- Joined

- 14 February 2005

- Posts

- 15,289

- Reactions

- 17,503

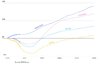

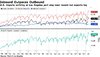

At the moment true although the US government's forecasts don't expect the situation to persist.American oil supply is a non-subject. Like I said, they're actually now net exporters of oil.

Selected data as follows for 2020:

Crude oil net imports = 2.75 mmbpd

Product net imports = -3.36 mmpbd

So a net export of 0.61 mmbpd

Forecast for 2021:

Crude oil net imports = 4.12 mmbpd

Product net imports = -3.37 mmbpd

So a net import of 0.75 mmbpd

Not a major level of import but a net importer nonetheless is what they're forecasting.

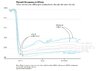

On the US domestic production side, for 2019, 2020, 2021 (all figures in million barrels per day):

US Domestic crude oil production: 12.25, 11.34, 11.10

Refinery processing gain = 1.07, 0.95, 1.07

Natural gas plant liquids = 4.82, 5.10, 5.27

Renewables and oxygenates = 1.12, 0.99, 1.08

So basically crude oil is trending down, natural gas liquids (condensate and LPG) is trending up on the domestic production side.

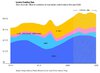

A particular complication with all US petroleum supply and consumption data is the US practice of including things which aren't oil, namely biofuels. My point there isn't to argue for or against the use of biofuels but simply that they are not oil. So if the aim is to count only actual oil then you need to take the biofuels out of the figures.

The original full data I'm quoting from is here: https://www.eia.gov/outlooks/steo/data/browser/#/?v=9

PS - In case anyone's wondering what "refinery processing gain" is, the short answer is that the density of petroleum products coming out of the refinery is, as a whole, lower than the density of the crude oil going in. So 1 barrel of crude oil yields more than 1 barrel of products. No laws of physics are being broken there, mass hasn't increased and nor has energy content, just lower density and thus greater volume brought about by some clever chemistry and the use of catalysts. Hence volume gain in processing needs to be counted in order to make the figures add up.

Last edited: