- Joined

- 20 July 2021

- Posts

- 11,046

- Reactions

- 15,349

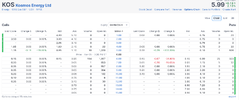

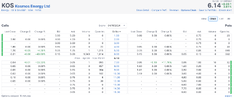

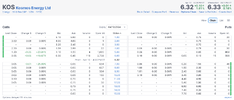

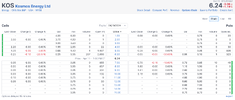

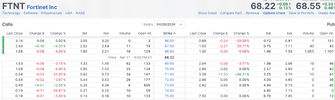

the 'very quickly ' ( and reliably ) part was the glitch that made short term trading ( less than a week ) , a glitch i could not work aroundThis means that you can be in/out of a trade very quickly.

i am not saying 'don't ' just check how reliable and fast your trading platform is to access/refresh , my setup was taking minutes to just refresh the Iress page so goodness knows how stale the 'live data' was

learning new skills is fun , losing money while learning is way less fun