Dona Ferentes

Pengurus pengatur

- Joined

- 11 January 2016

- Posts

- 16,274

- Reactions

- 22,215

Recession almost inevitable (says Alan Kohler)I think a recession is going to happen regardless its all the debt blowing up that really worries me.

The Australian economy was ... fragile, as shown by the December quarter national accounts, and not in a strong position to handle the crisis as the government claims it is.

Consumer spending growth of 0.4 per cent in the quarter underpinned the insipid GDP growth of 0.5 per cent. Net exports contributed 0.1 per cent.

the anecdotal evidence of changes isPopulation growth last year was 1.6 per cent — 0.4 per cent per quarter, the same as the increase in consumer spending. No one spent any more — there were just more people spending.

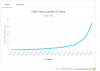

The increase in population in 2019 was 381,600. Included in that were 268,000 temporary visas for Chinese people, of which 134,000 are students. And then there is tourism. Short-term visitors from China have been running at about 1.4 million a year. In other words, most of Australia’s economic growth has been the result of extra people, not an increase in the productivity or wealth of the people already here. Most of the extra people aren’t coming now...

a) overwhelming

b) dramatic

c) self-evident

The second-order effects are where the blows are going to come from. Job losses, reduced or altered spending patterns, belt-tightening.