The shares are off 40% from their recent peak*. We believe the market is missing out on a fantastic longer-term opportunity, and the company remains a core holding in our portfolio.

- Joined

- 3 July 2007

- Posts

- 153

- Reactions

- 0

What are people's thoughts on the two oil stocks below?

Beaten Down Stock #1 - A small oil production and exploration company whose share price has fallen 50% from its recent peak, leaving the whole company valued at around $65 million.

Today the company is forecasting profits of over $16 million in 2008, putting the company on a price to earnings ratio of just 4 times. If that's not enough, the company themselves think their own shares might be worth around $1.55, some 384% above their current share price.

Beaten Down Stock #2 - The company about whom we recently told our Fat Prophets Members that "Despite continuing to add impressively to its West Australian mineral sands position through aggressive exploration, the company has recently hit a brick wall with respect to its share price."

The shares are off 40% from their recent peak*. We believe the market is missing out on a fantastic longer-term opportunity, and the company remains a core holding in our portfolio.

I am guessing #1 is SAE? Hit 68 cents couple month ago and trading at 32.5 today. 14M profit expected in 2008, market cap is over 70M though...

Anyone got any idea what the two gold stocks this time are?

These are the clues:

Hidden Gem Gold Stock #1

We have long regarded this West Australian company as a highly attractive, emerging gold player. In a sector dominated by projects with high-cost operations and flagging profitability, this company is set to be a fresh new face on the block, with strong operating margins.

Just recently the company announced that it had substantially boosted its resource base at its flagship mining location by 23% to 1.35 million ounces of gold.

We remain overwhelmingly positive on this company's story. There are very few emerging, high-quality gold producers in the Australian market, which means that the company should undergo a significant re-rating as first stand-alone gold production approaches during the middle of 2008.

Hidden Gem Gold Stock #2

The poor share price performance of this fellow West Australian gold explorer continues to stagger us.

We have had numerous meetings with their Managing Director, and we must reiterate that in our view the company appears to be doing everything right. Yet it still is unable to generate any sort of positive share price momentum.

We think the current price weakness presents an outstanding buying opportunity for astute investors in the near-term.

These are the clues:

Hidden Gem Gold Stock #1

We have long regarded this West Australian company as a highly attractive, emerging gold player. In a sector dominated by projects with high-cost operations and flagging profitability, this company is set to be a fresh new face on the block, with strong operating margins.

Just recently the company announced that it had substantially boosted its resource base at its flagship mining location by 23% to 1.35 million ounces of gold.

We remain overwhelmingly positive on this company's story. There are very few emerging, high-quality gold producers in the Australian market, which means that the company should undergo a significant re-rating as first stand-alone gold production approaches during the middle of 2008.

Hidden Gem Gold Stock #2

The poor share price performance of this fellow West Australian gold explorer continues to stagger us.

We have had numerous meetings with their Managing Director, and we must reiterate that in our view the company appears to be doing everything right. Yet it still is unable to generate any sort of positive share price momentum.

We think the current price weakness presents an outstanding buying opportunity for astute investors in the near-term.

- Joined

- 10 November 2005

- Posts

- 120

- Reactions

- 0

I know the 2nd one without having to go past the first line!

- Joined

- 1 May 2006

- Posts

- 561

- Reactions

- 0

Any of these AAR coz they could certainly do with a boost

- Joined

- 1 August 2007

- Posts

- 71

- Reactions

- 0

Hi guys..

Anyone have any idea the names of these 2 companies

STOCK 1

Beaten Down Stock #1 - A small oil production and exploration company whose share price has fallen over 50% from its recent peak, leaving the whole company valued at around $65 million.

Today the company is forecasting profits of over $16 million in 2008, putting the company on a price to earnings ratio of just 4 times. If that's not enough, the company themselves think their own shares might be worth around $1.55, some 384% above their current share price.

STOCK 2

We also think we've found another key winner, one that happily flies under the radar of most of the resource investment community. At a market value of around $260 million, compared to BHP's $225 billion, we think it's just a matter of time before this small Queensland explorer with the large and growing coal base will see its share price reflect the inherent value in the company.

There are plenty of other things to like about this company too…

It has no debt and plenty of cash in the bank.

It is focused on coal exploration and development in Queensland, having accumulated attractive acreage positions.

Its aim is to progress its current identified coal resources towards production within the next few years whilst at the same time, further exploration will hopefully yield new coal deposits - it has an aggressive exploration programme during 2008 at almost double last year's budget.

Longer-term coal demand is anticipated to rise by around 60% between now and 2030, according to the World Energy Council. Of this demand, Asia is expected to account for around 86% of the increase.

And all this for a company currently worth just $260 million. No wonder we currently rate this company as a BUY, having done so since mid December.

But that may be about to change, given the threefold increase in the price of coking coal.

Thanks

Anyone have any idea the names of these 2 companies

STOCK 1

Beaten Down Stock #1 - A small oil production and exploration company whose share price has fallen over 50% from its recent peak, leaving the whole company valued at around $65 million.

Today the company is forecasting profits of over $16 million in 2008, putting the company on a price to earnings ratio of just 4 times. If that's not enough, the company themselves think their own shares might be worth around $1.55, some 384% above their current share price.

