You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

EGO - Empire Oil & Gas

- Thread starter krisbarry

- Start date

-

- Tags

- ego empire oil & gas

- Joined

- 11 September 2007

- Posts

- 13

- Reactions

- 0

Re: EGO - Empire Oil

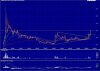

Hmm...looks to me like a good opportunity. I see it dropping back a bit tomorrow, but it looks like its on the way up for the mean time.

Hmm...looks to me like a good opportunity. I see it dropping back a bit tomorrow, but it looks like its on the way up for the mean time.

- Joined

- 1 February 2007

- Posts

- 1,068

- Reactions

- 0

Re: EGO - Empire Oil

Sorry to those wanting another chart.

Been on holidays

EGO looks the goods at the moment hey

Alot to the upside IF they find anything.

With the current price of oil, and everyone jumping on the gas bandwagon, any significant ann will rerate this stock imo.

.03 is firm resistance, but if the DJ is up tonight and with the buyers starting to come in, I would think it will push through this.

.032-.033 will be the next resistance to get through. May easily even go to .035!

.033 is proven support/resistance on a P&F chart too, where it acted as support in Sept 2001.

After that .043 is the next resistance.

Exciting time ahead for those of you who hold. But I'd keep my stops tight when it gets closer to drilling depth being made, as in the past when EGO has missed finding anything it gets dumped pretty hard...naturaly

Sorry to those wanting another chart.

Been on holidays

EGO looks the goods at the moment hey

Alot to the upside IF they find anything.

With the current price of oil, and everyone jumping on the gas bandwagon, any significant ann will rerate this stock imo.

.03 is firm resistance, but if the DJ is up tonight and with the buyers starting to come in, I would think it will push through this.

.032-.033 will be the next resistance to get through. May easily even go to .035!

.033 is proven support/resistance on a P&F chart too, where it acted as support in Sept 2001.

After that .043 is the next resistance.

Exciting time ahead for those of you who hold. But I'd keep my stops tight when it gets closer to drilling depth being made, as in the past when EGO has missed finding anything it gets dumped pretty hard...naturaly

Attachments

Re: EGO - Empire Oil

Cheers Nuke, nice chart. You are right about drilling success but with today' announcement, the odds are now in their favour.

Expect more good news before the closing date of the SPP

Sorry to those wanting another chart.

Been on holidays

EGO looks the goods at the moment hey

Alot to the upside IF they find anything.

With the current price of oil, and everyone jumping on the gas bandwagon, any significant ann will rerate this stock imo.

.03 is firm resistance, but if the DJ is up tonight and with the buyers starting to come in, I would think it will push through this.

.032-.033 will be the next resistance to get through. May easily even go to .035!

.033 is proven support/resistance on a P&F chart too, where it acted as support in Sept 2001.

After that .043 is the next resistance.

Exciting time ahead for those of you who hold. But I'd keep my stops tight when it gets closer to drilling depth being made, as in the past when EGO has missed finding anything it gets dumped pretty hard...naturaly

Cheers Nuke, nice chart. You are right about drilling success but with today' announcement, the odds are now in their favour.

Expect more good news before the closing date of the SPP

Re: EGO - Empire Oil

Chartwise looking very positive atm, would suggest some form of accumulation going on.

Nice breakout today with positive volume. With todays strong close I would like to see prices push higher tomorrow but with overseas markets looking weak atm it might be unlikely, either way where support comes in now on the next wave down will be telling.

Go Nuke I probably wouldn't be to concerned with any support or resistance on the chart any further back than July 07. There has been such a change of hands since then (huge volume on the chart) I would doubt it would have any effect on the current sp.

1.5c would be the next major support imo as thats where the buyers overcame the sellers last time but I would want to see some support at 2.2c or I will be out.

As for resistance we will just have to wait and see where the sellers turn up next .

.

I hold.

Chartwise looking very positive atm, would suggest some form of accumulation going on.

Nice breakout today with positive volume. With todays strong close I would like to see prices push higher tomorrow but with overseas markets looking weak atm it might be unlikely, either way where support comes in now on the next wave down will be telling.

Go Nuke I probably wouldn't be to concerned with any support or resistance on the chart any further back than July 07. There has been such a change of hands since then (huge volume on the chart) I would doubt it would have any effect on the current sp.

1.5c would be the next major support imo as thats where the buyers overcame the sellers last time but I would want to see some support at 2.2c or I will be out.

As for resistance we will just have to wait and see where the sellers turn up next

I hold.

