- Joined

- 27 November 2017

- Posts

- 1,200

- Reactions

- 1,887

I have invested in 2 companies recently in the cobalt sector and have been reading various information which has not been sinking in to much, so i decided to write some of this information down and hopefully we can build on the information below.

I claim no expertise in this field but I have worked at a few nickel mines and a couple of these extracted the cobalt as a by product.

….

Cobalt is recognised as an important technology enabling metal where energy storage, high temperature resilience, hardness, process efficiency and environmental benefits are required

I claim no expertise in this field but I have worked at a few nickel mines and a couple of these extracted the cobalt as a by product.

….

Cobalt is recognised as an important technology enabling metal where energy storage, high temperature resilience, hardness, process efficiency and environmental benefits are required

- General points

- Normally associated as a by product of copper or nickel mining operations

- Approximately 58% of the world cobalt production comes from copper ores

- Approximately 55% of the global supply originates from the Democratic Republic of the Congo (DRC)

- Global reserves

- Africa 50%

- Australasia 24%

- America's 10%

- Rest of the World 13%

- Uses

- Batteries - Lithium-ion have approx 10-20% Cobalt

- Magnets - used in wind turbines, hard disk drives, motors, sensors, actuators, magnetic resonance imaging (MRI)

- Inks and pigments - Glass, porcelain, ceramics, paints, inks and enamelware

- Super Alloys - used in aerospace, prosthetics, cutting tools, automotives and industrial equipment

- Electronics - used in printing circuit board materials (PCB).

- Price Factors - Cobalt is mostly produced as a by product of either copper or nickel. This leads to a supply, in which the price of cobalt is influenced by the supplies of nickel and copper – instead of that of cobalt. Therefore, speculations about more productions of nickel and copper could lead speculators to believe that cobalt supplies would increase, which ends up driving market prices low.

- Investing considerations

- Low capex/simple processing routes

- Sulphide deposits - Beneficiation, roasting, smelting - simpler and preferred

- Laterite ores - High Pressure Acid Leaching - notoriously difficult and expensive to process.

- Grade and primary cobalt – Higher grade is preferable and ideally a primary Cobalt deposit – 0.1 - 0.4%

- Location – sovereign risk and ethical mining are significant considerations when it comes to cobalt. – DRC are out of favour.

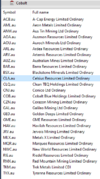

- Cobalt stocks on the ASX

- Aeon Metals (ASX: AML)

- Anson Resources (ASX: ASN)

- Archer Exploration (ASX: AXE)

- Ardea Resources (ASX: ARL) * holding

- Artemis Resources (ASX: ARV)

- Auroch Minerals (ASX: AOU)

- Aus Tin Mining (ASX: ANW)

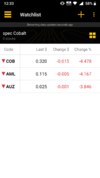

- Australian Mines (ASX: AUZ)

- Barra Resources (ASX: BAR)

- Berkut Minerals (ASX: BMT)

- Blackstone Minerals (ASX: BSX)

- Blina Minerals (ASX: BDI)

- Cape Lambert Resources (ASX: CFE)

- Castillo Copper (ASX: CCZ)

- Celsius Resources (ASX: CLA) * holding

- Clean TeQ (ASX: CLQ)

- Cobalt Blue Holdings (ASX: COB)

- Collerina Cobalt (ASX: CLL)

- Conico (ASX: CNJ)

- Corazon Mining (ASX: CZN)

- Cougar Metals (ASX: CGM)

- European Cobalt (ASX: EUC)

- FE Limited (ASX: FEL)

- First Cobalt (ASX: FCC)

- Golden Deeps (ASX: GED)

- GME Resources (ASX: GME)

- Hammer Metals (ASX: HMX)

- Havilah Resources (ASX: HAV)

- Jervois Mining (ASX: JRV)

- Longford Resources (ASX: LFR)

- Metalicity (ASX: MCT)

- Meteoric Resources (ASX: MEI)

- Marquee Resources (ASX: MQR)

- MetalsTech (ASX: MTC)

- Northern Cobalt (ASX: N27)

- Nzuri Copper (ASX: NZC)

- Pioneer Resources (ASX: PIO)

- Platina Resources (ASX: PGM)

- Riedel Resources (ASX: RIE)

- Red Mountain Mining (ASX: RMX)

- St George Mining (ASX: SGQ)

- Trek Metals (ASX: TKM)

- Victory Mines (ASX: VIC)

- Winmar Resources (ASX: WFE)