STOCK 2

We also think we've found another key winner, one that happily flies under the radar of most of the resource investment community. At a market value of around $260 million, compared to BHP's $225 billion, we think it's just a matter of time before this small Queensland explorer with the large and growing coal base will see its share price reflect the inherent value in the company.

There are plenty of other things to like about this company too…

It has no debt and plenty of cash in the bank.

It is focused on coal exploration and development in Queensland, having accumulated attractive acreage positions.

Its aim is to progress its current identified coal resources towards production within the next few years whilst at the same time, further exploration will hopefully yield new coal deposits - it has an aggressive exploration programme during 2008 at almost double last year's budget.

Longer-term coal demand is anticipated to rise by around 60% between now and 2030, according to the World Energy Council. Of this demand, Asia is expected to account for around 86% of the increase.

And all this for a company currently worth just $260 million. No wonder we currently rate this company as a BUY, having done so since mid December.

But that may be about to change, given the threefold increase in the price of coking coal.

Thanks

- Joined

- 2 May 2007

- Posts

- 4,720

- Reactions

- 2,957

Hi guys..

Anyone have any idea the names of these 2 companies

STOCK 1

Beaten Down Stock #1 - A small oil production and exploration company whose share price has fallen over 50% from its recent peak, leaving the whole company valued at around $65 million.

Today the company is forecasting profits of over $16 million in 2008, putting the company on a price to earnings ratio of just 4 times. If that's not enough, the company themselves think their own shares might be worth around $1.55, some 384% above their current share price.

STOCK 2

We also think we've found another key winner, one that happily flies under the radar of most of the resource investment community. At a market value of around $260 million, compared to BHP's $225 billion, we think it's just a matter of time before this small Queensland explorer with the large and growing coal base will see its share price reflect the inherent value in the company.

There are plenty of other things to like about this company too…

It has no debt and plenty of cash in the bank.

It is focused on coal exploration and development in Queensland, having accumulated attractive acreage positions.

Its aim is to progress its current identified coal resources towards production within the next few years whilst at the same time, further exploration will hopefully yield new coal deposits - it has an aggressive exploration programme during 2008 at almost double last year's budget.

Longer-term coal demand is anticipated to rise by around 60% between now and 2030, according to the World Energy Council. Of this demand, Asia is expected to account for around 86% of the increase.

And all this for a company currently worth just $260 million. No wonder we currently rate this company as a BUY, having done so since mid December.

But that may be about to change, given the threefold increase in the price of coking coal.

Thanks

My guess is the second stock is EER . It is owned by promoter of RMT . Currently RMT is much devalued with a coal seam result. EER is constantly approaching above 43 cents and it rose to 80 cents soon after listing . Please visit www.eer.com.au

East Energy Resources has acquired the rights to two coal tenements in the Bowen Basin and Adavale Basin in Queensland. The Norwich Park tenement is an exploration phase project with identified coal material in the western portion of the block. Coal measures are being mined adjacent to the tenement area and further data review, exploration and drilling are required to assess the area. The Blackall tenement includes a potential quantity of thermal coal measures which have been defined by a limited number of drill holes. Large adjacent areas await evaluation.

The proposed exploration and development programs are consistent with good industry and technical practice for the evaluation of mineral potential in the areas. Programs may be adjusted subject to the grant of the Blackall tenement and results available at specific intervals.

- Joined

- 2 May 2007

- Posts

- 4,720

- Reactions

- 2,957

After posting on EER - I used some 6th sense.

I think the first stock is OILEX. Fat prophets report is their site and their recommendation is HOLD.

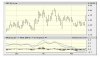

There has been a noteworthy softening of prices in Oilex since the stock fell short of resistance at 80p in

January. As shown on the daily chart, this well-established barrier has capped repeated rally attempts

since July and is the key to a sustained revival of the longer-term upward trend.

In the meantime, the recent slip below 60p leaves the stock exposed to a deeper correction. However, with near-term technical indicators exploring oversold territory, we believe that downside risks are limited.

In the weeks ahead, we anticipate further choppy trade with support between 53p and 50p protecting the August low of 44.5p. On the topside, a break above 64p would ease immediate downside risks with a

further gain above 70p to return focus to the 80p barrier.

I think the first stock is OILEX. Fat prophets report is their site and their recommendation is HOLD.

There has been a noteworthy softening of prices in Oilex since the stock fell short of resistance at 80p in

January. As shown on the daily chart, this well-established barrier has capped repeated rally attempts

since July and is the key to a sustained revival of the longer-term upward trend.

In the meantime, the recent slip below 60p leaves the stock exposed to a deeper correction. However, with near-term technical indicators exploring oversold territory, we believe that downside risks are limited.

In the weeks ahead, we anticipate further choppy trade with support between 53p and 50p protecting the August low of 44.5p. On the topside, a break above 64p would ease immediate downside risks with a

further gain above 70p to return focus to the 80p barrier.

Attachments

- Joined

- 5 July 2007

- Posts

- 54

- Reactions

- 0

the coal one is not EER, its COK

Similar threads

- Replies

- 10

- Views

- 4K