Attachments

- Joined

- 10 March 2008

- Posts

- 313

- Reactions

- 0

Re: EGO - Empire Oil

Hey bowseruni - I'd back your call for a 'what if' scenario calc. I can do a rough calc on the oil at lake macleod, but as for gas I don't have a rule of thumb for in ground value.

Re Lake macleod - best case scenario 150mmbl @ $20 in ground value ($130 above ground) means $3bn assset for ego. about 2bn shares on issue shows an asset value of $1.50 per share.....

Does anyone have a better method for giving a indication on valuing assets? Also what is the best way to value in ground gas as an asset?

Regarding the price action so far - I think it was inevitable that we'd see a bit of a retrace today - but very happy to see it sitting at around 2.8 -2.9c - pretty sure most are holding on for the drilling (and wisely so imo). Note that energy and materials indices are down 1% today....

bought some today, comsec shows some big buys today

what are peoples thought on how high they will go IF they succeed in drilling?

Hey bowseruni - I'd back your call for a 'what if' scenario calc. I can do a rough calc on the oil at lake macleod, but as for gas I don't have a rule of thumb for in ground value.

Re Lake macleod - best case scenario 150mmbl @ $20 in ground value ($130 above ground) means $3bn assset for ego. about 2bn shares on issue shows an asset value of $1.50 per share.....

Does anyone have a better method for giving a indication on valuing assets? Also what is the best way to value in ground gas as an asset?

Regarding the price action so far - I think it was inevitable that we'd see a bit of a retrace today - but very happy to see it sitting at around 2.8 -2.9c - pretty sure most are holding on for the drilling (and wisely so imo). Note that energy and materials indices are down 1% today....

Re: EGO - Empire Oil

I am new to this also, but bought in yesterday at 0.025...i'm just testing the waters in share trading so only bought 35000 shares.

It looks like the more experienced people think that this may well skyrocket (if drilling results are good), which makes sense to me. I'll just hold and see what happens. If drilling results are bad, then I might lose a couple of hundred $$. But if results are really good, then based upon the assessment of sp of around $1.50 (just for a great oil result, leaving aside what might also happen with the gas) then I'll make something like a 5000% profit. Its certainly a risk i'm willing to take

so at 0.029 i got a decent buy?

(still pretty green at all this, have no idea about the graphs you guys are posting and how to read them properly)

I am new to this also, but bought in yesterday at 0.025...i'm just testing the waters in share trading so only bought 35000 shares.

It looks like the more experienced people think that this may well skyrocket (if drilling results are good), which makes sense to me. I'll just hold and see what happens. If drilling results are bad, then I might lose a couple of hundred $$. But if results are really good, then based upon the assessment of sp of around $1.50 (just for a great oil result, leaving aside what might also happen with the gas) then I'll make something like a 5000% profit. Its certainly a risk i'm willing to take

- Joined

- 10 March 2008

- Posts

- 313

- Reactions

- 0

Re: EGO - Empire Oil

One thing about share price vs asset value - they don't always correlate. For example AIM resources is now developing the descent into a a pretty big zinc deposit - not so long agao they had cash backing of about 8c a share (not sure what cash position is now, but wouldn't have decreased much). the current share price is arounf 8 - 9c. So the market is giving a zero value to the zinc deposit.....

Oil & gas are a bit more exciting than zinc at the moment though. If they hit oil in LM while the asset value might be $1.50 per share that doesn't mean the share price will reflect that. But hey, if it was 1/3 of that I'd still be an exceptionally happy camper.

Heed the advice about short stops as they approach target depths though - ego gets dumped hard when they fail and there's been a lot of volume over the last week...

Good luck to the holders (& newbies)- I'm optimistic.

But if results are really good, then based upon the assessment of sp of around $1.50 (just for a great oil result, leaving aside what might also happen with the gas) then I'll make something like a 5000% profit. Its certainly a risk i'm willing to take

One thing about share price vs asset value - they don't always correlate. For example AIM resources is now developing the descent into a a pretty big zinc deposit - not so long agao they had cash backing of about 8c a share (not sure what cash position is now, but wouldn't have decreased much). the current share price is arounf 8 - 9c. So the market is giving a zero value to the zinc deposit.....

Oil & gas are a bit more exciting than zinc at the moment though. If they hit oil in LM while the asset value might be $1.50 per share that doesn't mean the share price will reflect that. But hey, if it was 1/3 of that I'd still be an exceptionally happy camper.

Heed the advice about short stops as they approach target depths though - ego gets dumped hard when they fail and there's been a lot of volume over the last week...

Good luck to the holders (& newbies)- I'm optimistic.

