skc

Goldmember

- Joined

- 12 August 2008

- Posts

- 8,277

- Reactions

- 329

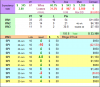

ok so I've been through the thread and added everything up.

You're approx. -7.5% since starting.

With 10 contracts and 10 point hard stop on a $75K account that's $2.6K loss or 3.5%.

That's a pretty big percent for most systems let alone a scalper!

Has anyone worked out the risk-of-ruin?