I prefer to take a risk with stocks and i like to be in early. I have read through the various announcements and research available, i am just wandering what peoples expectations are. Where do people believe this SP will reasonabley head to? .80? .90? 1.50? 2.00?

ECH - Echelon Resources

- Thread starter stiger

- Start date

-

- Tags

- ech echelon resources

I prefer to take a risk with stocks and i like to be in early. I have read through the various announcements and research available, i am just wandering what peoples expectations are. Where do people believe this SP will reasonabley head to? .80? .90? 1.50? 2.00?

haha Nizar..

Gangis..so hard to predict the SP.

They have 3.5 million IOH Shares..worth close to 2.5 million.

They will have 4 million cash at bank as an estimate after the funds from the placement to sophisticated investors come through.

The Company will also make a placement of 4.0 million shares at $0.35 each to raise $1.4 million to a number of Canadian and European investors. Funds raised from the placement will be used to fund an accelerated exploration programme on the tenements including a detailed aerial radiometric survey within the next three months to further delineate drill targets, as well as a surface sampling campaign.

In total 30,962,878 shares at 78 cents is a market cap of just over 24 million. 4 million of that is cash and 2.5 million in shares for IOH.

So what value do you put on their tenements? They are still cheap IMO. If they find anything on their licenses which looks likely..I feel confident they will run. This is why I bought into them. All the best in your decisions.

Thanks for the info Chris, definetly worth a go. I'll see what i can pick up in the morning.

Is there any particular reason why they went to international investors?

Not sure...maybe it was faster for them to raise it that way?

Its also important to note they only started to focus on uranium exploration during late November 2006.

"21 Nov 2006 11:31 ECH Acquisition of Uranium Tenements in Yeelirrie Area"

It hasn't been too long since they started to focus on uranium. Maybe this is why it's still not a well known uranium explorer.

It hasn't been too long since they started to focus on uranium. Maybe this is why it's still not a well known uranium explorer.

Like Blaze, lol

Like Blaze, lol

haha go the Blaze

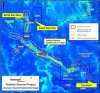

Let me pursuade you to back this one instead of BLZ. I would of actually got onto BLZ if they had some promising radiometrics. They could still have something though. Heres a good image of the Yeelirrie Deposit taken from ENR's website. It shows how concentrated the deposit is on their long strip of radiometrics. Really high grade too.

Attachments

Sold down after the close for a price of 75.

Someone decided to flog off 25,000 shares at 75 after trading all day in the low to mid 80's.

A bit silly if you ask me..especially after having a VWAP of 83.5 for the day. He must of been happy with grabbing his profit. There will be news for this one soon though..the airborne radiometric survey will be finished by the end of this month so keep a close eye out for any increased volume and movement.

Someone decided to flog off 25,000 shares at 75 after trading all day in the low to mid 80's.

A bit silly if you ask me..especially after having a VWAP of 83.5 for the day. He must of been happy with grabbing his profit. There will be news for this one soon though..the airborne radiometric survey will be finished by the end of this month so keep a close eye out for any increased volume and movement.

Sean K

Moderator

- Joined

- 21 April 2006

- Posts

- 23,003

- Reactions

- 13,132

Crazy increase today in a very weak and volatile uranium market.

ERN as well.

My portfolio actually is up today.

Mine is up today, but BMN has dragged it well down in past 2 weeks. Why oh why did I top up BMN  . Sometimes these decisions can stuff you up for weeks. Deep Yellow(DYL) up 15%.

. Sometimes these decisions can stuff you up for weeks. Deep Yellow(DYL) up 15%.

Disclosure my portfolio weighted as follows:

35% BMN

15% MTN

15% ERN

Rest other uraniums, Nickel, zinc, industrials, banks.

Disclosure my portfolio weighted as follows:

35% BMN

15% MTN

15% ERN

Rest other uraniums, Nickel, zinc, industrials, banks.

Good pick Chris!

Thanks. Still watching carefully though. Look how fast it has run. The thing on its side though is the very low market cap. When do you take profits? Hard decision. They will have news out around mid May. You know me though..if I like something I wont sell. Not yet anyway.

Sean K

Moderator

- Joined

- 21 April 2006

- Posts

- 23,003

- Reactions

- 13,132

Any profit's a good profit!When do you take profits?

Any profit's a good profit!I always like it when I'm free carried......

Im all for free carried. This is also the method at which I trade. I like to try and make a good 150-200% gains though before I sell to free carry the rest..im a little bit greedy

- Joined

- 3 February 2007

- Posts

- 138

- Reactions

- 0

Good pick Chris!

I didn't think this would do this well due to location, was I wrong.

Have to hand it to you Chris, you know how to pick them.

Im all for free carried. This is also the method at which I trade. I like to try and make a good 150-200% gains though before I sell to free carry the rest..im a little bit greedy

Chris, not sure if I should have posted here, but at what point do you decide to free carry? When you've doubled up? I know each share would be different but do you have a guide line? I like this method But I feel I am a bit greedy.

Sean K

Moderator

- Joined

- 21 April 2006

- Posts

- 23,003

- Reactions

- 13,132

My understanding of being 'free carried' is that the shares you are left holding are 'free'. eg, the shares have doubled, and then you sell half.Chris, not sure if I should have posted here, but at what point do you decide to free carry?

My understanding of being 'free carried' is that the shares you are left holding are 'free'. eg, the shares have doubled, and then you sell half.

JWBHO1...kennas explains it well. I sold half my BMN and free carried the the other half..I have also done the same with Arrow Energy. I only had to sell 1/4 of my Arrow energy to free carry 3/4 because the price went very close to 4 fold on the price that I got in. They arent exactly all free carried but pretty close to it. I'll continue to do the same with Erongo and Echelon. I'll let them run more than 100% though. ERN is allready close to 100% in profit. I find it the safest way for me to ensure I lock profits in..no matter how much I like the stock. Nothing is a sure thing but if you can sell enough shares in a stock you hold to free carry a decent holding you have the best of both worlds. You can continue to see the rewards of a company you have faith in and you can also look for the next one to target. Thats just my trading plan and I try to stick to it..even though I dont stick to it all the time

Similar threads

- Replies

- 6

- Views

- 1K

- Replies

- 2

- Views

- 1K

- Replies

- 380

- Views

- 36K