Re: EGO - Empire Oil

Thanks Datsun, it great to have people in the know to assist...and hopefully I'll get to a point where I'm assisting rather than asking qns. One further qn I do have though is whether you have a ballpark idea of when results are likely to be announced, on the presumption that the Star Finch-1 well is drilled in June as scheduled and the Lake MacLeod-1 well the July as scheduled.

Heed the advice about short stops as they approach target depths though - ego gets dumped hard when they fail and there's been a lot of volume over the last week...

Thanks Datsun, it great to have people in the know to assist...and hopefully I'll get to a point where I'm assisting rather than asking qns. One further qn I do have though is whether you have a ballpark idea of when results are likely to be announced, on the presumption that the Star Finch-1 well is drilled in June as scheduled and the Lake MacLeod-1 well the July as scheduled.

- Joined

- 10 March 2008

- Posts

- 313

- Reactions

- 0

Re: EGO - Empire Oil

The continuous disclosure rules of the market mean that companies are required to announce market sensitive news as it comes to hand. This means that the results of the drilling will be reported as the drilling occurs. Ego provide daily drilling reports with a good amount of detail that make it easy to follow. (have a look at the previous drill reports from february for an indication) There's 2 events that we will want to see. First is encountering gas in the target areas - usually sands, once gas has been encountered they need to test the reservoir for commercial flow rates. This is the follow up and is usually a confirmation of what was encountered during drilling. testing is usually done fairly soon after reaching the target depth, maybe a fortnight if they don't have any major issues (like the rain that postponed the testing of stokes bay). So with positive drilling results we will see a good price movement within the next 2-3 months. A good strategy can be simply riding the share price increase as we head towards the target depth - lower risk, and lower returns if they hit something - if they don't then you make some money and feel smarter than the average bear....

Thanks Datsun, it great to have people in the know to assist...and hopefully I'll get to a point where I'm assisting rather than asking qns. One further qn I do have though is whether you have a ballpark idea of when results are likely to be announced, on the presumption that the Star Finch-1 well is drilled in June as scheduled and the Lake MacLeod-1 well the July as scheduled.

The continuous disclosure rules of the market mean that companies are required to announce market sensitive news as it comes to hand. This means that the results of the drilling will be reported as the drilling occurs. Ego provide daily drilling reports with a good amount of detail that make it easy to follow. (have a look at the previous drill reports from february for an indication) There's 2 events that we will want to see. First is encountering gas in the target areas - usually sands, once gas has been encountered they need to test the reservoir for commercial flow rates. This is the follow up and is usually a confirmation of what was encountered during drilling. testing is usually done fairly soon after reaching the target depth, maybe a fortnight if they don't have any major issues (like the rain that postponed the testing of stokes bay). So with positive drilling results we will see a good price movement within the next 2-3 months. A good strategy can be simply riding the share price increase as we head towards the target depth - lower risk, and lower returns if they hit something - if they don't then you make some money and feel smarter than the average bear....

Re: EGO - Empire Oil

Datsun, hope you are looking to upgrade from that 120Y.

What in your honest opinion is the chances of finding gas at star Finch???

Do you have any knowledge of the surrounding areas success?

Do they have a good location here or is it just a stab in the dark??

Cheers.

The continuous disclosure rules of the market mean that companies are required to announce market sensitive news as it comes to hand. This means that the results of the drilling will be reported as the drilling occurs. Ego provide daily drilling reports with a good amount of detail that make it easy to follow. (have a look at the previous drill reports from february for an indication) There's 2 events that we will want to see. First is encountering gas in the target areas - usually sands, once gas has been encountered they need to test the reservoir for commercial flow rates. This is the follow up and is usually a confirmation of what was encountered during drilling. testing is usually done fairly soon after reaching the target depth, maybe a fortnight if they don't have any major issues (like the rain that postponed the testing of stokes bay). So with positive drilling results we will see a good price movement within the next 2-3 months. A good strategy can be simply riding the share price increase as we head towards the target depth - lower risk, and lower returns if they hit something - if they don't then you make some money and feel smarter than the average bear....

Datsun, hope you are looking to upgrade from that 120Y.

What in your honest opinion is the chances of finding gas at star Finch???

Do you have any knowledge of the surrounding areas success?

Do they have a good location here or is it just a stab in the dark??

Cheers.

Re: EGO - Empire Oil

reading between the line i think chances of success are high, see yesterdays repprt where the director's other company bought 6.5 mill shares. doubt this would happen if they thought nothing would happen.

so tempted to sell up some bhp and get some more of these guys.

up 7.4% so far today

reading between the line i think chances of success are high, see yesterdays repprt where the director's other company bought 6.5 mill shares. doubt this would happen if they thought nothing would happen.

so tempted to sell up some bhp and get some more of these guys.

up 7.4% so far today

prawn_86

Mod: Call me Dendrobranchiata

- Joined

- 23 May 2007

- Posts

- 6,637

- Reactions

- 7

Re: EGO - Empire Oil

I dont know anything about the fundamanetals of this stock, but it has a history of pump and dump.

Look what happen last time they ran up quickly. I know it gets a lot of attention from other forums so be very careful.

It can drop faster than it rises....

I dont know anything about the fundamanetals of this stock, but it has a history of pump and dump.

Look what happen last time they ran up quickly. I know it gets a lot of attention from other forums so be very careful.

It can drop faster than it rises....

- Joined

- 10 March 2008

- Posts

- 313

- Reactions

- 0

Re: EGO - Empire Oil

Lioness! You upgrade to a 120Y not from it!!!! Cheeky.

For star finch it sounds like more than a shot in the dark. The drilling announcement described the following -

But for the Gingin I think the odds are pretty good - the 10 june announcement points out that -

So two good points here. Up dip from a previous discovery at the crestal position. Gas (& oil) rises underground. It is the seals that are important to capture the gas / oil. Bit like an upturned bowl. If a previous well has intersected the structure and found gas and the seismic data shows that the structure rises further then unless some event has cracked the seal between the last flow of gas and now then I would say chances are pretty good that they will find something. BUT sesimic data can't tell the whole story, we are still carrying risk (which is why it's not sitting at a higher sp right now) The second good point is it's close to an existing pipeline so operating costs will be low should it turn out to be a commercial discovery.

Now time for me to fess up. I quoted an in ground asset price for Lake Mcleod of $1.50 per share - forgot the whole pie doesn't belong to ego... The have 30% so it is actually 45c per share asset value in the ground. In barrels at the market the value is (@$130/b) $2.92..... Was a dreamer as a kid and haven't gotten any better.

Prawn you raise a good point and I am all for caution (been done too many times - what's that saying - 300 times bitten, twice shy.. ) but I think that this run (I'm not calling it a re-rating yet) is based on some pretty good prospects. The Gingin group sounds like good quality. If star finch is a barren then I'll be looking for a lower entry opportunity to take advantage of the LM spud and then the Gingin prospects (no news on a drill schedule there yet) Anyway better get off before you guys figure out that I have no life...

) but I think that this run (I'm not calling it a re-rating yet) is based on some pretty good prospects. The Gingin group sounds like good quality. If star finch is a barren then I'll be looking for a lower entry opportunity to take advantage of the LM spud and then the Gingin prospects (no news on a drill schedule there yet) Anyway better get off before you guys figure out that I have no life...

Datsun, hope you are looking to upgrade from that 120Y.

What in your honest opinion is the chances of finding gas at star Finch???

Do you have any knowledge of the surrounding areas success?

Do they have a good location here or is it just a stab in the dark??

Cheers.

Lioness! You upgrade to a 120Y not from it!!!! Cheeky.

For star finch it sounds like more than a shot in the dark. The drilling announcement described the following -

I don't have any other knowledge about this area, I get most of my stuff from the announcements.As mapped from the 2D seismic data the crestal position, the crestal high

is also encouragingly coincident to a topographic high. The Star Finch-1 Prospect

demonstrates bright seismic anomalies over the mapped closure. These amplitudes

die out at the mapped spill point of the structure which are encouraging for the trap

integrity. ~ Bright

amplitude anomalies have been a successful indicator in many cases for natural gas

entrapment in the Carnarvon Basin. Two good examples are the Tubridgi and Rivoli

Gasfields in the Carnarvon Basin.

But for the Gingin I think the odds are pretty good - the 10 june announcement points out that -

The Gingin West No. 1 well is to test an updip well location from the 1981 gas discovery Bootine-

1 well that flowed gas naturally at a rate of 2.5 million cubic feet of gas per day from one of the

5 prospective sands. The interpretation of the 3D seismic is to define the crestal position of the

Gingin West Structure to intersect all 5 gas prospective sands within closure. The estimated

recoverable gas reserves at Gingin West are 212 billion cubic feet of gas.

The Gingin West Prospect is located approximately 2.5 kms immediately adjacent to the underutilised

Parmelia Natural Gas Pipeline (Dongara to Pinjarra) and adjacent to the Dampier to

Bunbury Natural Gas Pipeline.

