- Joined

- 21 May 2010

- Posts

- 224

- Reactions

- 9

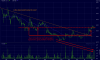

I've been thinking about this comment and just can't make any sense of it. On any metric you choose (income, acres, production, etc), EKA is vastly better value than AUT. AUT is much closer than EKA to the price analysts reckon it's worth. The only advantage AUT has is pure size and therefore liquidity and being in the ASX 200.

Whether it was my money or your mum's, I'd be putting it into EKA.

So how has that worked for you over the past 18,12,6 months Kremmen. Do you not like your mother.

Best you find something else to think about. At least you didn't call me a liar this time.

Absolute whackjob.