- Joined

- 27 June 2007

- Posts

- 161

- Reactions

- 54

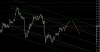

I am Long EUR/JPY as of a few mins ago.

Entry at 132.803 with a 10 pip stop. No cemented target.

Initial target 138 then, up up and away.

Sorry cant post chart at work. will update later

Good luck as you may die from the boredom it’s been floating in the wilderness for sometime.