So two good points here. Up dip from a previous discovery at the crestal position. Gas (& oil) rises underground. It is the seals that are important to capture the gas / oil. Bit like an upturned bowl. If a previous well has intersected the structure and found gas and the seismic data shows that the structure rises further then unless some event has cracked the seal between the last flow of gas and now then I would say chances are pretty good that they will find something. BUT sesimic data can't tell the whole story, we are still carrying risk (which is why it's not sitting at a higher sp right now) The second good point is it's close to an existing pipeline so operating costs will be low should it turn out to be a commercial discovery.

Now time for me to fess up. I quoted an in ground asset price for Lake Mcleod of $1.50 per share - forgot the whole pie doesn't belong to ego... The have 30% so it is actually 45c per share asset value in the ground. In barrels at the market the value is (@$130/b) $2.92..... Was a dreamer as a kid and haven't gotten any better.

dont know anything about the fundamanetals of this stock, but it has a history of pump and dump.

Look what happen last time they ran up quickly. I know it gets a lot of attention from other forums so be very careful.

It can drop faster than it rises....

Prawn you raise a good point and I am all for caution (been done too many times - what's that saying - 300 times bitten, twice shy..

Re: EGO - Empire Oil

Excellent research from you Datsun, we all appreciate it too!

You may get to upgrade that 120Y to a Datsun 200B!!

Lioness! You upgrade to a 120Y not from it!!!! Cheeky.

For star finch it sounds like more than a shot in the dark. The drilling announcement described the following -

I don't have any other knowledge about this area, I get most of my stuff from the announcements.

But for the Gingin I think the odds are pretty good - the 10 june announcement points out that -

So two good points here. Up dip from a previous discovery at the crestal position. Gas (& oil) rises underground. It is the seals that are important to capture the gas / oil. Bit like an upturned bowl. If a previous well has intersected the structure and found gas and the seismic data shows that the structure rises further then unless some event has cracked the seal between the last flow of gas and now then I would say chances are pretty good that they will find something. BUT sesimic data can't tell the whole story, we are still carrying risk (which is why it's not sitting at a higher sp right now) The second good point is it's close to an existing pipeline so operating costs will be low should it turn out to be a commercial discovery.

Now time for me to fess up. I quoted an in ground asset price for Lake Mcleod of $1.50 per share - forgot the whole pie doesn't belong to ego... The have 30% so it is actually 45c per share asset value in the ground. In barrels at the market the value is (@$130/b) $2.92..... Was a dreamer as a kid and haven't gotten any better.

Prawn you raise a good point and I am all for caution (been done too many times - what's that saying - 300 times bitten, twice shy..) but I think that this run (I'm not calling it a re-rating yet) is based on some pretty good prospects. The Gingin group sounds like good quality. If star finch is a barren then I'll be looking for a lower entry opportunity to take advantage of the LM spud and then the Gingin prospects (no news on a drill schedule there yet) Anyway better get off before you guys figure out that I have no life...

Excellent research from you Datsun, we all appreciate it too!

You may get to upgrade that 120Y to a Datsun 200B!!

Re: EGO - Empire Oil

Good point. Still, if drilling results are good and if share price reflected, say, a third of the asset value, then its still 15c per share. Ego has approx 30% interest in Lake Mcleod (as you said), 23% in Star Finch and 62.5% in Gingin West.

On a separate matter, thanks lioness for your reply in the outstanding breakouts thread last night. I saw it before you took it down again (or perhaps it was removed because of your projection regarding the sp). Anyway, it was helpful to know that you think that I was reading the chart properly

Now time for me to fess up. I quoted an in ground asset price for Lake Mcleod of $1.50 per share - forgot the whole pie doesn't belong to ego... The have 30% so it is actually 45c per share asset value in the ground. In barrels at the market the value is (@$130/b) $2.92..... Was a dreamer as a kid and haven't gotten any better.

Good point. Still, if drilling results are good and if share price reflected, say, a third of the asset value, then its still 15c per share. Ego has approx 30% interest in Lake Mcleod (as you said), 23% in Star Finch and 62.5% in Gingin West.

On a separate matter, thanks lioness for your reply in the outstanding breakouts thread last night. I saw it before you took it down again (or perhaps it was removed because of your projection regarding the sp). Anyway, it was helpful to know that you think that I was reading the chart properly

Re: EGO - Empire Oil

done a stupid thing today, because it kept fluctuating between .029 - 0.03 i thought i would be smart and sell all at .03 and rebuy at .029. Didn't work that way, ended up selling at 0.029 and rebuying at 0.03

oh well, serves me right for trying to make a quick buck

done a stupid thing today, because it kept fluctuating between .029 - 0.03 i thought i would be smart and sell all at .03 and rebuy at .029. Didn't work that way, ended up selling at 0.029 and rebuying at 0.03

oh well, serves me right for trying to make a quick buck